Financial Services

Brookfield buys Australia non-bank lender for $1.1b

Brookfield Asset Management has agreed to acquire Australian non-bank lender and asset manager La Trobe Financial for about USD 1.1bn, facilitating an exit for The Blackstone Group.

Japan mobile banking player Kyash gets $41m Series C

Altos Ventures, Goodwater Capital, Greyhound Capital, and StepStone Group are part of an investor group that has committed JPY 4.9bn (USD 41m) in Series D funding to Tokyo-based mobile banking start-up Kyash.

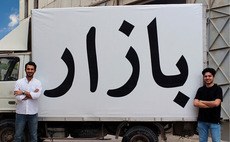

Pakistan's Bazaar gets $70m Series B

Pakistani B2B e-commerce and financial technology platform Bazaar has raised a USD 70m Series B round led by Dragoneer Investment Group and Tiger Global Management.

Deal focus: Financial crime pays for Silent Eight

Singapore’s Silent Eight is tackling the toughest cybersecurity subsegment and securing global clients in its early stages. Wavemaker Partners predicts a near-term explosion in growth

Singapore financial crime AI start-up gets $40m

Singapore’s Silent Eight, a compliance and financial crime risk investigation platform, has raised a USD 40m Series B round led by US-based TYH Ventures.

Warburg Pincus buys control of Indonesian insurer

Warburg Pincus has acquired stakes in two Indonesian insurance businesses from Spain-headquartered multinational insurance company Mapfre for EUR 56.6m (USD 62.9m).

India's CredAvenue sees 3x valuation jump in six months

Indian small business credit platform CredAvenue has raised a USD 137m round featuring B Capital Group at a valuation of USD 1.3b, up 3x in the past six months.

China e-commerce SaaS player secures $100m Series C

China-based e-commerce software-as-a-service (SaaS) provider Dianxiaomi has secured a USD 100m Series C round led by Tiger Global Management and Huaxing Growth Capital.

Singapore's Volopay gets $29m Series A

Singapore’s Volopay, a B2B financial technology provider specialising in cross-border transactions, has raised USD 29m in Series A funding led by Justin Mateen, co-founder of Tinder.

India banking start-up Niyo raises $100m Series C

Accel Partners and Lightrock India have led a USD 100m Series C round for India’s Niyo, which offers digital savings accounts and other banking services in partnership with traditional banks.

Vision Fund leads $144m round for Singapore lending platform

SoftBank Vision Fund 2 has led a USD 144m equity round for Singapore small business lending platform Funding Societies.

Blackstone buys majority stake in Indian wealth manager

The Blackstone Group has acquired a majority stake in Indian wealth manager Ask Investment Managers, taking out positions held by Advent International and other investors.

Deal focus: Indonesia's fintech plumber

Brick is developing backend digital infrastructure so that financial technology start-ups in Southeast Asia can provide seamless services. Priorities include deepening functionality and geographic expansion

Philippines digital bank Tonik raises $131m

Mizuho Bank has led a USD 131m Series B round for Philippines digital bank Tonik with support from Sequoia Capital India and Prosus Ventures.

India BNPL start-up Mintifi raises $40m Series C

Norwest Venture Partners and Elevation Capital have led a USD 40m Series C round for Indian B2B buy now, pay later (BNPL) platform Mintifi.

India's Chargebee gets $250m, valuation more than doubles

Tiger Global Management and Sequoia Capital India have co-led a USD 250m round for Indian financial technology provider Chargebee, more than doubling its valuation in 10 months to USD 3.5bn.

India's Moglix raises $250m at $2.6b valuation

Tiger Global Management and Alpha Wave Global have led a USD 250m Series F round for India’s Moglix. It more than doubles the industrial B2B start-up’s valuation in the past eight months to USD 2.6bn.

CVC moves to exit Indonesia's Link Net, buys Malaysia's Affin Hwang

CVC Capital Partners is shaking up its Southeast Asia portfolio with a renewed attempt to exit Indonesian broadband and cable TV provider Link Net and the acquisition of Malaysia-based asset manager Affin Hwang Asset Management.

Singapore's Fireblocks closes Series E, hits $8b valuation

Fireblocks, a US and Singapore-based blockchain services provider that aims to “help every business become a crypto business,” has raised a USD 550m Series E round at a valuation of USD 8bn.

KKR commits $45m to Philippines B2B e-commerce player

KKR has invested USD 45m in GrowSari, a Philippines-based company that helps micro, small, and medium-sized enterprises (MSMEs) take their retail operations online.

WestBridge leads $29m Series B for India's Vyapar

WestBridge Capital has led an approximately USD 29m Series B round for Indian small business financial technology provider Vyapar. The company is now valued at around USD 118m.

Insight leads $56m Series C for India's M2P Fintech

India’s M2P Fintech, a software provider that connects banking infrastructure to consumer-facing technology platforms, has raised USD 56m in Series C funding led by Insight Partners.

Indonesia e-commerce SaaS player gets $80m Series C

Lummo, an Indonesian e-commerce software-as-a-service (SaaS) provider for small businesses, has raised USD 80m in Series C funding led by Tiger Global Management and Sequoia Capital India.

India digital wealth manager secures $75m Series D

Indian personal finance app INDmoney has raised USD 75m in Series D funding from Steadview Capital, Tiger Global Management, and Dragoneer Investment Group.