India banking start-up Niyo raises $100m Series C

Accel Partners and Lightrock India have led a USD 100m Series C round for India’s Niyo, which offers digital savings accounts and other banking services in partnership with traditional banks.

Beams Fintech Fund, a specialist growth vehicle backed by local incubator Venture Catalyst, also participated, as did Prime Venture Partners and JS Capital, the family office of Jonathan Soros, son of George Soros.

JS joined a USD 35m Series B in 2019 led by Horizons Ventures with support from Tencent Holdings and US-based Social Capital. A USD 13.5m Series A featured Horizons, JS, Prime, and Social. Prime was the earliest institutional investor, providing USD 1m in seed funding as early as 2016, according to AVCJ Research.

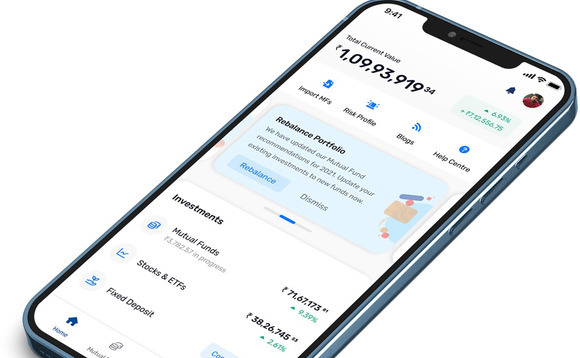

Niyo serves about 4m customers and 7,000 companies across its banking and wealth management products and claims more than 10,000 new users are added to its platform every day. The service is said to process USD 3bn of transactions a year, making it the largest consumer neo-banking platform in India.

The company has a sales presence in at least 20 states and union territories in India and around 500 employees in total. It has cited the pandemic as a major tailwind in its expansion, with Accel calling it India's fastest growing neo-bank.

Niyo launched India's first fully digital salary account this month and is in the process of launching personal loans, credit cards, and integrated forex services. Additional banking products are expected to be launched in the next three months.

The plan is to build the user base to more than 30m through organic and inorganic expansions. This will coincide with a marketing and branding initiative, extension of the distribution footprint, and the hiring of additional staff across functions.

"We are extremely excited about the potential of Niyo in re-imagining the banking experience for millions of users in India across the income pyramid," Ashish Garg, a principal at Lightrock, said in a statement.

"Neo-banks are an emerging asset class in India and believe that the quality of Niyo's team, customer understanding and technology stack will enable them emerge as the leader of the space."

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.