China

China MSME financier raises $70m

Micro Connect, a China-based provider of financing to micro, small and medium-sized enterprises (MSMEs), has raised USD 70m in Series B funding.

Alibaba leads Series C extension for China AR start-up Nreal

Nreal, a Chinese manufacturer of augmented reality (AR) glasses that resemble normal sunglasses, has raised an extended Series C of USD 60m led by Alibaba Group.

CDH, Huaxing lead $120m Series B for China's InnoRNA

CDH Investments and Huaxing Healthcare Fund have led a USD 120m Series B for InnoRNA, a China-based mRNA drug developer. Existing investors CPE and Fangyuan Capital re-upped.

China EV maker Eezi raises $78m

Shenzhen-based electronic vehicle (EV) manufacturer Eezi has raised a CNY 500m (USD 78m) pre-A round led by China Merchants Venture.

GP profile: DCM

Investing in China, Japan, and the US out of a single global fund, DCM sticks to a formula of small funds, concentrated portfolios, early-stage deals, and collaborative cross-border teams

Deal focus: Jade Invest rides pest control M&A boom

Having offered a blueprint for pest control consolidation globally in Anticimex, EQT wants to repeat the trick in China with Guardian Hygiene Service. It meant a 3.3x return for previous owner Jade Invest

Investment becomes Tencent's main profit driver in 2021

Investment accounted for the bulk of Tencent Holdings' annual profit for the first time in 2021 as the Chinese technology giant saw earnings from its core business contract in the second half of the year.

China's JD Property closes $800m Series B

Warburg Pincus and Hillhouse Investment have re-upped in JD Property, the infrastructure property asset management arm of Chinese e-commerce giant JD.com, as part of a USD 800m Series B round.

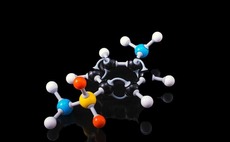

CBC strikes China's first royalty-based biomedicine deal

R-Bridge Fund, a credit vehicle established by healthcare-focused private equity firm CBC Group, has completed what it claims is the first royalty-backed investment in China’s biomedicine space.

China enterprise AR specialist Rokid raises $160m

Rokid, a China-based company specialising in augmented reality (AR) technology applications, has raised USD 160m in Series C funding across two tranches.

China AI start-up Aibee joins unicorn club

China-based artificial intelligence start-up Aibee has achieved a valuation of more than USD 1bn on closing a new funding round led by smartphone brand Xiaomi and featuring China Merchants Capital.

EQT buys China pest control business

EQT Private Equity Asia has acquired majority stake in Guardian Hygiene Service, China’s largest domestic pest control company, for an undisclosed sum. It facilitates a full exit for Jade Invest.

Primavera SPAC to merge with Fosun-owned fashion platform

A special purpose acquisition company (SPAC) with ties to China-based private equity firm Primavera Capital Group has agreed to merge with global luxury fashion platform Lanvin Group at a pro forma enterprise valuation of USD 1.5bn.

Eight Roads launches $350m China tech fund

Eight Roads Ventures has raised a China fund with a corpus of USD 350m which will make venture and early growth investments across enterprise, financial, and consumer technologies

Deal focus: Medilink chases global ADC opportunity

The Medilink Therapeutics team spun out from Kelun-Biotech to develop antibody drug conjugates capable of competing with the world’s best. Its USD 70m Series B will support the pursuit of this goal

China's Nio Capital closes Fund II on $400m

Nio Capital, a China-based investment firm established by the founder of domestic electric vehicle (EV) manufacturer Nio, has raised USD 400m for its second US-dollar denominated fund.

Trustar buys China condiments supplier

Trustar Capital, formerly known as CITIC Capital Partners, has acquired China-based food condiments supplier Beijing Salion Foods for an undisclosed sum.

PE-owned Belle Fashion files for Hong Kong IPO

China’s largest women’s footwear retailer Belle Fashion, which is backed by Hillhouse Capital and CDH Investments, has filed for a Hong Kong IPO with a reported target of USD 1bn.

PE-backed TuSimple ponders Asia asset spinout

TuSimple, a private equity-backed developer of autonomous driving technology for trucks that listed in the US less than 12 months ago, is considering a spinout of its Asia Pacific operations.

China's Rockets Capital hits $200m first close on debut fund

Rockets Capital, a Chinese investment firm co-founded by Bing Yuan, formerly COO of Hony Capital, in conjunction with the senior leadership of local electric vehicle (EV) maker Xpeng, has reached a first close of USD 200m on its debut fund. The overall...

Hong Kong digital asset custodian Hex Trust raises $88m

Hong Kong-based digital asset custodian Hex Trust has raised a USD 88m Series B round co-led by local counterpart Animoca Brands and US crypto specialist Liberty City Ventures.

China smart projector brand JMGO raises $158m

IDG Capital and Chinese smartphone brand Oppo have invested CNY 1bn (USD 158m) in JMGO, a local manufacturer of smart projection equipment developer JMGO that also goes by the name Holatek.

Genesis leads Series A extension for China's Nutshell Therapeutics

Nutshell Therapeutics, a China-based specialist in protein-focused drugs, has raised USD 40m in an extended Series A led by Genesis Capital.