Asia secondaries: Layers and structures

With private market valuations yet to see a meaningful reset in Asia and heightened risk factors in China, investors are exploring ways to drive secondary deal flow by closing the bid-ask spread

The healthcare portfolio features a few standout companies, including one that has already received approval for a Hong Kong IPO. The assets are being offered at a 40% discount to net asset value (NAV). An anchor investor is in place. But no one is willing to participate in syndication for the rest, leaving the transaction – a renminbi-to-US dollar restructuring – teetering on the brink.

"I think it will die off in 30 days," the agent responsible for placing the deal observed. "We are seeing a lot more deals than last year, but the market has never been this bad – hardly anyone wants to touch China. Last year, we might have looked at one in 20 deals we were shown. Now it's one in 100. With fundraising also very difficult, a lot of people will go out of business."

China is an outlier, given the unique challenges presented by geopolitical tensions, regulatory uncertainty, and a near-term macroeconomic trajectory bound tight to the longevity of zero-COVID-19 policies. Yet the broad message is consistent across Asia when it comes to GP-led secondaries: there is a plentiful supply of assets but relatively limited demand.

Secondary investors are inclined to wait for more conclusive evidence of a turnaround, especially in China. Frustration at a perceived reluctance on the part of GPs to value unlisted assets in a way that more accurately reflects adjustments in public markets is also holding them back. Agents are getting creative with structuring as they look to bridge the gap, with mixed success.

"Investors are seeing historic levels of deal flow in Asia, but people remain reluctant to transact. It's likely there is a bid-ask spread that needs to be narrowed, and then there are underlying concerns around the macro and geopolitics," said Damien Jacobs, a partner at law firm Kirkland & Ellis.

Conversely, when it comes to Asian LPs selling positions in private equity funds, Jacobs is having one of his busiest years. Other investors and advisors concur. LPs of all kinds are looking to offload assets, from pension funds and insurers that have been left overallocated to private equity following public market declines, to individuals facing liquidity constraints and need to free up capital.

From single to multiple

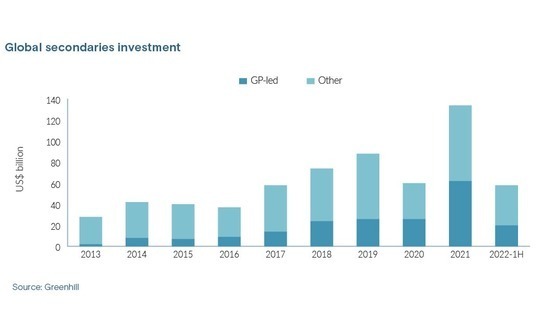

Secondaries investors put USD 58bn to work in the first half of 2022, according to Greenhill, which expects the full-year tally to roughly match the USD 134bn recorded in 2021. LPs under selling pressure was the story of the first six months. This contributed to the GP-led share of overall volumes falling to 34% from 46% last year.

Unmoving private markets valuations were just as much of a problem globally as they were in Asia, with Greenhill noting that net asset values (NAVs) in March were mostly flat compared to December 2021. It expected adjustments to happen during the second half, although venture NAVs are unlikely to change until underlying portfolio companies raise new capital, which might not be until 2023.

Within the GP-led segment, the rise of single-asset continuation funds, designed to allow GPs to hold onto prize investments for longer, continued. Their share of deal flow was 46% in the first half compared to 39% in 2021. Multi-asset continuation funds fell from 42% to 38%.

This does not correspond to patterns in Asia, where single-asset transactions are a less mature phenomenon and activity rests on the appetite of global investors that are also weighing options in more developed markets. Hahn & Company closed the region's largest such deal for Korea's Ssangyong C&E in July, but it is one of several transactions where processes trickled over from 2021.

"Buyer appetite for single asset deals has come down quite dramatically," said Martin Yung, an Asia-based principal at HarbourVest Partners.

"This is driven by the fact that we are seeing certain types of opportunities – typically highly diversified fund portfolios trading at attractive discounts and in some instances with attractive payment structures. On a relative value basis, single asset transactions are not delivering the extra alpha they should for the increased risk profile currently."

"You must be flexible. Maybe you are working on something that isn't structured and then someone comes in and says we can give you a better price if you provide this kind of downside protection," a second placement agent observed. "It's good to close the bid-ask spread, but it's not a solution to all problems. If you are structuring to take security over something, it must be of high quality."

Preferred equity transactions, whereby the secondary investor receives the bulk of distributions from the portfolio to a certain point, are among the most used structures globally. But Kirkland's Jacobs observes that few deals in Asia qualify as pure preferred equity with covenants much like loan terms. Rather, they are more like continuation funds with some subordination of economics.

Moreover, the region has yet to see specialist preferred equity investors like Whitehorse Liquidity Partners or 17 Capital, where downside protection justifies the pursuit of mid-teens returns.

One Asia-based manager, TR Capital, is planning to raise a fund to pursue this strategy, according to three sources familiar with the situation. Another, NewQuest Capital Partners, would consider preferred equity but not on a wholesale basis because it doesn't meet the firm's return criteria. Investments are typically equity because NewQuest wants the upside.

A recent investment involving Hidden Hill Capital featured a deferred payment: NewQuest moved to enhance its return by committing a portion of the capital upfront and agreeing to finance the rest using distributions from the portfolio. For the most part, though, the firm looks to differentiate itself by mobilising on-the-ground resources and taking a partnership approach when working with GPs.

"We have a large investment team, we understand different markets and sectors, and we can get more into the weeds of a deal," said Bonnie Lo, a partner and COO at NewQuest. "There could be situations where – even though it's not a preferred structure – we can give better pricing."

The four variables

Lo declined to comment on specific deals, but several sources identified NewQuest as one of the bidders when L Catterton sought an investor to underwrite a USD 360m strip sale of minority interests in positions held by its third Asian fund earlier this year.

NewQuest offered to pay cash but valued the assets at a significant discount to NAV. Meanwhile, Hamilton Lane proposed a structured transaction at zero discount, one source said. L Catterton and its investors went for the latter option, ultimately betting that sufficient exits would emerge to more than satisfy the near-term obligations to Hamilton Lane in the form of access to distributions.

The L Catterton structure is described as typical in so far as it comprised several layers. Secondary investors receive most of the distributions in the first layer, ending when the portfolio achieves a certain multiple; economics are more evenly split in the second, until another return target is reached; and existing investors in the fund play catch-up thereafter. But there's no single solution.

"The concept of preferred equity might be standard, but during negotiations, it's every colour in the spectrum," said Vincent Ng, a partner at placement agent Atlantic Pacific Capital. "In one deal, there were five different thresholds, with investors getting their money back, a small catch-up, a swing back to the investors, then a catch-up, and so on. It's case-specific, and right now it's buyer-friendly."

Transactions are essentially structured across four variables: the loan-to-value (LTV) ratio, or the size of the investment relative to the valuation applied to the portfolio; the discount to NAV; the return thresholds at which different layers are triggered; and how distributions are shared in each layer.

According to Lloyd Bradbury, head of Asia Pacific capital advisory at Greenhill, LTVs are falling while preferred return hurdles are rising. "Much like any other debt or quasi-debt product, they are becoming more expensive," he said, adding that he has seen LTVs of 20% to 60%, return hurdles of 1.25x to 1.8x, and usually some upside sharing once that hurdle is met.

There are anecdotal accounts of investors securing 100% of the distributions up to a 1.8x return, but it is difficult to put this in context without the other variables. The quality of the portfolio and the manager, and paths to exit for individual assets, are also vital in shaping performance expectations.

"There is interconnectivity between the discount you can achieve, the LTV, and the threshold. If you are providing more loan or preferred equity, you would want to keep a larger portion of the cash flows to a higher tier," said Jason Sambanju, a partner and CEO at Foundation Private Equity.

"If you aren't paying a discount to NAV and the LTV is high, you'd probably want a relatively high threshold, something like 1.8x. If you're paying a 20% discount and the LTV is 20%, you might live with 1.4x, especially if there's a lot of value and you can capture it early on."

Sambanju adds that he's heard of "all kinds of funky stuff" around the sharing of distributions, including investors sharing more of the distributions in early layers because they want everything above 3x. Kirkland's Jacobs observes that secondary investors underwrite to a certain return based on their perception of risk and are largely agnostic as to how they get there.

Other options include earnouts, whereby investors commit a smaller amount of capital upfront but incentivise the manager by offering additional payments if performance milestones are met. Structures like these are often used as the asset level rather than the portfolio level when certain companies face challenges that result in a wide divergence in likely outcomes.

"The pricing of those specific assets would be very different to others in the portfolio because of that risk which will form a part of the overall price for the whole portfolio," said HarbourVest's Yung.

Managing expectations

While creative structuring can be used to meet the needs of incoming investors, selling a deal to existing LPs is another matter entirely. The potential obstacles are twofold. First, LPs object to the size of the discount to NAV. Second, the structure is so convoluted that LPs don't understand it.

Before beginning detailed negotiations, investors want to know that the GPs leading transactions have at least consulted their LP advisory committees to establish whether what they are proposing would be feasible. For advisors considering secondaries mandates, once they get comfortable with GP motivations and product quality, they ask whether LPs have been briefed and are supportive.

"The GP might say that LPs are keen to sell, but do they understand what selling means? If we don't get that implicit guidance, we are hesitant about working on a deal. We've hit hurdles in the past when we've come back with a strong bid from investors only to find that the sellers' expectations were way off," said Ng of Atlantic Pacific.

Expectations management becomes harder when transactions are highly structured. Ng notes there are plenty of GPs in Asia that are supported by LPs that aren't necessarily institutional and have limited experience of secondaries. It is not unusual for investment committees or trustee boards to flail when faced with complexity and ask for a discount to NAV instead.

While it is the GP's duty to ensure LPs are up to speed on what is being offered, advisors and secondary investors may play supporting roles. Indeed, intervention might be essential in situations where GP-LP relations are crumbling. "Some of these smaller funds have been stuck in limbo for a long time, LPs are frustrated, and a lot of the capital is relationship capital," said Jacobs of Kirkland.

Foundation Private Equity goes so far as to establish the priorities of individual LPs and devise a package of structures that address a range of different outcomes. For example, one investor might be dealing with a liquidity shortage elsewhere in its investment programme and want to cash out immediately, while another is willing to wait for the portfolio to deliver more upside.

"For a large enough transaction, we might go to the largest LPs in a fund, create a structured solution to meet the needs of each one, and then offer the same solutions to the other LPs. And if it's a tender offer organised by the GP, we would negotiate directly with the LPs," said Sambanju. "Even then, we would still include a cash offer, so everyone has a baseline they can look at."

Secondary investors are generally encouraged by an increased receptiveness to secondaries in Asia, regardless of structuring. GPs that previously declined to engage because they had IPOs in the pipeline are now revising their expectations, while LPs are keen to generate liquidity given uncertain market conditions.

"We're at a point in the cycle where, for the right price, everyone is a seller," said Greenhill's Bradbury. "We are not seeing widespread distress, but different pockets of pressure and areas of opportunity. Last year, we were in a strong bull market, and everyone wanted to hold their risk assets. This year, having liquidity is attractive."

Whither China?

As to where secondary investors are looking for opportunities, Greenhill noted in its first-half report that there had been an uptick in Korean, Japanese, and Australian managers executing or looking to launch GP-led transactions. India and Southeast Asia were "selectively attractive" as part of efforts to diversify away from China while still maintaining exposure to growth markets.

Despite enthusiasm for Asia ex-China, investors recognise the implausibility of trying to counterbalance the absence of China by deploying more capital elsewhere. Groups with a presence in the region remain open to opportunities in China, albeit with a heightened degree of caution, an eye to underwriting to longer holding periods, and a hope that GPs are realistic in their expectations.

Those able to rationalise the risk could be rewarded with substantial returns. Several advisors describe China as a buyer's paradise, pointing to discounts to NAV as large as 60% and the prospect of modelling out a worst-case scenario and still being able to find a taker for those terms. Investors are also looking at the market with guarded optimism.

"We still believe that China in the long term is investable," said NewQuest's Lo. "We have two partners and 15 investment professionals on the ground in China, and they've been there throughout the past three years while the country has been somehow shut to the world amid COVID. This could be a very good vintage for secondaries if you avoid the sectors that are riskier."

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.