Boyu Capital

PE-backed Waterdrop falls on debut after $360m US IPO

Waterdrop, a China-based insurance, medical crowdfunding and mutual aid platform, fell 19% on its New York Stock Exchange debut following a $360 million IPO.

PE-backed Brii Bioscience pursues Hong Kong listing

Brii Biosciences, a three-year-old Chinese biotech start-up that has raised approximately $415 million in private funding from the likes of Sequoia Capital China, Boyu Capital, and Yunfeng Capital, has filed for a Hong Kong IPO.

China's Kuaishou surges on debut after $5.4b Hong Kong IPO

Kuaishou, a Chinese video-sharing and social networking platform backed by Tencent Holdings, 5Y Capital and DST Global, started trading at nearly three times its IPO price following a Hong Kong IPO that valued the company at HK$1.1 trillion ($142 billion)....

Aspex leads $200m Series E for Hong Kong's Klook

Aspex Management has led a $200 million Series E round for Klook as the Hong Kong travel app pivots to domestic holiday services during a freeze in international tourism.

AVCJ Awards 2020: Deal of the Year - Mid Cap: Perfect Diary

Perfect Diary’s $100 million Series D round came after the Chinese company proved itself with multiple hit color cosmetics brands and eight months ahead of a bumper US listing

China AI specialist 4Paradigm receives $700m Series D

Boyu Capital, Primavera Capital Group, and Hopu Investments have led a $700 million Series D round for 4Paradigm, a Chinese artificial intelligence (AI) technology developer that serves enterprise customers.

LAV, Arch lead $100m round for China's SciNeuro

SciNeuro Pharmaceuticals, a China and US-based drug developer specializing in treatments for central nervous system (CNS) disorders, has announced its formal launch with a $100 million funding round.

PE-backed Antengene trades flat after $359m HK IPO

Antengene, a China-based drug developer that previously raised $238 million across three private funding rounds, closed roughly flat on its first day of trading in Hong Kong following a HK$2.78 billion ($359 million) IPO.

PE-backed Perfect Diary jumps 75% on debut after $616m IPO

Yatsen Holding, the parent company of Chinese cosmetics brand Perfect Diary, gained 75% on its first day of trading on the New York Stock Exchange following a $616.9 million IPO.

Sequoia, Matrix back $200m Series A for China's D3 Bio

D3 Bio, a Chinese drug developer that studies and specifically targets areas where existing approaches to care are not delivering satisfactory outcomes, has raised $200 million in Series A funding.

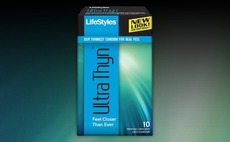

Hillhouse, Boyu, CareCapital back condom maker

Chinese private equity firms Hillhouse Capital, Boyu Capital and CareCapital Partners, a specialist dental and consumer health investor, have paid $200 million for a 40% stake in condom brand LifeStyles.

China short video platform Kuaishou files for Hong Kong IPO

Kuaishou, a Chinese video sharing and social networking platform backed by the likes of Tencent Holdings, Sequoia Capital China, Boyu Capital and DST Global, has filed for a Hong Kong IPO.

China cosmetics brand Perfect Diary files for US IPO

Yatsen Holding, the parent company of Chinese cosmetics brand Perfect Diary has filed for a US IPO, potentially delivering a liquidity event for the likes of Hillhouse Capital, ZhenFund and Gaorong Capital.

China's Yuanfudao hits record valuation with $2.2b round

Yuanfudao, a Chinese education start-up that targets the K-12 segment, has raised $2.2 billion in Series G funding at a valuation of $15.5 billion, nearly double the valuation of its previous round, which closed in April.

China biotech player Antengene raises $97m Series C

Fidelity Investments has led a $97 million Series C round for Chinese hematology and oncology biotech developer Antengene.

Ocumension climbs on debut after $184m Hong Kong IPO

Ocumension Therapeutics, a Chinese drug developer targeting eye diseases that counts Boyu Capital and Temasek Holdings among its backers, posted a 152% gain on debut following a HK$1.5 billion ($200 million) Hong Kong IPO.

PE-backed Hygeia completes $286m Hong Kong IPO

Chinese radiotherapy business Hygeia Healthcare, which counts Warburg Pincus, Boyu Capital, and CITIC Capital among its investors, raised HK$2.22 billion ($286.4 million) in its Hong Kong IPO.

Hillhouse leads $1b round for China's Yuanfudao

Chinese online education start-up Yuanfudao has seen its valuation soar to $7.8 billion on closing a $1 billion funding round led by Hillhouse Capital.

Boyu leads $300m round for Chinese apartment rental player

Boyu Capital has led a $300 million Series A round of funding in Cjia.com, a serviced apartment brand created by Huazhu Hotels Group and IDG Capital.

Alibaba, Yunfeng invest $700m in NetEase Cloud Music

NetEase Cloud Music, one of China's largest music streaming platforms, has secured a $700 million investment from Alibaba Group and Yunfeng Capital, a private equity firm established by Alibaba founder Jack Ma.

Alibaba invests $700m in NetEase Cloud Music

Alibaba has announced on Friday two deals with NetEase. It has acquired NetEase’s e-commerce business Kaola for $2 billion and it has committed a $700 million investment in NetEase’s online music Platform – NetEase Cloud Music.

Boyu co-founder Mary Ma dies at 66

Mary Ma, the long-serving Lenovo Group executive who forged a second career in private equity with TPG Capital and Boyu Capital, has died aged 66.

PE-backed Hansoh Pharma completes $1b Hong Kong IPO

Hansoh Pharmaceutical Group, a Chinese drug developer that counts Hillhouse Capital and Boyu Capital among its investors, has raised HK$7.86 billion ($1 billion) through a Hong Kong IPO.

Boyu leads round for Chinese health insurance platform

Waterdrop, a Chinese online health insurance platform that runs mutual aid programs and provides brokerage services, has raised RMB1 billion ($145 million) in Series C funding led by Boyu Capital.