China

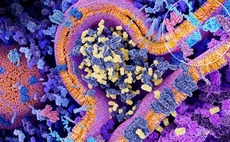

China's JW Therapeutics trades up after $300m Hong Kong IPO

JW Therapeutics, a private equity-backed Chinese drug developer specializing in CAR T-cell therapies that engineer immune cells to fight cancers, has raised HK$2.33 billion ($300 million) through a Hong Kong IPO.

Model behavior: China to Southeast Asia tech transplants

Plenty of internet start-ups in Southeast Asia have been inspired by Chinese forebears, but transplanting ideas from one market to another is often fraught with complications

China's CARsgen raises $186m Series C

Chinese biotech player CARsgen Therapeutics has raised $186 million in Series C funding led by Loyal Valley Capital.

China cosmetics brand Perfect Diary files for US IPO

Yatsen Holding, the parent company of Chinese cosmetics brand Perfect Diary has filed for a US IPO, potentially delivering a liquidity event for the likes of Hillhouse Capital, ZhenFund and Gaorong Capital.

Regulators halt Ant Group's Shanghai, Hong Kong IPO

Private equity-backed Ant Group’s bumper IPO in Hong Kong and Shanghai has been put on hold by Chinese regulators over a potential failure to meet listing qualifications or disclosure requirements.

Asia e-sports: Pumping up in a timeout

A recent slew of deals targeting e-sports in Asia has coincided with the live events that generate most of the industry's revenue going on hiatus. Investors appear happy to play the long game

Eight Roads adds healthcare partner in China

Eight Roads Ventures has recruited Xin Liu, formerly of Greater Pacific Capital, as a partner in its China team.

China's Bits x Bites hits first close on second food tech fund

Chinese food and agriculture technology investor Bits x Bites has reached a first close of $30 million on its second VC fund. The target is $70 million.

Chinese O2O retail platform Dmall gets $418m Series C

Dmall, a Chinese digital solutions provider for traditional retailers, has raised a Series C of RMB2.8 billion ($419 million) led by Industrial Bank and China Structural Reform Fund at a valuation of $2 billion.

Deal focus: Proterra whisks Asia supply chain for Eat Just

With China consuming more eggs per capita than its Western peers, Proterra Investment Partners sees strong growth potential for plant-based substitute Just Egg. The GP has committed $100 million to an Asia supply chain roll-out

PE-backed Lufax follows $2.3b US IPO with weak debut

Online lending and wealth management platform Lufax raised $2.36 billion in the largest US IPO by a PE-backed Chinese company so far this year but endured a difficult first day of trading.

China biotech player Genecast raises $149m Series E

Genecast Biotechnology, a Chinese gene sequencing and precision diagnostics company, has closed a RMB1 billion ($149 million) Series E funding round led by China Structural Reform Fund.

China's LianBio receives $310m round

LianBio, a Chinese biotech start-up incubated earlier this year by life sciences investor Perceptive Advisors, has raised $310 million from a group featuring BlackRock.

China biotech player Gracell raises $100m Series C

Wellington Management, OrbiMed and Morningside Ventures have led a $100 million Series C round for Gracell Biotechnologies, a China-based developer of cancer treatments.

Shunwei leads $22m round for Chinese fruit tea brand

Chinese fruit tea brand Sweet7 has raised RMB150 million ($22 million) in funding led by Shunwei Capital, with participation from Insight Fund, a vehicle launched by financial advisor MM Capital.

China apartment rental start-ups: In arrears

There were doubts about the viability of long-term property rental platforms in China before COVID-19. Post-pandemic regulation is creating further problems

Fund focus: Secondaries drive Ping An unit's transition

China Ping An Insurance Overseas Holdings has aspirations to manage assets for third-party investors. Spinning out part of the global private equity portfolio may help it get there

YF Capital leads $315m Series E for China MRO player

Zhenkunhang, a China-based distribution platform for industrial products, has raised $315 million Series E funding led by YF Capital - previously Yunfeng Capital - a private equity firm co-founded by Alibaba’s Jack Ma.

Legend Star raises $119m for fourth renminbi fund

Legend Star, the early-stage investment arm of China’s Legend Holdings, has raised RMB800 million ($119 million) for its fourth renminbi-denominated fund.

China e-sports business VSPN raises $100m

VSPN, a China-based start-up that claims to be the world’s largest e-sports provider, has raised nearly $100 million in Series B funding led by Tencent Holdings.

Morningside Venture Capital rebrands as 5Y Capital

Morningside Venture Capital has formally separated from Morningside Group, which is controlled by the Chan family, founders of Hong Kong property developer Hang Lung Group, and rebranded as 5Y Capital.

China's Yuanfudao hits record valuation with $2.2b round

Yuanfudao, a Chinese education start-up that targets the K-12 segment, has raised $2.2 billion in Series G funding at a valuation of $15.5 billion, nearly double the valuation of its previous round, which closed in April.

China O2O medicine platform raises $150m

Chinese online-to-offline (O2O) medicine retailer Dingdang Kuaiyao has raised RMB1 billion ($150 million) in an extended Series B round featuring Dragon Gate Investment Partners.

Sinovation seeks $1b for China AI fund

Sinovation Ventures is looking to raise $1 billion for a growth-stage private equity fund that will focus on introducing artificial intelligence technologies (AI) to traditional industries.