LPs

Victoria stops investing in PE

Victoria Funds Management Corporation, which manages funds for the State of Victoria, Australia, has announced that it will stop investing into private equity and will, instead, focus on infrastructure investing. The once-prominent limited partner, which...

Announcing the AVCJ Private Equity & Venture Capital Awards China

2003 was probably one of the gloomiest years in recent memory for people in Asia. It was in that year that we launched our first annual AVCJ Private Equity & Venture Capital Awards at the suggestion of Walden’s Lip Bu Tan, who rightly proposed injecting...

Co-investments: Are GPs and LPs on the same page?

Private equity funds investing together with their limited partners have been on the rise recently with no signs of slowing down but what are the economics and the implications for the relationship?

Asia Pacific fund terms to fore in tough times

The latest Asia Pacific Private Equity Fund Terms Survey from independent fund of funds group Squadron Capital highlights a few shortcomings in regional funds’ adherence to the Institutional Limited Partners Association (ILPA) principles, increasingly...

NewQuest, backed by PE consortium, acquires BoaML Asia's non-real estate assets

A newly launched fund managed by NewQuest Capital Partners, backed by a consortium consisting of Paul Capital, HarbourVest Partners, LGT Capital Partners and Axiom Asia, has acquired “substantially all” of Bank of America Merrill Lynch’s (BoaML) non-real...

Asian funds set to maintain high management fees - Squadron

Despite the emerging status of Asia Pacific’s private equity market, the region’s largest funds charge more than those from the West when it comes to management fees, an annual survey conducted by Squadron Capital finds, and are unlikely to drop anytime...

VIDEO: PE experts discuss challenges in Oz

While Australia’s economic landscape has increasingly improved as the affects of the global financial crisis fade, some of the private equity and venture capital industry’s experts discuss the ongoing challenges they still face in Oz.

Squadron Capital boosts investor relations team

Hong Kong-based fund of funds Squadron Capital has bolstered its investor relations team with appointments that include Chau Ly as Director of Investor Relations & Business Development.

Even megafunds need to meet LP demands

After industry debate, Bain’s Asia Fund II may give investors options that focus on performance, not fees

MIVCC sees both side of Oz VC

The Melbourne International Venture Capital Conference (MIVCC) held on March 8 as a joint venture between AVCJ and the Victoria government, brought together venture firms from across Australia, domestic LPs and government representatives to explore the...

Partner Group hires Sony Life's Numata

Mamoru Numata of Sony Life has joined Partners Group’s Tokyo office as a senior manager. His responsibilities will include investment origination, client relationships and business development.

IDFC no longer a fund of funds

IDFC has pulled out of the private equity fund of funds business, which it entered in September 2009 under IDFC Capital. The Singapore-based FoF venture, which was headed by former ADB private equity head, Veronica John, reportedly failed to raise any...

Deal making Down Under

The 8th Annual AVCJ Private Equity and Venture Forum in Sydney brought together optimists, skeptics, GPs, LPs and the industry that makes Austrasia a hotbed of private investment activity

Opportunity knocks, but cautiously so

Twelve months ago, it was all sunshine and roses in Australia. The market has since rationalized and it seems GPs are still remarkably positive, while on the LP side, there are question marks around the market dynamics down under.

Super funds and private equity

Historically, Aussie superannuation funds have been fairly consistent in the way they manage private equity programs, which is also why talk about pulling back from the asset class is making waves.

HDFC takes stake, LP role in Kaizen

India’s Housing Development Finance Corp. (HDFC) has acquired a minority stake in education-opportunities group Kaizen Management Advisors Ltd., pledging an undisclosed amount of capital as an LP into Kaizen Private Equity’s new vehicle.

VIDEO: Adams Street Partner's T. Bondurant French

'Bon' French, CEO of Adams Street Partners, discusses Asia's role in the global LP's allocation strategy, and why his opinion on megafund investing has changed.

Investing without rose-tinted glasses

The CEO of global LP Adams Street Partners T. Bondurant French sits down with AVCJ to discuss allocation strategies, the PE industry’s challenges and how his wariness of global mega funds paid off post-crisis.

Susan Flynn rejoins Coller

A newly updated ‘Team’ page on the Coller Capital website served as a public announcement that Susan Flynn has rejoined Coller Capital as a Partner responsible for investor relations. She spent the last four years as CEO of Hermes Private Equity, where...

Carlyle buys AlpInvest, becomes LP

ALPINVEST, THE NETHERLANDS-BASED fund-of-funds, has been acquired by the Carlyle Group, which simultaneously makes its foray onto the LP side of the private equity industry.

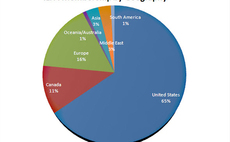

Brazil – battling for emerging Asia dollars?

ASIA HAS ALWAYS SEEN THE LION’S SHARE of emerging markets-dedicated dollars. Latin America has always lagged.

Investing without rose-tinted glasses

The CEO of global LP Adams Street Partners, sits down with AVCJ to discuss allocation strategies, the PE industry’s challenges and how his wariness of global mega funds paid off post-crisis.

ILPA polishes its private equity principles

New version incorporates more GP and LP input aimed at increasing focus, clarity and practicality on both sides of the private equity equation.

Carlyle acquires AlpInvest in first foray into FoF world

After nearly six months of speculation about who would acquire global fund of funds investor AlpInvest – until now held by two Dutch pension funds – the Carlyle Group has been announced as the chosen buyer, marking the PE giant’s first foray into the...