Alternatives: Times of plenty

The Willis Towers Watson global alternatives survey offers few surprises in terms of where investors are putting their capital, but there are some interesting developments in which investors are providing it

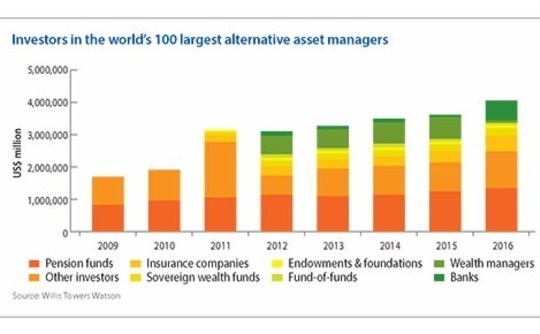

It should come as little surprise that institutional investors are piling more capital into alternatives than ever before – the low-interest rate environment has sent the search for returns into new asset classes. This was the context for Willis Towers Watson's latest global alternatives survey finding that the top 100 managers had $4.01 trillion in assets last year, up from $3.61 trillion in 2015.

Nor is it surprising that more capital has ended up in the hands of the largest managers (although for reasons of practicality, the survey doesn't cover the entire GP universe). It is well documented that many LPs with more mature programs are looking to consolidate their GP relationships. This means more money for managers that have scale and offer multiple strategies.

The movement away from hedge funds has also been widely flagged. Numerous LPs have complained about high fees, skewed alignment of interests, and performance headwinds. Private equity has benefited, with its share of the top 100's asset pool rising to $1.19 trillion ($695 billion in funds and $492 billion in fund-of-funds) from $1.06 trillion the previous year. This could be seen as testament to its relatively strong long-term performance.

Similarly, the growth in illiquid credit has been illustrated by some LPs awarding the asset class an allocation bucket of its own, where once it was hidden away in other pools. Illiquid credit went from $169.1 billion in 2015 to $359.9 billion last year. As recently as 2013, its was at $77.7 billion.

Changes in the make-up of the investors providing this capital, though small in percentage terms, offer some less obvious insights. First of all, the pension fund share has been consistently around one-third for the last five years. This doesn't reflect a static LP base as much as the fact that pension funds account for such a large portion – $1.33 trillion in 2016 – the moves made by others seen comparatively less significant.

Insurers were responsible for $500.5 billion of the top 100's assets last year, a 45% increase on the 2015 total. Over the three years ended 2014, the share rose by just 37%. In contrast, the growth experienced by sovereign wealth funds, as captured by the survey, was initially explosive – it nearly doubled year-on-year in 2012 to $185.7 billion – but has since steadied. Either concerns about non-traditional sources of capital disrupting alternatives are overblown, or sovereign funds are finding ways to put capital to work without the assistance of the top 100 asset managers.

Perhaps most striking is the amount of capital being deployed by groups that don't fall into any of the conventional LP categories. It has risen from $605.2 billion in 2012 to $1.15 trillion last year. This could be seen as symptomatic of an alternatives universe that is wallowing in capital as all kinds of latecomers flock to the party. Needless to say, the demand-supply imbalance – and its impact on pricing – doesn't bode well for managers' ability to deliver alpha.

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.