ILPA polishes its private equity principles

New version incorporates more GP and LP input aimed at increasing focus, clarity and practicality on both sides of the private equity equation.

BACK IN SEPTEMBER 2009, WHEN THE sky seemed to be falling on most of the financial world, and relationships between GPs and the LPs who are their majority investors were becoming anxious, the Institutional Limited Partners Association (ILPA) released its foundational Private Equity Principles with a view toward providing a set of globally recognized industry guidelines that would prevent miscommunication and misplaced expectations. The guiding tenets were: alignment of interest, governance and transparency, which were endorsed by some 140 industry organizations.

On January 11 this year, ILPA published an update to their original work. It is intended to refine and elaborate on means of reporting and dealing with some of the more complex issues, drawing on additional feedback from GPs, LPs and industry third parties with a view to setting the bar higher in terms of focus, clarity, practicality and adoption.

AVCJ spoke to ILPA's chairman, Tim Recker, about these developments, and an apropos starting point seemed to be to inquire about how successful the original principles have been, especially as it regards industry acceptance and compliance.

"Very," he replied.

A step in the right direction

"If you look at the industry's evolution since [the first edition], and how it has responded to the principles, you've already seen meaningful improvements," he told AVCJ. "That's taken different forms. But if you consider it in the context of the three main pillars, with governance, for instance, I'd say advisory boards have been modified in a meaningful way across many funds." He refers to how Boards operate now, the frequency of their meetings, and the increasingly efforts to adopt a good many of the best practices recommended. "Similarly, if you look at the transparency side, it's evident that investors in the current economic cycle have a heightened concern about markets and conditions and so, logically, are asking for more information. "GPs for their part have looked at the principles as a standard for the type of reporting and transparency that investors are looking for, and so over the past 18 months or so, have become more transparent than they have ever been."

On alignment, meanwhile, in surveying the funds that have been raised over the same time period, there has also been a noticeable shift, Recker says. "Obviously this isn't just due to the ILPA's principles. Rather it's a combination of their being in a place juxtaposed against the general economic environment." In the funds the ILPA has tracked, "…it's clear to me that their lawyers have gone through and racked and stacked their documents against the principles, and have made recommendations, in particular how these can be adjusted to make them more LP-friendly, and more compliant with the principles in a holistic way. It doesn't mean that they're going to agree with every little thing. But they are looking through them and thinking about what they can take from them in the context of improving what they already have."

Resolving investor ‘angst and frustration'

Driving this willing compliance has been the considerable, if latent, investor "angst and frustration" around transparency. "The principles basically gave them a tool to say yes, I agree with this; this is what I've been looking for. But simply asking their GPs in a common language for the same things made it easier for the GPs to respond." Previously, requests from GPs were dependent on the individual investor and the individual deal. They were inherently similar, of course. But still responses had to be individually tailored. What ILPA did was take a wide collection of these requests and boil them down to the key best practice issues, laying out precisiely what was needed to resolve them.

"My feeling is that it was a great beginning for a lot of GPs. They reckoned getting this base line set of information would decrease the number of requests and volume of information they were getting from their investors." In other words, they could see greater efficiencies.

But with time passing,ILPA also noted that ongoing engagement with sub-sets of the industry made it clear that there were specific areas that would benefit from further fine tuning; hence this latest release.

Clawback complexities

"We decided to go back and think with more focused clarity on some of the more complex issues, which we felt could use some more detail; for example the ‘clawback' provisions. These comprised one of the most common areas where there was meaningful disagreement around the original provisions' approach to dealing with them; quite specifically in a pre-tax/post-tax context. Emotionally, most investors favored taking the pre-tax approach. But as we worked through the issues with the GPs it became apparent that, practically speaking, it is exceptionally difficult – and may not be in the best interests of investors – to have a post-tax clawback," Recker recalls. Rather than continue with this as a difficult issue, ILPA took a pragmatic approach and made the adjustment. At the same time, however, they went into more detail on all of the various ways clawbacks might be prevented, while putting forward other mechanisms that can be put in place to minimize the risk of LPs thinking they are getting the short end of the stick if a clawback occurs.

Beyond this particular issue, this updated and more detailed version of the principles contains a number of strong governance expedients added to improve alignment. While GPs get more freedom, LPs have enhanced control options to assure resolution of any conflicts in a mutually satisfactory way. In short, the win-win aspect has been bolstered.

"We also changed the document in terms of the flow of it, to provide more color and further documentation around why various items are an issue, rather than just stating what the answer should be. After all, it only makes sense to go back every once in a while for some appropriate revisions, especially with the volume of input we'd received from the GPs since the original release. We take their concerns seriously," he told AVCJ.

The Asian acceptance factor

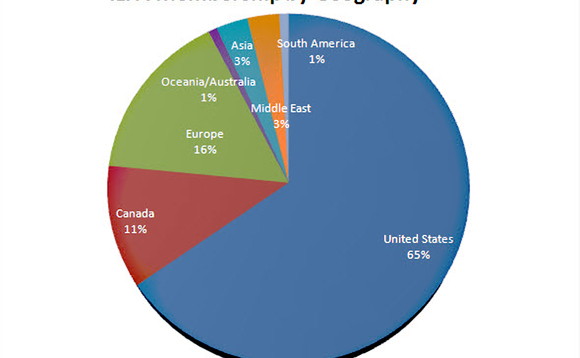

Of course today's private equity industry is increasingly global. AVCJ wondered how the ILPA principles' adoption rate in the region compares with what the organization sees in developed markets. Recker says that presently, comparative data of this sort is unavailable.

"You'd have to expect that adoption would be less than in the US and Europe," he explains. "In more emerging markets, they're still maturing and thus at a different stage in the private equity life cycle. And that's not just true of Asia. It applies to other geographies as well, such as Brazil. Over time, as they mature and want to continue to improve their practice, firms will look at these principles and see the advantages of adopting at least some."

Viewed from the standpoint of ILPA's present membership and community – basically drawn from the international LPs – he adds, "Moving into 2011, these three key areas will become even more important in strengthening private equity as an asset class, especially as liquidity returns to the market, investors shift towards global emerging markets where risk exposures increase, and investors become more discerning about the various asset classes in the post-financial crisis (environment)."

That's the expectation at least. But presently, in practical terms, other industry sources tell AVCJ there are many issues in play in China, for example, particularly under the transparency and conflict of interest umbrellas. "It's going to take some time," one commented to AVCJ. "Many (international) investors these days are signing up for apparent opportunities, and are willing to sort of give in and set some of these best practice items on the back burner because the opportunity set seems so great. We are, after all, economic animals: we have to make decisions that are in the best interests of our institutions, that make us the most money. But I'd surmise that over the longer haul, pointed issues will emerge that may make them change their mind."

He notes that many, if not most, international LPs have not ridden a full cycle in Asia. But even though the region has generally been enjoying a very beneficial time over the past 6-7 years, the wheel will continue to turn. And when the darker parts are inevitably encountered is when a re-think and a greater willingness to embrace the ILPA principles are likely to occur:

"Because they're going to need them; eg when they need to restructure a partnership and find they don't have the legal remedies needed to do so, because these were waived at the point the LP signed up for the fund," he contends. "At some point they're bound to start re-evaluating that process."

From the perspective of Asia's various markets and the indigenous players within them, it bears noting that they are far from uniform. Rather they operate on widely varied degrees of comparability with their developed counterparts. So those that are the most sophisticated are those most likely to pay heed to the ILPA principles. But some are developing their own norms and conditions, and are buoyed in doing so by their present prosperity. Because of this, a common thread is not easily achievable; for the short term.

Further out Asian funds seeking multiple-market international sources of funding may very well decide that the ILPA principles amount to a sort of guiding light by which to navigate. Therefore the new updated version is likely to have real relevance beyond the current GP constituency.

As John Breen, head of funds and secondaries with the giant Canada Pension Play Investment Board (CPPIB) says, "While the updated version of the principles provides latitude for using different ways to achieve common objectives, the overriding spirit of the document is universal. It's an example of how GPs and LPs have worked together to create appropriate frameworks for best practices that will enhance the long-term attractiveness of the private equity asset class. Private equity remains a growing component of our long range global investment strategy, and alignment, governance and transparency are critical success factors."

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.