Consumer

India's Licious raises $150m at $1.6bn valuation

India’s Licious, a direct-to-consumer fresh meat and seafood delivery company, has raised a USD 150m round led by Amansa Capital at a valuation of USD 1.6bn.

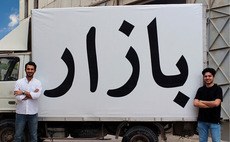

Pakistan's Bazaar gets $70m Series B

Pakistani B2B e-commerce and financial technology platform Bazaar has raised a USD 70m Series B round led by Dragoneer Investment Group and Tiger Global Management.

Deal focus: Mighty Jaxx revels in 'phygital' bridge role

In collectables maker Mighty Jaxx, East Ventures saw not only an effective traditional retail brand, but a company capable of elevating the user experience by straddling the digital and physical worlds

Deal focus: Chatbots position for cross-border expansion

Cathay Innovation, an affiliate of Cathay Capital, sees voice recognition services as a key area of B2B growth. Singapore’s AI Rudder is hoped to prove this idea on a global scale

China 3D content platform Xverse raises $120m

Xverse, a Shenzhen-based 3D user-generated content platform has raised USD 120m across a Series A and a Series A extension, led by GL Ventures and Sequoia Capital China, respectively.

Tiger Global leads Series A for New Zealand's ArchiPro

Tiger Global Management has led a NZD 35m (USD 24m) Series A round for New Zealand’s ArchiPro, a platform that connects homeowners with interior design and construction professionals.

India's Byju's raises $800m at $22b valuation

Indian education platform Byju’s has raised USD 800m at an estimated valuation of USD 22bn, with the company’s founder Byju Raveendran providing USD 400m.

China's Cloudview reaches $316m first close on renminbi fund

Cloudview Capital, a Chinese GP that previously operated as a joint venture with ICBC International, has completed a first close on its second renminbi-denominated Fund with CNY 2bn (USD 316m) in commitments.

East leads $20m round for Singapore's Mighty Jaxx

Singapore-based toy figurine manufacturer Mighty Jaxx has raised USD 20m in an extended Series A led by East Ventures. Crypto specialist Mirana Ventures also participated.

KKR-backed massage chair business files for Hong Kong IPO

V3 Brands Asia, a KKR-backed holding entity for OSIM, which claims to be Asia’s number one brand in the premium massage chairs market, has filed for an IPO in Hong Kong.

Tiger Global, Coatue lead Series B for Singapore's AI Rudder

Tiger Global Management and Coatue Management have led a USD 50m Series B round for Singapore-based voice artificial intelligence start-up AI Rudder.

AVCJ Awards 2021: Deal of the Year – Mid Cap: Danggeun Market

A social, hyperlocal overlay has made Korea’s Danggeun Market a subversively complex e-commerce play. As the company scales and experiments, it reflects new confidence in its home market

AVCJ Awards 2021: Responsible Investment: The Arnott's Group

In taking ownership of an iconic Australian brand like Tim Tam, KKR was conscious of the need to be a market leader on sustainability. Progress is being made across sourcing, emissions, and packaging

Portfolio: Aspirant Group and Yamato Group

Improving cost controls and realising efficiencies underpinned Aspirant Group’s investment thesis for Japanese fish retailer Yamato Group, and they have helped the company withstand external pressures

Deal focus: Faux fowl fast-forwards

Next Gen Foods is pushing hard to popularise its meatless chicken brand Tindle in the name of climate action. The largest-ever Series A round in alternative protein is jumpstarting the campaign

Deal focus: Freemium works for Dianxiaomi

China cross-border e-commerce services platform Dianxiaomi has achieved traction, and profitability, by only charging for value-added services. Its Series C will fuel global expansion

Creador makes second SE Asia food investment in five months

Malaysia-based Creador has acquired a significant minority stake in local food industry supplier Custom Food Ingredients for an undisclosed sum as part of a category platform play.

India edtech player Filo gets $23m Series A

Filos, an India-based instant live-tutoring platform, has raised USD 23m in Series A funding led by US investor Anthos Capital. It is said to be the largest-ever Series A in India’s education technology space.

China's VC-backed Perfect Corp agrees $1bn SPAC merger

Perfect Corp, a Chinese software developer specialising in artificial intelligence (AI) and augmented reality (AR) solutions that allow consumers to experience brands, has agreed to merge with a US-listed special purpose acquisition company (SPAC) at...

CLSA acquires Japan childcare operator

CLSA Capital Partners (CLSA CP) has acquired a majority stake in Japanese childcare facility operator Task-Force for an undisclosed sum.

China e-commerce SaaS player secures $100m Series C

China-based e-commerce software-as-a-service (SaaS) provider Dianxiaomi has secured a USD 100m Series C round led by Tiger Global Management and Huaxing Growth Capital.

AVCJ Awards 2021: Exit of the Year – IPO: Zomato

Zomato’s milestone offering last year saw a pandemic-ready business model awaken the local market to internet-based risk profiles as global investors shifted interest from China to India

Deal focus: Quadria goes shopping in Vietnam

Singapore’s healthcare-focused Quadria Capital has made its most overtly consumer retail-oriented investment with Vietnam’s Con Cung. But the endgame is considered squarely on-strategy

Investcorp seeks $400m for India private equity fund

Investcorp is targeting USD 400m for its third India private equity fund as part of efforts to quadruple its assets under management (AUM) in the country to USD 2bn within six years.