2022 preview: SaaS

Software-as-a-service continues to benefit from a digitalization push across multiple markets. Investors are looking for differentiation in a market characterized by high valuations and intense competition

Freshworks was the India software-as-a-service (SaaS) success story that made everyone take notice. It was among the first to achieve unicorn status and arguably the first to do so with support from local VCs. The company's $1 billion NASDAQ IPO in September was hailed as a landmark event.

But Mohan Kumar, founder of Avataar Venture Partners, which makes growth-stage investments in enterprise software businesses, is already looking closer to home. RateGain, a travel and hospitality specialist, is poised to become the first SaaS company to go public on an Indian bourse. How well the INR13.3 billion ($176 million) offering is received will determine whether others can follow.

"Companies used to go to the US because analysts and investors there look at where you are going to be in two years, not where you are today. In India, it was all about being profitable immediately," Kumar says. "Now, though, you can get a premium valuation in India. Many of the institutional investors are the same as in the US and they value companies like they do in the US."

Avataar, an investor in RateGain, is eyeing two more IPO exits, with Appnomic Systems and Capillary Technologies looking to list next year. Kumar expects some companies to continue pursuing IPOs in the US – for example, those that are domiciled in North America and primarily serve clients based in that region – but it is no longer a given. Local appetite for these assets is real.

SaaS providers globally are already enjoying a prolonged period of expansion. If the global financial crisis was instrumental in convincing corporates in developed markets to switch from buying to renting software – it took cost off their balance sheets – then the dislocations of COVID-19 have reminded any laggards of the need to catch up.

"The pandemic has forced these leaders to think differently because they had no other choice. They had to think differently about the physical world and the digital world. The second quarter of 2020 was terrible; the third was decent, the fourth was great, and we've never looked back," Orlando Bravo, founder and managing partner of software-focused GP Thoma Bravo, told AVCJ last month.

"During the past year, there have been solid valuation markups on companies that manage to deliver true value to its users. Based our experiences from the global market and our understandings of the local context, we see plenty of potential in some still nascent spaces in China, including cross-border e-commerce, marketing technology, and advanced manufacturing applications," says Daisy Cai, head of China at B Capital Group.

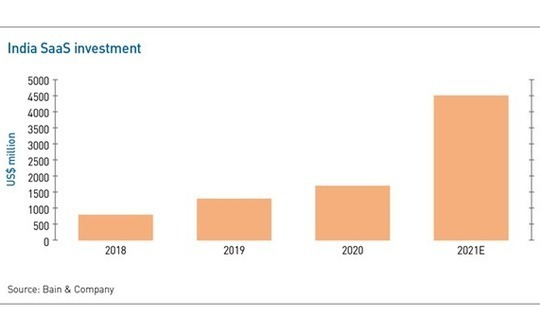

The question is at what point do valuations outstrip what is realistically achievable. Investment in Indian SaaS is on course to reach $4.5 billion in 2021, up from $1.7 billion last year, according to Bain & Company. Growth was driven by a rise in the number of larger deals, classified as $50 million and above.

Notably, the likes of Gupshup, HighRadius, Postman, Eightfold, and BrowserStack closed rounds of $200 million or more. Meanwhile, the title of India's most valuable SaaS company moved from Freshworks to Browerstack and on to Postman, with the latter completing its Series D was at a valuation of $5.6 billion.

Bain argues that rising investor interest is supported by a newfound maturity in the market. More than 35 Indian SaaS start-ups achieved annual recurring revenue (ARR) of at least $20 million in 2021, a sevenfold increase over five years. At least seven companies have reached the $100 million ARR milestone, compared to no more than two five years ago.

Yet Kumar of Avataar observes that valuations have risen from 10-12x ARR in 2019 to 20-50x ARR today. "If a company is growing at 150%-plus, you are paying ahead but 30x ARR becomes 15x after one year of growth. Then 15x becomes 1.5x," he says. "But the moment these companies run into slower growth, their valuations will correct rapidly."

This valuation spike has come as more investors crowd into the growth space, reflecting a broader shift in focus from B2C to B2B. Jai Das, a managing director and co-founder at Sapphire Ventures, adds that valuations are getting bid up by investors like hedge funds that underwrite to lower IRRs than traditional VCs. Sapphire invests in SaaS companies globally and Das doesn't expect a correction.

"Valuations are crazy, and you have to ask how people are making money, but people have been asking that for 10 years," Das says. "Unless the market environment changes drastically for two years, valuations are not going to come down."

In contrast, Andrew Gray of Potentia Capital, an enterprise software-focused PE firm in Australia, sees pressure on valuations but it has yet to prove an obstacle to deal access. This is partly a function of competitive dynamics and partly a function of target profile – Potentia only backs businesses that are profitable or near profitable, so valuations aren't based on ARR, and it usually takes control.

"We don't see consistent domestic or international competition," Gray says. "COVID has made it harder for international players to do deals in Australia. At the same time, they are raising so much money that the deals we look at are too small for them. They would rather have us acquire businesses, do some bolt-ons, and position them as businesses they can pay more dollars for. There will be symbiosis."

Potentia often takes companies into new geographics or adjacencies. The latter is a common theme across markets, with investors seeing potential for technology-enabled solutions in verticals such as education, healthcare, logistics, agriculture, and e-commerce. Horizontal applications like customer relationship management offer breadth, but it takes something special to displace the incumbents.

Only four of 16 India SaaS deals of $80 million-plus identified by Bain involved vertical businesses. However, Kumar maintains that verticals are the best way to address the digitalization needs of the country's small and medium-sized enterprises (SMEs), which represent a relatively untapped market.

In terms of China strategy, Cai of B Capital recommends that SaaS start-ups serve SMEs to build scale and then target larger enterprises where there is a greater willingness to pay for quality products. Once established as a leader in its core area, a start-up can consider adjacent verticals to maintain growth momentum. Many companies are also integrating artificial intelligence as a barrier to entry.

"Almost every sector has specific demands that cannot be fully addressed by horizontal SaaS products. To accelerate digitalization, enterprises need supports from providers who know clearly about the industry pain points and can develop tailored solutions," Cai adds.

This contributes to an enduring quirk of the China market: robust demand for product customization as opposed to standardization. This is attributed to the diverse and complex needs of local companies that lack in-house engineering capabilities and sophisticated infrastructure.

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.