Made to measure: Customized co-investment

Growing appetite for co-investment among foreign and local institutions in Asia has given rise to a wider variety of advisors offering customized solutions to those with limited in-house resources

The combined private equity portfolios of the Oregon Public Employees' Retirement Fund and Washington State Investment Board are worth approximately $32 billion. This comprises positions in more than 600 funds, although there is a high degree of crossover between the two portfolios. In Asia, for example, they both back Affinity Equity Partners, KKR and CDH Investments.

For the past decade, Fisher Lynch Capital has been tasked with combing through these manager relationships for co-investment opportunities on a global basis, easing the burden on limited in-house resources. Andy Hayes, private equity investment officer at Oregon State Treasury, has previously observed that the arrangement also brings clarity to his team's decision-making process: there is no danger of backing "a B-minus GP that could deliver a lot of co-investment."

Oregon and Washington each committed $250 million to Fisher Lynch in 2005 and then put $500 million apiece into a vehicle that started investing in 2011. They are the two biggest clients of the boutique investment firm.

Fisher Lynch to a certain extent owes its existence to Asia. Brett Fisher, the firm's co-founder, and Leon Kuan, one of his fellow managing directors, previously managed the North American private equity group for GIC Private. In addition to making LP commitments to funds, they took the Singapore sovereign wealth fund into 22 co-investments. Fisher Lynch was set up in 2003 to help US LPs get exposure to a strategy that, in the wrong hands, is as risky as it is lucrative.

Growth industry

Thirteen years on, co-investment is a priority for many LPs, even if relatively few are willing and able to act on opportunities, particularly when the target assets are far from home. But as foreign groups become increasingly comfortable with Asia and more local investors follow in the footsteps of GIC and build out PE programs, demand is growing. This has also given rise to advisors who offer highly customized services.

"We thought we could help institutions in three areas where they were struggling," says Michael Prahl, who set up Asia-IO Advisors last year. "First, execution capabilities in co-investment, and resolving the tension between striving for active co-investment programs, which are expensive to set up, and having a cost-efficient program that is passive. Second, corollary to the co-investment program, access to Asian PE given how fragmented it becomes beyond the global brand names. Lastly, we wanted to provide these larger clients with something more customized than the traditional model."

Prahl, an adjunct professor with INSEAD's Global Private Equity Initiative and before that an investment professional at Apax Partners, joined his partner Denis Tse, formerly head of private investments in Asia for Lockheed Martin Investment Management, in founding Asia-IO. They have signed up several large clients and closed their first transaction in late 2015.

Asia-IO is not alone in offering customized co-investment solutions, but categorizing these different industry participants is challenging. They are defined not only by their willingness to provide flexibility, but also their desire to go against the grain, in whatever direction that may be.

For example, EXS Capital Group has operated as a fund-less sponsor for more than eight years, bringing co-investors into its deals through bespoke structures. If it sits closer to GPs working deal-by-deal basis as a stepping stone to launching a blind pool fund (EXS itself has no plans to do this), then others that address co-investment as part of broader portfolio construction services have more in common with fund-of-funds providers that have for years offered customization through separately managed accounts (SMAs).

Countless other strategies are scattered around these, as advisors match up investment opportunities with LPs that have particular needs. "Three quarters of our pipeline is funds and one quarter is SMAs or structured companies," says Mounir Guen, CEO of MVision. "With structured companies, we could either find a solution for an investor and put together a partnership, or help a GP turbo-charge an outstanding portfolio company by finding long-term capital, so it doesn't have to be sold after 4-5 years."

These are solutions that exist outside of traditional fund structures, replacing or complementing them. However, for now they remain firmly in the minority. The bulk of capital entering the asset class enters blind pool funds that charge a 2% management fee and 20% carried interest, or some variation on that theme, depending on the popularity of the GP and the clout of the LP.

This is in part because most of the larger private equity investment programs follow a similar evolutionary path. It could take a year or so for an institution to enter the asset class as consultants help to work out its objectives and how they can be achieved. Certain functions are handled directly and others are packaged into mandates for third-party providers. For example, primary commitments to managers in certain geographies or below a certain size are often outsourced. Secondaries and co-investment might also be placed in the hands of more experienced advisors.

The speed with which different areas of coverage are brought in house, if this happens at all, varies greatly - Canadian pension funds have been much more aggressive in accumulating internal expertise than their public sector counterparts in the US. But the route from fund-of-funds to direct primary commitments to co-investment to direct investment is well-trodden.

"Asia will develop in the same way as other parts of the world," says Weichou Su, a partner at StepStone. "As the Chinese insurance companies go from five GP commitments a year to 20, it is easier to play the co-investment game. GPs give co-investment to the top 3-5 LPs that have been with them for a long time and are sizeable. If you are a Chinese insurance company you are not there yet, in terms of size, history or relationship. You have to build that before you can ask for co-investment."

Finding a niche

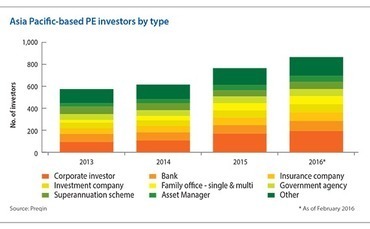

Those with customized co-investment propositions by necessity exist at the margins, targeting institutions that for reasons of size, cost, flexibility or attitude are not getting what they want from standard offerings. While sovereign wealth funds and government-related entities are the largest Asia Pacific-based investors in private equity, Preqin has records of 867 groups within the region currently having exposure to PE - not necessarily exposure to co-investment - up from 575 three years ago. The biggest LP group is corporate investors, which number 100 more than the second-largest, banks.

Indeed, the Asia-IO model was initially based on working with large Western institutional investors - and it may still end up that way - but the current crop of clients are all Asian. These groups understand the region and are comfortable with direct exposure, but they may need help designing a program or pursuing opportunities outside their home markets across Asia or occasionally even on a global basis.

"They are not your typical large-scale institutional investors in private equity," says Prahl. "Some have emerging PE programs, some have corporate venture capital-style activities and occasionally they may make larger investments on a project-by-project basis. Yet, if you don't have a structure set up, direct investing is a very complicated process."

Asia-IO's debut investment says a lot about the customization being sought. A fund managed by the firm bought a majority stake in Daiwa Associate, a Hong Kong-listed electronics manufacturer. The plan is to turn the business into a smart manufacturing systems specialist, serving as a platform for other acquisitions.

The Asia-IO fund raised capital from a number of LPs, but 75% was contributed by a clutch of companies with strategic interests in the IT sector, including Taiwan's Foxconn Technology and Korea's SK Holdings. The remaining 25% came from high net worth investors.

As such, this kind of approach doesn't have to be a threat to traditional exposure. It allows investors to opt for additional coverage that addresses a particular strategic niche or fills a gap in execution capabilities. It is also cost-efficient because infrastructure is shared with a handful of other groups. LPs might want to avoid going it alone in these areas because it is unclear whether there will be enough deal flow to sustain the deployment of internal resources.

Erik Solberg, founder and CEO of EXS, divides the LP community into three broad categories: US and European institutions that have minimal capabilities in Asia, are unlikely to seek co-investments from portfolio GPs, and will never learn about his firm; groups, such as big family offices in Asia, that have no interest in entering blind pool funds, and may prefer direct exposure to deals through EXS or a similar model; and a broad swath of players, ranging from sovereign wealth funds to pension funds to fund-of-funds, that make commitments to funds and are looking for co-investment as well.

One of the reasons he gives for LPs choosing a customized approach rather than simply doubling down on deals sourced by portfolio GPs is access to a wider range of deal-flow. If, as StepStone's Su also noted, big funds offer their best co-investments first to LPs that write the biggest checks or have the longest relationships with the manager, others miss out. In addition, funds are often constrained by fairly narrow mandates, which may or may not remain applicable over time in highly volatile Asian markets. For instance, co-investments alongside a large pan-Asian manager would not offer the middle market exposure.

The co-investment vehicles offered by the likes of StepStone, HarbourVest Partners and Hamilton Lane are intended to address this dilemma. Furthermore, their solutions feature a degree of fee arbitrage: the 1/10 investors might pay is lower than the 2/20 for direct entry into a fund, even if the GP charges zero fees on co-investment. "We have so much exposure globally with hundreds of thousands of GPs and we can leverage those primary relationships to get more deal flow than any single group," Su notes.

So why go with a small platform instead of or in addition to a global player? It comes down to the level of customization required. While LPs able to get SMAs can to a large extent write their own ticket, the rest would typically commit to a co-mingled co-investment vehicle - paying fees on committed capital rather than just invested capital - and not everyone is comfortable with blind pool risk. Working with an advisor on a specific strategy can also result in differentiated deal-sourcing and offer a more intimate and educational investment experience.

"We think of ourselves as the outsourced investment office for our clients. We operate like direct investors yet we plug in much deeper to our clients' preferences and decision processes and create very flexible, customised solutions. In effect we are constructing a portfolio of concentrated exposures that match their specific asset allocation agenda through a range of investment styles," Asia-IO's Prahl says.

Choosing whether to invest and how to invest in a deal can be important to groups as they develop a familiarity with the asset class. For example, in 2013, EXS led an investment in a Vietnam-based real estate developer through a single project investment vehicle, charging fees and carry to investors only on invested capital, with strong transparency and close alignment. It is now working on another, larger round for the company, and while some investors are once again coming in through the fund, others are participating directly because they no longer needed third-party assistance. EXS receives no economics from these investors, but gets a placement fee from the investee company.

"Discretion makes the whole process more difficult to execute, so there are bigger advisors that might not want to give discretion on single co-investment decisions," says Javad Movsoumov, executive director in the private funds group at UBS. "There is definitely a market for a strategy that offers greater flexibility but I don't see it exploding and growing bigger. I see more people being converted in terms of investing in funds. Maybe they get burned on one investment and appreciate a more diversified approach."

The broader question

This observation widens the debate to consider whether the current craving for co-investment is sustainable. Plenty of industry participants predict a scenario in which certain LPs - most likely those with limited resources to devote to due diligence - find their co-investments have underperformed, leaving the very large players to dominate the space. If there is truth to anecdotal reports of certain Asian LPs pushing into co-investment with a haste that belies their relative inexperience, the fallout could be severe.

"Some groups talk about it conceptually but it is very difficult to say whether they've done it successfully," says Niklas Amundsson, a partner at Monument Group. "There is a sense that some Asian institutions are skipping a few steps because they want to be like the Canadians. But the Canadians started out by investing in funds, then they did co-investment, and then they went direct. I think there will be a lot of secondary deal flow in Asia at some point."

If there is a reevaluation as to how LPs address co-investment, it isn't necessarily a bad thing for those offering customized solutions. Large investors may become increasingly open to creative structures as they develop their private equity programs. This points to more SMAs and a greater interest in ways to get direct exposure to deals.

Another potential development is variations on the typical fund structure, at least for managers that struggle to raise capital on their own terms. A first step might be funds with smaller core corpuses and larger guaranteed allocations for co-investment. UBS' Movsoumov agrees this is a possibility, noting that LPs are already trying to codify co-investment rights, with legal undertakings to show co-investment opportunities to them before everyone else, up to a certain total capital commitment.

"If you are popular you can go for a 2/20 structure, but those outside the top quartile will come under pressure to offer something more bespoke, just like some GPs have come under pressure to give preferential terms to large LPs," he says. "If you go back 5-6 years, preferential terms on economics were not that common but now you see them all over the place."

For bespoke service providers adapting to this changing environment, the caveat is how far they can evolve. First, it is difficult for these platforms to achieve scale and retain their high touch, high customization characteristics - as they grow in size they may become less differentiated from the global fund-of-funds. Another mode of expansion is to deepen relationships with a closely held set of clients, but the more vehicles a provider manages the more complicated the allocation procedures and the greater the risk of conflicts of interest.

Second, the temptation to raise committed capital - possibly offering less discretion to the investor - might be too great. There are various ways in which a flexible mandate can be secured, from pledge-style funds where the LP agrees to sponsor a team and commit to some of the deals the team generates to pure deal-by-deal arrangements. There are also different ways in which compensation can be agreed. But there is no substitute for having the capital in place to support a transaction from day one.

"How are you going to hang on to a deal without being able to promise you can close the transaction?" asks Sanjay Chakrabarty, a partner at Singapore-based Capital Square Partners, who has experienced working deal-by-deal. "That is the dichotomy you have to break through and the only way you can do it is by getting some committed capital.

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.