GP profile: DCM

Investing in China, Japan, and the US out of a single global fund, DCM sticks to a formula of small funds, concentrated portfolios, early-stage deals, and collaborative cross-border teams

All that stood between Yuguang Gao, founder and CEO of China-based robotic process automation (RPA) start-up Cyclone Robotics, and a Series A was DCM's investment committee (IC). These meetings are usually attended by a handful of partners at a venture capital firm. DCM sent in its entire investment team.

"It was a large meeting room on Zoom and there were about 20 investors there from the US, Japan, and China, peppering me with questions for an hour," Gao recalled. "I'd previously worked for foreign corporates, so I was confident I could hold my own with no translator, but it got really hard."

More than seven hours later, after the DCM engaged in lively deliberations, the deal was signed off. This was 2019 and four-year-old Cyclone was raising its first institutional round. DCM came in as the sole investor, taking a 25% stake. The VC firm has re-upped in two rounds since then, most recently a USD 150m Series C that closed in late 2021.

This exhaustive approach to decision-making is typical of DCM, which prides itself in being small, nimble, and able to collaborate across borders. The firm also claims to move early on deals overlooked by the mainstream, often stress-testing its theses through fierce disputes.

A global mandate

DCM was established in 1996 as Doll Capital Management by Dixon Doll, who had previously established the first telecom-focused VC fund, and David Chao, a technology executive with experience in the US and Japan. Doll is now partner emeritus. Chao is still involved on a day-to-day basis though he plans to step back from the investments of future funds.

The firm started out investing only in Silicon Valley, but the founders were wise to opportunities in China and the broader Asian region. In the mid-2000s, there was a significant change in tack punctuated by the recruitment of Hurst Lin and Osuke Honda.

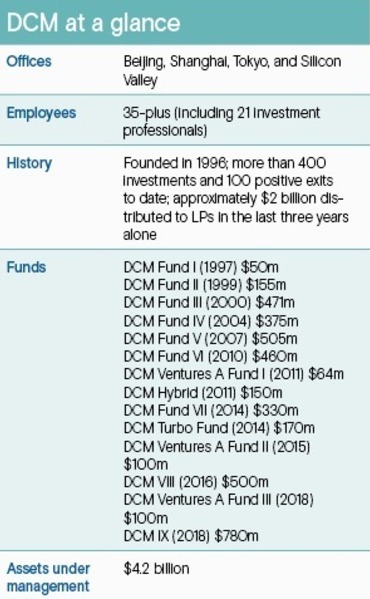

The trio has helmed DCM ever since, overseeing the accumulation of USD 4.2bn in assets under management (AUM) and maintaining an IRR above 50% for the past decade. In the past three years alone, the firm returned more than USD 2.2bn to LPs.

One distinguishing feature of all 14 funds raised to date, including nine flagship funds, is the global mandate. DCM has no dedicated China, US or Japan products, largely to ensure internal cohesion. Honda argues that no other venture capital firm executes a cross-border strategy to the level of DCM.

"In my previous firm, people were not incentivised to give real feedback to colleagues in other markets. Because, at the end of the day, I was paid to do investments in Japan," he said. "At DCM, we work with one global fund and share in each other's success."

Honda has served on the boards of several Chinese companies where his expertise is relevant. They include mobile gaming start-up Happy Elements, which was struggling to make money in China when DCM invested. Honda and his colleagues in China and Japan soon helped the company find success in Japan. DCM exited via a USD 100m management buyout.

The China-US nexus works equally well, with DCM facilitating fundraising activity by the likes of short video platform Kuaishou and classified player 58.com in the US. Both subsequently found it easier to secure additional funding in China.

"Investors in a different market often demonstrate the catfish effect. Local players may initially have little interest in a deal, but when the catfish is let in, they suddenly start chasing it," said Ramon Zeng, a general partner at DCM.

Maintaining discipline

Imposing size limits – on funds and teams – is also considered essential to maintaining this internal cohesion. It wasn't always this way. Lin joined as the eighth partner alongside seven US-based incumbents. He recalls an environment of intense competition for capital, which ultimately contributed to an emphasis on deal quantity rather quality.

Lin responded by sticking rigidly to a structure of two partners and six investment professionals in China. Zeng rose up to become the other partner largely for his ability to connect with Chinese entrepreneurs and understand the local start-up ecosystem – a healthy complement to the Silicon Valley-style of Lin, an American born Chinese.

The setup hasn't changed in seven years, even as huge home runs such as Vipshop, 58.com, and Kuaishou – each of which generated a USD 1bn-plus return – saw China emerge as the preeminent market. The country became DCM's largest geographical allocation 10 years ago. It is expected to account for 70% of ninth flagship fund, which closed on USD 780m in 2018.

The Japan operation is much the same with no more than four or five investment professionals. Globally, DCM has 35 staff, including 21 investment professionals.

This approach naturally lends itself to relatively concentrated portfolios, regardless of whether bull markets are allowing rivals to deploy faster and raise larger funds. DCM targets early-stage rounds, acquires interests of 15-25%, and then gets heavily involved post-deal.

As such, DCM is willing to stop and look for additional angles when other investors move on. For example, the firm became the first investor in Japan-based accounting software provider Freee in 2012 when it comprised only two people and the prevailing wisdom was that market leader Yayoi, then owned by MBK Partners, was impregnable.

But Honda concluded that MBK would be reluctant to disrupt Yayoi's steady stream of revenue – from selling packaged software to small and medium-sized enterprises (SMEs) – by shifting to a cloud-based model. This gave Freee an up to two-year head start. The company raised USD 320m through a domestic IPO in 2019 with DCM as the largest shareholder.

The firm's often counter-intuitive thinking can be a source of great anxiety. Lin believes this is part and parcel of backing new ideas that may represent a departure from the norm.

DCM led Kuaishou's Series B in 2014, taking a 20% stake at a time when the company's short videos were limited to eight seconds and sceptics were asking how it could ever monetise through selling ads. Kuaishou's breakout moment came shortly thereafter, and DCM executed its super pro-rata right in the following round.

Even then, uncertainty remained over the company's revenue-generating capabilities. Lin focused on one key positive: high growth driven by a loyal user base of 14–16-year-olds. "When we did a roadshow in New York three years later, the range had expanded to 18 years-olds because those 16-year-olds continued to use it," he said, explaining the path to monetisation.

Kuaishou raised USD 5.4bn through a Hong Kong IPO in 2021 with a market capitalisation of USD 142bn. DCM's 7.5% stake was worth USD 10.7bn.

B2B awakenings

Across Asia, venture capital investment strategies are gravitating from 2C to 2B models. DCM can point to Freee as an example of how it got ahead of this trend. It started in early 2012, when Honda, who enjoyed success in consumer internet with Japanese gaming platform Gree and Korean social network Kakao, saw rising valuations and many "me too" ideas.

Seeking inspiration, he settled on software-as-a-service (SaaS) in the US and Chao's lucrative investment in cloud-based B2B payments player Bill.com. Honda decided to cease investing in 2C for three years and focus on B2B. Freee, contact management tool Sansan, and customer relationship management solutions provider Coubics. All three are now listed.

The China team made this transition around nine years ago, participating in a debut institutional round for Ucloud. The company went on to raise more than USD 300m in follow-on funding before becoming the first independent cloud service provider to list on Shanghai's Star Market in 2020 with a market capitalisation of USD 2bn.

DCM began digging into specific 2B verticals, which led to investments in the likes of Sensors Data, a start-up that leverages big data capabilities to deliver customer behaviour analysis solutions. After the initial meeting in early 2016, DCM moved quickly to lockout the company's entire Series B round. The details were thrashed out in just two weeks.

Four years later, after raising USD 74m across a Series C round and an extension, Sensors Data found itself at a crossroads. The company had carved out a market-leading position, but there was a low ceiling for further expansion within its vertical. It needed guidance.

"We looked at about 20 different types of companies that had strong or weak relationships with the Sensors Data business model. We then considered how we could bring together the best products under an overall framework to define the company's long-term strategy," said Zeng. "I think it was a critical node in the company's business development."

Marketing automation was identified as an attractive expansion target and Adobe was chosen as a benchmark. On one hand, this transition created a broader customer base, stretching from e-commerce platforms to traditional corporates. On the other, it required a degree of compromise from Sensors Data.

Wenfeng Sang, the company's founder and CEO, had previously insisted he would "never change a single line of code for any customer." However, standardised products weren't enough for large Chinese corporates. Sang agreed to follow SAP's approach by offering a product in which 20-30% of the features are customisable.

"We worried about becoming a project-based company [where products are customised to meet customer needs and often command low margins]. My co-founder and I were both in tears when we decided to make the transition. Now, we understand that we are not off course, we're following great pioneers and we're on the road to excellence," said Sang.

Meanwhile, DCM's focus within the 2B space has moved to super automation, a mega theme that encompasses SaaS, implementation of artificial intelligence-enabled technology, as well as the underlying technology infrastructure.

"As the technology matures and labour costs keep on rising, Chinese companies are showing more interest in controlling labour costs and achieving higher levels of efficiency and digitalisation. As the marginal returns on consumer technology are diminishing, areas such as super automation can generate high returns," said Zeng.

China vs the rest

This does not mean 2C ideas are dismissed out of hand – the water is still deep enough to have big fish swimming in it, to borrow Zeng's analogy. DCM recently invested in Litmatch, a cross-border social networking start-up in Southeast Asia, while Honda marked his Japan 2C return by looking for demographics-related opportunities around pets, beauty, and healthcare.

Avoiding the crowds and not getting sucked in by groupthink remain guiding principles. "When you've been in a market for a long time, it's normal to get caught up in big movements and market sentiment," said Lin. "We do better than our peers because we have colleagues in different countries constantly exchanging new ideas and perspectives."

Honda emphasises the virtues of this process, noting that breaking down ideas and explaining them to investors in other markets is challenging, yet it serves as a sanity check.

"If I can't explain it, that means I don't understand it. Maybe it really doesn't make any sense," he added. "However, if I conduct further research and still think it's a good idea, then they'll say, ‘Sure, go for it.'"

Global funds covering multiple geographies and close collaboration between teams in different markets also affords DCM a degree of flexibility, in terms of what ideas to pursue and where to pursue them.

With China's technology sector spending much of 2021 in the grip of regulatory uncertainty and China-US tensions looming large in the background, diversification has become a prevalent theme in Asia. Japan is among the beneficiaries with VC investment climbing 60% year-on-year in 2021 to an all-time high of USD 3.7bn, according to AVCJ Research.

Honda believes the pace of growth can be maintained through 2022, although he laughs at the notion that LPs might prefer Japan over China. First, such binary allocation decisions are impractical: China VC investment reached USD 38.6bn, 10x more than Japan's total.

Second, DCM remains optimistic on China. As US listings of Chinese companies remain on hiatus due to regulatory pressures on both sides, Lin and Zeng draw comparisons with the previous fallow period in 2012. Vipshop was one of the two IPOs that year.

Their view is that industry participants will find ways around whatever obstacles stand in their way. It has happened before. Sina's IPO in 2000 was made possible by the introduction of the variable interest entity (VIE) structure that allowed foreign investors to get exposure to restricted sectors in China.

Zeng argues that the current problems are technical rather than philosophical and therefore shouldn't necessarily impact VC investment decisions predicated on long-term trends. It's usually three years before a portfolio exhibits early signs of performance and then it ramps up significantly between years five and seven.

DCM backed Vipshop and 58.com during periods of volatility in financial markets, with China concept stocks trading poorly, yet ultimately the returns were strong. The biggest challenge for VC investors is not reading the macro environment as much as being open-minded to the possibilities around technology disruption.

"You have to get used to stopping and thinking about whether there is a new way to do the same thing, like a different route to your office or a different approach to personal care," said Zeng. "That way, when an entrepreneur comes to you, you naturally consider whether his method can make a breakthrough and whether the breakthrough can be sustainable."

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.