Family offices: A role for Hong Kong?

Hong Kong’s package of incentives for family offices is intended to redress a balance that has swung in favour of Singapore. Geopolitics is dampening its competitive advantages

Hong Kong remains one of the world's preeminent financial centres, but it suffers from a perception problem that may stymie efforts to attract more family offices to the territory, according to Danny Lee, until recently a partner at Blue Pool Capital, the family office of Alibaba Group co-founder Joe Tsai.

"The problem is political in nature. Hong Kong has been dragged into the US-China issue, and once people have a certain perception, it is very difficult to change that even if the facts are different to what is perceived," said Lee, who last year launched VCA Capital, an investment firm that channels Asian family office capital into mid-market buyout deals in North America.

"I don't have a magic answer. The government is doing certain things right such as finding a way to accommodate crypto investors, but we must do better. It's not just about running a couple of conferences. Hong Kong should learn from what Singapore does well, like introducing integrated policies, and it should also make the most of the advantages it has over Singapore."

This is a widely held view. Industry participants express, in turn, frustration at poor public relations, sadness at Hong Kong's strategic position, and hope that ground lost can be reclaimed. Countless high net worth individuals (HNWIs) have – apparently – already voted with their feet, contributing to a near-threefold increase in the number of registered family offices in Singapore over the past three years.

The geopolitical bind also offers some context to Hong Kong's recent initiatives – notably a tax exemption – intended to cultivate a family office ecosystem. The territory's proximity to the mainland is, at present, a key strength and a key weakness: a family office that isn't physically located in Hong Kong or has no interest in maintaining or accumulating China business interests may simply opt for Singapore.

"For family offices that are already here, the tax exemption offers some comfort on exposure," said Darren Bowdern, a partner in KPMG's Hong Kong tax practice. "For those that are not here, apart from Chinese family offices perhaps, would they come? I'm not sure."

Roadshow realities

From a private equity fundraising perspective, little has changed. Challenging conditions globally are pushing many managers to search for sources of capital that aren't restrained by overallocation. Asia is a target and local family offices are part of that. One investment director with a Hong Kong single-family office (SFO) noted having five meetings in the past month with GPs making their first visits to the region.

Yet the same organisations known for having reasonably mature, professionally managed investment programmes and an appetite for private equity funds are being pitched.

The SFO investment director suggested that about eight family offices meet this description in Hong Kong, while the most meaningful departures have been family offices established by mainland property developers. These groups expanded aggressively pre-pandemic, "trying to become multi-family offices (MFOs) or GPs," only to run out of money when distributions dried up. Some sold off their portfolios via secondary deals.

The mainstays on placement agent call sheets are SFOs formed by local real estate firms and Chinese technology entrepreneurs and a sprinkling of MFOs. Vincent Ng, a partner at Atlantic Pacific Capital, estimates only a half dozen, capable of writing cheques for funds of USD 10m-USD 30m on a consistent basis, would be must-have meetings on a roadshow for a US manager. Five more would be possibilities.

Thomas Yu, a managing director at Thrive Alternatives, another placement agent, references a deeper pool of 20-plus names that would be realistic targets for the same hypothetical GP. He added that appetite for PE fund exposure can vary considerably, with plenty of groups actively pursuing direct investments.

Despite the uptick in family offices establishing a presence in Singapore – from 50 in 2018 to 400 in 2020 to 700 in 2021 to more than 1,100 as of end-2022, according to the Monetary Authority of Singapore (MAS) – the number of targets are the same as Hong Kong.

"Of every 100 family offices that have opened in Singapore, only about 20 are genuine players we would categorise as institutional family offices. The rest are more like warehousing vehicles, set up for residency reasons and to some extent for money laundering," said Ng. "They haven't benefited Singapore beyond setting up an office and buying phantom properties."

Singapore-based fundraising professionals offer a similar view. One noted that about one-quarter of family offices in the country claim to look at private equity funds but barely a handful engage in formal due diligence and even fewer make commitments.

Another said of the family office community: "You can't ignore it, but you can't build a business around it." Most of this fundraiser's local clients are traditional institutional players – and they are to some extent self-selecting. A European manager targeting USD 6bn would not prioritise LPs writing cheques of less than USD 30m; doing business with most family offices rests on a willingness to aggregate them.

The aggregation role is often performed by intermediaries, which can place family offices one step removed from GPs. Anthony Chan, CEO of Hong Kong-based MFO Isola Capital observed there are easily 30-50 names in each of Hong Kong and Singapore that can commit to funds. Few, however, have the internal sophistication to properly analyse fund strategies and conduct due diligence.

"Some use external consultants or gatekeepers, some use platforms like ours that have in-house teams, some will use private banks," he said.

Tweaking models

It doesn't help that family offices can be hard to define. In Hong Kong, SFOs are largely self-declared and MFOs must be licensed. Singapore has a more robust framework, but the influx of capital has still led to scandal. In August, 10 individuals holding foreign passports believed to be issued by China were charged with money laundering. Properties, cars, and luxury goods worth SGD 1bn (USD 736m) were seized.

Singapore introduced its framework as early as 2019, perhaps not anticipating the surge of applications from those – such as HNWIs keen to preserve their wealth beyond the reach of China – for whom immigration status is a motivating factor. A patriarch establishes a family office in Singapore and staffs it with children or other relatives, enabling them to secure a local employment pass.

"A lot of immigration consultants in China were selling this as a product, and in the last year, Singapore authorities have tried to clamp down on the practice," said Edmund Leow, a senior partner at Dentons Rodyk in Singapore, who co-heads the trust, estates, and wealth preservation and family office practice.

"Conditions have become more stringent, and the number of family offices being set up has fallen significantly. That's not a bad thing. Singapore wants quality rather than quantity."

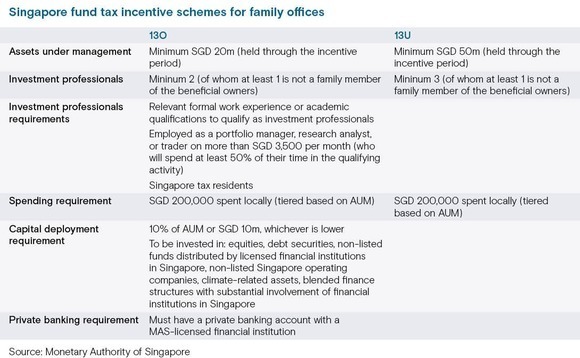

In July, qualification criteria for schemes through which family offices can obtain an income tax exemption – fund structures known as 13O and 13U – were heightened. The minimum assets under management (AUM) threshold doubled to SGD 20m (USD 14.7m) – previously, family offices had a two-year grace period in which to get there – and MAS said this level must be maintained for the life of the fund.

In addition, family offices must employ at least two professionals, of which one cannot be a family member, and the minimum annual business spending requirement of SGD 200,000 was altered such that it applies to local expenditure rather than total expenditure. Family offices must still invest 10% of their AUM or SGD 10m, whichever is lower, in local assets.

Separately, the Economic Development Board runs the Global Investor Programme (GIP) scheme through which individuals can achieve permanent residency. Family office principals are one of four profile types identified in the criteria. They must establish an SFO with at least SGD 200m in AUM and invest SGD 50m into local assets, including funds distributed by licensed managers and private equity investments.

Hong Kong's regime, announced in March, is intended to level the playing field with Singapore from a tax perspective. The government added various other incentives, such as promises of a revamped Capital Investment Entrant Scheme (CIES, the equivalent to GIP), an academy for training wealth management professionals, art storage facilities at the airport, and streamlined oversight of philanthropic activities.

A dedicated team within InvestHK, a government agency responsible for facilitating overseas business in the territory, has been tasked with promoting the family office proposition. InvestHK declined to be interviewed for this story. According to the agency's press representative, everyone is too busy to talk.

Qualification for Hong Kong's tax exemption involves achieving minimum AUM of HKD 240m (USD 30.7m), hiring at least two local staff, and spending more than HKD 2m per year. Otherwise, it is seen as more flexible than the Singapore offering. Notably, there is no upfront registration requirement: an advisor confirms a structure is compliant and tax reporting begins a year later.

Jessica Cutrera, president of Hong Kong-based MFO Leo Wealth, believes Hong Kong can turn inclusivity and flexibility into a competitive advantage, contrasting it with widely cited anecdotal evidence of Singapore's increasingly cumbersome bureaucracy and difficulties hiring staff from overseas. In the wake of the money laundering crackdown, mainland Chinese recruits are subject to more scrutiny than before.

Angie Han, head of wealth planning for South Asia at Pictet Wealth Management, added: "The Singapore regime started with more relaxed thresholds, then they became stricter with a higher minimum AUM and a more focused approach in terms of the family offices they wanted to attract. The Hong Kong regime doesn't have a pre-approval process, so it could be an attractive proposition for certain families."

Nevertheless, it is debatable how much difference the tax exemption really makes. Capital gains, dividend payments, and interest payments are not taxed in Hong Kong or Singapore. The exemption brings certainty regarding gains from trading public securities; in its absence, gains might be taxed as standard income. But such concerns are likely to be limited to larger family offices.

"The tax exemption isn't unhelpful, but I know of people with family offices who aren't using it because most of what they are doing involves capital gains or offshore distributions, neither of which is taxed," said Bowdern of KPMG. "What else could Hong Kong offer? They could tie the tax break to an investor visa scheme aimed at those with sufficient wealth."

Han of Pictet also highlights the potentially transformative impact of a CIES that dovetails with family office setup, but the government has yet to release further details. The situation substantiates Lee of VCA's observation that Singapore is better than Hong Kong at integrated policymaking.

Local attractions

Convenience is often a factor when choosing a family office location. North East Private Equity Asia, the regional arm of a family office established by the founders of jewellery retailer Pandora, opted for Singapore in 2016. The rationale, according to Sam Robinson, North East's managing partner, was that the family office CIO had ruled out China investments and two family members were based in Thailand.

3 Capital Partners, which seeks to bring elements of the endowment or outsourced CIO model to family offices in Asia, formed in Hong Kong around the same time. Most of the firm's clients live in Greater China, so Singapore was never really an option. Jon Shelley, the firm's COO, doesn't rule out expansion into Singapore, but concedes now would not be a good time given rising local operating costs.

"It also comes down to whether our clients feel more comfortable custodising assets in Singapore rather than Hong Kong," he added. "That's not been raised much in the last 6-12 months as a pressing issue."

Isola's Chan echoed that asset protection and custody are both concerns for family offices, but perhaps not the most paramount – besides, it is possible for a family office to operate from Hong Kong while booking assets in Singapore. There is no such workaround for talent, something Isola discovered 18 months ago when it opened a Singapore office and initially struggled to find staff with relevant skills.

This point is reiterated by multiple industry participants, with Leow of Dentons Rodyk warning that the supply-demand imbalance will only worsen now that family offices are required to recruit staff from outside the family. Hong Kong, by comparison, is well positioned.

"Most family offices are extremely frugal. They need human capital to support their endeavours, but they want it at reasonable cost. That is proving difficult in Singapore," said Atlantic Pacific's Ng. "Hong Kong still has depth. We lost some with the expatriate community decreasing in size, but there is still the indigenous community, and more professionals are moving from the mainland to Hong Kong."

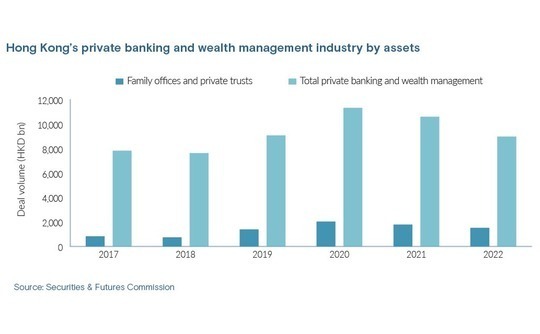

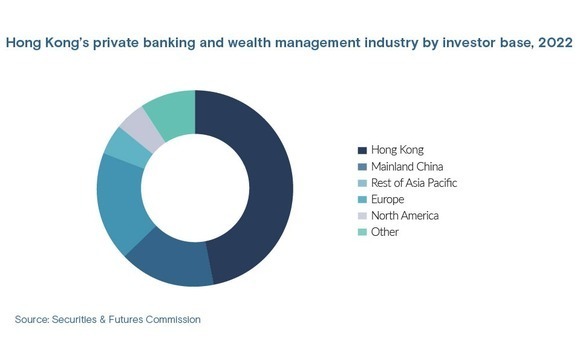

The territory's asset and wealth management AUM came to HKD 35.5trn (USD 4.6bn) in 2021, up 46% from 2017, according to the Securities & Futures Commission. Singapore has been closing the gap based on a 66% increase in asset management AUM to SGD 5.4trn (USD 4trn) over the same period tracked by MAS.

However, Hong Kong's broader financial services industry, with greater strength in areas like capital markets, supported a total headcount in asset and wealth management of more than 54,000 in 2022. There were 10,300 people working in private banking and wealth management specifically. AUM for the segment reached HKD 10.6trn in 2021, of which HKD 1.8trn was held by family offices and private trusts.

Regardless, Lee believes talent across all aspects of family offices, from investment to philanthropy, is more readily available in Hong Kong than in Singapore. Alfred Ip, a Hong Kong-based partner at Hugill & Ip who specialises in wealth management, emphasized the importance of ancillary services as well.

"It's about managing families, not just managing their wealth. The net worth of a very large family might exceed the value of a listed company, so governance must be good," he said. "Capabilities in tax planning, estate planning, and long-term development, especially when there are many families with different objectives, will attract more families to come to Hong Kong or stay in Hong Kong."

Uncertain outlook

Ip and Isola's Chan contest the notion that established family offices – as distinct from HNWIs – have fled the territory. Rather, they see larger players expanding their geographic footprints, adding Singapore while retaining Hong Kong. Chan observed that many "have tended to be multi-jurisdictional; and they've been aware of the Hong Kong geopolitical issue for a number of years."

To some extent, these characteristics are reflected in Leo Capital's client base. The firm focuses on family offices that have exposure to Asia but aren't necessarily Asian, leveraging expertise in cross-border estate and tax planning, and often providing a global rather than a region-centric service. One client recently established a 13O structure in Singapore to take advantage of the tax treaty network.

"A Western international family usually wants to have everything in one place. Traditional Asian families don't want that at all. They want 10 different private banks, and they play them off against each other. They want different service providers," said Cutrera. "Part of that is business model preference, and it can facilitate family office growth because there are lots of different ways to engage."

Hong Kong's role as a family office hub, and whether it can be more than just a China nexus, is fiercely debated. Family offices and advisors in Hong Kong and Singapore claim to have seen families from Europe, the Middle East, Australia, and Latin America set up shop – usually as an expansion initiative, occasionally as a relocation of the main decision-making entity.

Cutrera sees scope for Hong Kong to attract families from the Middle East and South Asia, provided there is some kind of China interest. A stronger outreach effort in these markets would help, not least to wash away some of the negative sentiment that coalesced around Hong Kong during the protracted period of mandated hotel quarantine during COVID-19.

Above all, Hong Kong needs the mainland to become investable again. "Once family offices see Hong Kong's public markets coming back and IPOs by top Chinese companies that they want to access, the ecosystem will come back," said Atlantic Pacific's Ng. "Until that happens, Hong Kong must ensure the talent pool not only remains but also continues to improve."

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.