China biotech player Gracell raises $100m Series C

Wellington Management, OrbiMed and Morningside Ventures have led a $100 million Series C round for Gracell Biotechnologies, a China-based developer of cancer treatments.

Vivo Capital came in as a new investor, while existing backers Temasek Holdings, Lilly Asia Ventures (LAV), and King Star Capital re-upped. The company received $85 million in Series B funding in early 2019 led by Temasek and featuring LAV, Kington Capital, King Star, and Chengdu Miaoji. 6 Dimensions Capital provided a Series A round of undisclosed size in 2017, shortly after the company's founding.

Gracell was established by William Cao – previously co-founder and CEO of US-listed Cellular Biomedicine Group – to address several challenges facing CAR-T cell therapies. Specifically, the manufacturing process is expensive, lengthy and inefficient and the drugs produced aren't effective against solid tumors. Gracell wanted to create an affordable yet effective off-the-shelf product.

It has developed two main development platforms: FasTCAR, where cell culturing takes place within 24 hours rather than the standard 2-3 weeks, resulting in younger, more potent T-cells; and TruUCAR, which involves taking cells from healthy donors and modifying them with gene editing to reduce the chances of rejection by the host. TruUCAR therapies are available off-the-shelf at a fraction of the typical cost for CAR-T therapies, but the product is not tailored to individual patients.

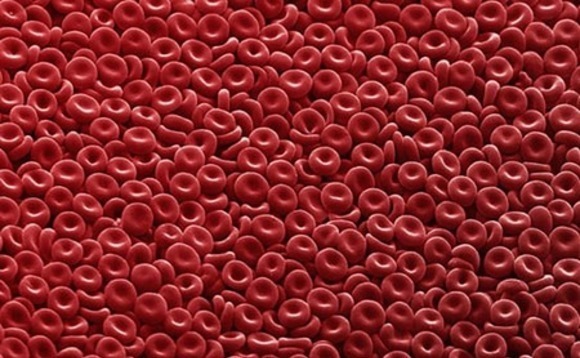

Gracell is now developing a pipeline of drug candidates that have come through the FasTCAR and TruUCAR systems, targeting solid tumors as well as blood, bone marrow and lymph node cancers. One product – which addresses cancers that have returned after remission or are not responding to standard therapies – is undergoing phase-one clinical trials in China.

"We are very pleased to expand our investor base with support from a high caliber consortium," said Cao, in a statement. "Our passion is to bring transformative CAR-T cell therapies to a broader group of patients by developing products that are efficacious and can be made widely available."

The new funding will go towards R&D and the advancement of clinical programs.

Other recent funding rounds for Chinese start-ups focusing on CAR-T cell therapies include a $100 million Series B – led by CPE – for JW Therapeutics. The company, which is also backed by Temasek, is an immunotherapy specialist developing CAR-T treatments for blood cancers. It has one drug in stage-two trials in China that targets the CD19 antigen, one of the most common proteins in white blood cells.

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.