Early-stage

Deal focus: Mapping malls and metaverses

Mapxus sees indoor maps of high-traffic areas in high-density cities as the last piece of infrastructure to digitalise. The Hong Kong start-up has won corporate and VC backing to expand region-wide

China artificial heart developer raises $100m

China-based medical device manufacturer Evaheart has raised a Series A of close to USD 100m led by Chinese vaccine developer Sinovac.

Qiming, Ince invest in China, US biotech start-up

Qiming Venture Partners and Ince Capital have led a USD 50m Series B round for China and US-based oncology and autoimmune diseases treatments developer Allorion Therapeutics.

Korea audience engagement platform Bemyfriends gets $29m

Korea’s Bemyfriends, an audience engagement platform for brands and creators, has raised USD 29m in Series A funding, with the latest tranche provided by US-based VC firm Cleveland Avenue.

Deal focus: Qiming backs Chinese GPT pioneer

Frontis.ai is a Chinese start-up founded by local entrepreneur who helped lay the groundwork for ChatGPT in the US. Qiming Venture Partners was won over by its product conception capabilities

US, UK VCs invest Pakistan logistics start-up Trukkr

US-based Accion Venture Lab and Sturgeon Capital of the UK have led a USD 6.4m seed round for Pakistan’s Trukkr, a financial technology provider for the trucking industry.

Deal focus: Tiamat innovates around words and pictures

Tiamat originated from a Chinese college student’s experimentation with nascent text-to-image artificial intelligence technology. DCM China and VitalBridge Capital believe it will cut through the industry hype

Deal focus: Digital marketing piggybacks e-commerce boom

Malaysian digital marketing specialist Involve Asia is making hay as regional e-commerce shows no signs of slowing. Fresh VC support will guide inorganic expansion amidst erratically trendy user behaviour

Japan construction software supplier gets $8.5m

Japan’s Ballas, a software provider focused on metals procurement for the construction industry, has raised an approximately JPY 1.2bn (USD 8.5m) round led by Global Brain.

Qiming, Matrix back Chinese AI start-up Frontis

Chinese artificial intelligence generated content (AIGC) start-up Frontis.ai has raised a round of hundreds of millions of renminbi led by Qiming Venture Partners with support from Matrix Partners China.

Premji Invest leads $26m round for India's SpotDraft

India’s Premji Invest has led a USD 26m Series A round for local contract lifecycle management and legal work automation supplier SpotDraft.

China vaccine developer Immorna raises $100m

Immorna, a China-based biotech start-up focused on RNA-based therapeutics and vaccines, has raised about USD 100m across two Series A extensions.

China VCs back local automotive chip developer

SiEngine Technology, a China-based developer of chips for smart cars, has raised CNY 500m (USD 73m) in an extended Series A round featuring several local VC firms.

Northstar leads pre-Series C for Singapore's Una Brands

Northstar Group had led a USD 30m pre-Series C round for Una Brands, a Singapore-based brand agglomeration platform that operates across Asia.

Japan enterprise blockchain supplier LayerX raises $40m

Japan’s LayerX, an enterprise technology supplier that incorporates blockchain into functions such as expense management, has raised JPY 5.5bn (USD 40m) from a mostly local VC syndicate.

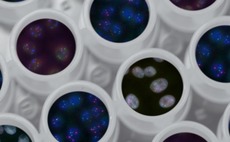

China's Oricell secures $45m Series B extension

Qatar Investment Authority (QIA) and RTW Investments, a US-based healthcare investor, have led a Series B extension of USD 45m for Oricell Therapeutics, a China-based drug developer working on CAR-T cell therapies.

Deal focus: Going regional to fill the coding gap

NxtWave is helping India’s massive engineering community get up to snuff in much-needed software-related skillsets. This is most difficult and most rewarding in lower-tier cities

Q&A: Blackbird Ventures' Rick Baker

Rick Baker, co-founder of Australia’s Blackbird Ventures, on pricing adjustments in the tech space, fundraising and secondaries, valuing unicorns, and the rise of ChatGPT

Deal focus: Indian drone maker takes flight

Recently launched Indian VC firm SphitiCap is making a high-conviction investment in local industrial drone maker Garuda Aerospace. It hopes a sizeable debut fund will help carry the start-up to IPO

China edtech player Nowcoder raises $50m

Beijing-based Nowcoder Technology, a Chinese campus recruitment platform also known as Niuke, has raised USD 50m in Series B funding from Sequoia Capital China, Shunwei Capital, 5Y Capital, Tiger Global Management, and Pegasus Capital.

Cenova leads $40m Series B for China's Eluminex

China-based healthcare investor Cenova Capital has led a USD 40m Series B round for Eluminex Biosciences, which is developing drugs and regenerative tissue used to treat eye disease and other vision-threatening medical conditions.

Fengyuan leads Series A for China battery components maker

Fengyuang Capital has led a CNY 150m (USD 22m) Series A round for Haodyne Technology, a China-based battery materials supplier.

L Catterton re-ups in Australian kombucha brand

Remedy Drinks, an Australia-based healthy beverage brand, has raised a Series B round from existing investors L Catterton and Kin Group.

Greater Pacific Capital leads round for India's NxtWave

Greater Pacific Capital has led a USD 33m round for NxtWave, an India-based online training platform that looks to develop skilled professionals suitable for employment in the technology sector.