North America

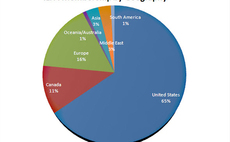

North American property funds dominate 2Q fundraising

North America property funds accounted for most of the $11.2 billion raised by private equity funds with a final close in the second quarter of 2011, according to research firm Preqin. Total commitments were up on the $8.9 billion raised in the first...

Illinois pension fund earmarks $7b for private equity

The Teachers’ Retirement Board of the State of Illinois has won approval from its board of trustees for a plan that could see it invest up to $7 billion in private equity by 2016. The $37 billion fund wants to commit $900 million to $1.4 billion to the...

Warburg Pincus considers new fund

Warburg Pincus is preparing to raise a new buyout fund that could be worth $12 billion, Bloomberg reported, citing two people familiar with the situation. The New York-based private equity firm, which has invested more than 80% of its current $15 billion...

Carlyle's diversifies its business ahead of IPO

The carlyle Group's purchase of a 55% stake in Emerging Sovereign Group (ESG) is its second acquisition in the asset management space within seven months and a clear indication of how the private equity wants to develop its business.

Carlyle tipped to choose JPMorgan, Credit Suisse, Citi as IPO underwriters

The Carlyle Group is expected to name JPMorgan, Citigroup and Credit Suisse as the lead underwriters for its IPO, Reuters reported, citing sources familiar with the situation.

Lone Star challenges stock manipulation charges in Korean court

Lone Star will file a petition to void stock manipulation charges leveled against it and Paul Yoo, the head of its South Korea unit, Reuters reported. The move is likely to prolong the private equity firm’s sale of a 51% stake in Korea Exchange Bank (KEB)...

HarbourVest sees net asset value hit record high

HarbourVest Global Private Equity posted a net asset value of $10.92 per share on Wednesday, its highest ever level. The increase – up 6.6% from January and up 9% since the private equity firm listed in 2007 – was driven by rising portfolio asset value...

Banks pitch to underwrite Carlyle's $1b IPO

The Carlyle Group is interviewing banks seeking the mandate to manage its expected $1 billion IPO, Reuters reported, citing a person familiar with the situation. It is thought that the private equity firm will choose the main underwriters by the end of...

Pennsylvania pension fund commits $220m to private equity

Pennsylvania Public Schools Employees’ Retirement System has committed up to $220 million to private equity investments, including $50 million for Orchid Asia V, which focuses on growth capital investments in China.

Advantage Partners completes takeover of GTA TeleGuam

Japanese buyout firm Advantage Partners (AP) finally completed its takeover of GTA TeleGuam, Guam’s leading telecom operator.The selling party is Shamrock Capital Advisors, a California-based private equity firm that obtained GTA from the Guam government...

Wall Street's clean up reaches far and wide

To say the New York federal jury, which pronounced Galleon Group hedge fund founder Raj Rajaratnam guilty of all 14 charges of securities fraud and conspiracy against him, sent shock waves through the city’s financial services community is an understatement....

Top PE firms target Asia at the expense of North America – study

The top 10 private equity firms globally have increased their focus on Asia over the past three years at the expense of North American investment, according to research by Preqin. These firms account for 18.6%, or $425.7 billion, or the $2.3 trillion...

Temasek takes stake in Canadian mining firm

Singaporean sovereign wealth fund Temasek Holding has purchased approximately 11% of publicly listed Canadian mining group Inmet Mining Corporation for CAN$500 million ($511million).

Khosla Ventures gets $15 million from Wipro chairman

Silicon Valley-based VC firm Khosla Ventures (KV) has received $15 million of funding from Azim Premji, the Chairman of Indian technology company Wipro, according to India’s Economic Times.

PE and the pension system

Ontario Teachers’ reported record-high results in 2010, yet substantial liabilities overhang remains, signaling a broad-based issue likely to challenge many pension plans going forward

Richard Ong's RRJ Capital makes first deal

Hopu Fund co-founder Richard Ong has made his first investment from his $2 billion maiden fund, into US-focused oil exploratory and extraction firm Frac Tech Services - a seeming departure from his vehicle’s Asia Pacific mandate.

China's Phoenix New Media aims to raise $179m in the US

China media group Phoenix New Media has targeted a $178.7 million raise on its impending public listing on a US bourse, and is specifically looking to sell 12.8 million American depositary shares between $12 to $14 each, according to a filing with the...

Ontario Teachers' Pension Plan posts 14.3% rate of return

Canada’s largest single profession pension plan, Ontario Teachers’ Pension Plan (OTPP), announced that it had earned its largest value-add dollar amount ever in 2010, claiming C$13.3 billion ($13.9 billion) in investment income by the year’s end, representing...

Saving PE on Republicans' agenda

US Congressional Republicans are drafting five bills aiming to curtail the reach of the Dodd-Frank Act in specific areas of the financial industry, further targeting a provision that regards private equity’s disclosure protocol.

Joncarlo Mark to leave CalPERS

One of private equity's most prominent investors, Joncarlo Mark, has resigned from his position as senior portfolio manager of CalPERS’s $32 billion Alternative Investment Managers program.

KKR appoints ex-Clinton staff to public affairs and comms

Kohlberg Kravis Roberts & Co. L.P. has appointed Steven R. Okun, once an administrator under former US President Bill Clinton, as Director of Public Affairs in Asia Pacific, affective on February 13, 2011.

Carlyle buys AlpInvest, becomes LP

ALPINVEST, THE NETHERLANDS-BASED fund-of-funds, has been acquired by the Carlyle Group, which simultaneously makes its foray onto the LP side of the private equity industry.

Investing without rose-tinted glasses

The CEO of global LP Adams Street Partners, sits down with AVCJ to discuss allocation strategies, the PE industry’s challenges and how his wariness of global mega funds paid off post-crisis.

ILPA polishes its private equity principles

New version incorporates more GP and LP input aimed at increasing focus, clarity and practicality on both sides of the private equity equation.