HNWIs & private equity: Access all areas?

The private equity industry wants more efficient and inclusive ways to raise high net worth money than private bank feeder funds. Technology, in different ways, might provide the answer

Victor Jung's explanation of why high net worth individuals (HNWIs) play a limited role in alternatives is delivered emphatically yet precisely: 10, 10, C. The two 10s represent the typical $10 million minimum investment amount and the 10-year lock-up on a fund commitment, while the C stands for capital call. Jung follows up with an account of how wealthy Asians run into this three-part obstacle.

"They might have sold assets to PE, and they wonder why it isn't coming to them as an investment option. We pitch them, they like it, and they ask to put in $4million. When we say it's $10 million minimum, it comes as a shock – that could be their entire yearly investment budget," Jung explains.

"Then we tell them it's a 10-year lock-up and they joke, ‘Some marriages last less than 10 years, and you're asking me to give $10 million to someone I barely know, and I cannot redeem?' As for capital calls, Asian HNWIs are typically cash-poor and asset-rich, a function of efficient money management. They are used to all-in and all-out. With private equity, you go all-in, but it's a drawdown mechanism, which is less straightforward, and they can risk default."

Jung is head of distributions and liquid private markets for Asia at Partners Group, where HNWIs account for 18% of the firm's total assets under management (AUM). This compares favorably with other global GPs, albeit those with larger AUM. The percentages for The Blackstone Group and Apollo Global Management are 15% and 8%, respectively, while KKR's 14% includes family offices.

The key, according to Jung, is Partners Group's Global Value SICAV Fund, a semi-liquid vehicle offering private equity exposure through direct deals, funds, and secondaries. The 10, 10, C does not apply: minimum commitments are $10,000; liquidity is monthly, although redemptions can be gated if there is insufficient liquidity; and investors are fully paid in.

It is one of various solutions offered to broaden access to an asset class traditionally structured to meet the needs of large-scale institutions. If rising demand – in a world where investors of all types are looking for new sources of alpha – is the primary driver, then technology is the key enabler.

In addition to listed and semi-liquid vehicles, there has been a proliferation of digital platforms that aggregate dozens of smaller fund commitments and automate reporting. Tokenization is viewed as a logical next step. While supplanting feeders established by private banks as the primary gateway is a commonly stated goal, bringing private equity to HNWIs will create alliances as well as rivalries.

"We often see challenges with private placement and feeder funds because they can be complex, cumbersome, expensive, and illiquid. Minimum investments are high, they have multiple layers of fees, and multiple parties must be at the table. These factors impact the profitability of banks engaged in distribution of private market products," says Markus Egloff, head of Asia wealth at KKR.

"Looking ahead, it's possible that something like tokenization could create an opportunity for new players in this field."

Wealth by numbers

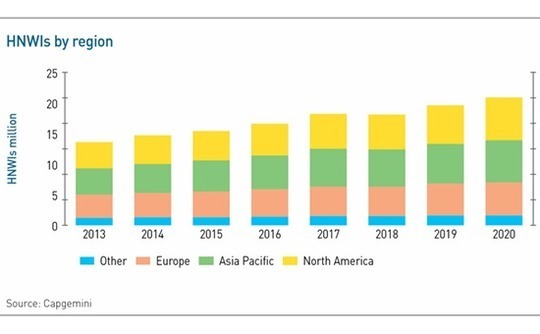

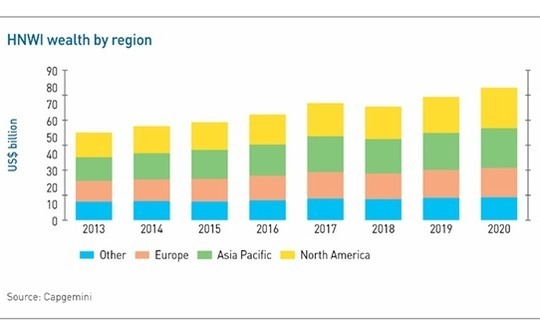

There were 20.8 million HNWIs – defined as individuals with at least $1 million investable assets – with a combined worth $70.6 trillion at the end of 2020, according to Capgemini's latest world wealth report. In 2013, they numbered 13.7 million and controlled $52.6 trillion. Asia Pacific is home to 6.9 million HNWIs (five million live in Japan or China) with $24 trillion in assets. It overtook North America as the largest HNWI region in 2015 but ceded the place last year.

Ultra HNWIs, with more than $30 million in assets, account for 1% of the global HNWI population and about one-third of the asset pool. Their wealth is often managed through family offices, and they have the means to participate in private equity funds directly. This leaves approximately 1,900 mid-tier millionaires with $5-30 million and 18,700 "millionaires next door" with $1-5 million.

Switzerland-headquartered Pictet, which has been active in alternative investment in Asia since 2015, is typical among private banks in only considering clients with at least $5 million in assets. For customized alternatives mandates, the minimum commitment is $10 million, otherwise comingled solutions are available with a starting point of EUR125,000 ($145,000). Three-quarters of clients globally have customized mandates.

Feeders are the lifeblood of private banks and wealth managers in alternatives. Global players routinely raise $400-500 million a time, with clients asked to put in at least $250,000. This size requirement, combined with the need to generate interest among a client base that may not be familiar with private equity, means the menu is limited to large funds from global firms.

"Some banks to annual vintage programs where they raise a fund-of-funds and invest in 5-6 mid-cap managers to give diversified exposure. Those commitments can be $20-100 million per fund and we're seeing increasing demand for such products. Single feeders range from $100 million to $1 billion at the high end. Even the regional banks start at $100 million," says Thomas Swain, a director in the private funds group at Credit Suisse.

In addition, there are often direct investment groups within private banks that source allocations to deals – typically growth rounds for in-demand start-ups – and distribute to clients.

Feeding time

Outside of the global firms, which have touchpoints with private banks across different strategies, the larger Asia-based fund managers have mixed views on feeders. Affinity Equity Partners and MBK Partners, for example, have never raised capital in this way; Baring Private Equity Asia (BPEA) has, with HSBC Private Bank contributing $300 million to Fund VII, which closed at $6.5 billion in 2020.

"I don't have $400 billion in AUM in multiple strategies and the need to tap every source of demand. If I can get all the money from institutions, I will. You need a different kind of fundraising team to contact aggregators and family offices," says one fund manager who hasn't taken HNWI money.

The manager gives four more reasons – echoed by several other GPs – for avoiding these investors: they lack stickiness and cannot be relied on for re-ups; they can be unstable, potentially missing capital calls; fielding questions from these investors in presentation calls "causes brain damage"; and the fees, which can include trailing fees and a slice of carried interest, are exorbitant.

HNWI accounts for less than 5% of BPEA's AUM, but the firm has noted the increasing prominence of this channel globally and is spending more time on it, cultivating several different pockets of capital, according to a source close to the situation. Moreover, HSBC received no fee from BPEA for its work on Fund VII and the same will apply to Fund VIII, which is currently in the market.

This points to a divide in the distribution model. On one hand, the likes of J.P. Morgan and Goldman Sachs commit to raising a certain amount of capital in a short period of time and charge a placement fee to the GP. On the other, HSBC and others are less explicit as to how much they expect to raise and receive no fee from the GP. Either way, HNWIs pay fees to the bank and to the manager.

Marketing materials for L Catterton Asia's third fund outline the fees paid by HNWI clients. A 2% origination levy was applied to commitments below $1 million, with progressive discounts applied to commitments above this threshold. All investors paid unspecified fees to cover administration and other costs, while the bank took 1% of the value of any co-investments that clients chose to pursue.

L Catterton Asia is an outlier in terms of the extent of private bank participation. J.P. Morgan clients accounted for about 50% of each of the firm's first two funds and 40% of the third, which closed at $1.45 billion in 2019. This underscores what sort of product resonates with HNWIs – L Catterton is consumer-focused and boasts ties to luxury goods conglomerate LVMH.

Yet a heavy reliance on private banks, in relative terms, brings other concerns to the surface. "The feeders don't worry about 2/20 and they never negotiate on terms. They come in big, and they won't make a fuss about key person clauses or the hard cap," the second source observes.

"They are a very convenient source of money, very GP friendly. This introduces some interesting conflicts, especially when there's an ongoing fee stream for the wealth manager associated with a fund. If a no-fault termination comes up, would they vote for it – having decided that doing so is in the best interests of underlying clients – and stop their income stream?"

Institutional LPs in the same funds ask this question. "Private banks are perceived as friendly LPs and this becomes a point of tension if, for example, a feeder is $350 million out of a $1 billion fund. Other LPs want them excluded from voting, but that doesn't work. It comes down to the voting threshold for termination and whether it can be lowered," says Justin Dolling, a partner at Kirkland & Ellis.

Choosing channels

It goes without saying that private equity firms would like to avoid giving up so much to private banks in fees. Technology presents a solution in the form of "white label" feeders, whereby managers create their own structures independently of private banks.

These feature in the product portfolio of iCapital Network, which serves as a technology bridge between private equity firms and HNWIs. It is the outsourcing partner, assuming responsibility for the operational and technical infrastructure – from establishing the feeder to the management of capital calls, reporting, and distributions. The company has 120 white label platforms in operation.

Private equity firms without the internal resources for HNWI distribution recognize the value of iCapital's B2B offering as well as that of B2C players like Moonfare that take alternatives – in fractional quantities – direct to the consumer. Yet these solutions do not wholly free them of costly intermediaries. While the likes of iCapital can set up and run a feeder and solve for many of the practical barriers that come with fundraising, it is still incumbent on the manager to raise the money.

"They promise a lot, but when it comes to distribution, they say, ‘You've got to do that yourself, think of us as the people who set up the vehicle, onboard the client, and report to the client,'" says one Asia-based investor relations professional. "You can go after the advisors in the US if you're big enough. Otherwise, you go to the private banks, who now set up their own feeders with iCapital."

Even among the global multi-strategy managers that are big enough to target registered investment advisors (RIAs), it is an open question as to what magnitude of resources should be mobilized to this end. The dilemma was captured in the most recent round of earnings calls as Blackstone and KKR pledged to build out their private wealth exposure, while Carlyle emphasized the institutional channel.

Blackstone has invested heavily in its Private Wealth Solutions business, assembling a team of several hundred specialists that educate advisors on the role of alternatives in portfolio construction. HWNIs make up $100 billion of AUM – not far off Partners Group's total AUM. Rather than stop at the feeder level, the firm is said to identify top advisors in banks and asset managers and cultivate relationships.

KKR is equally bullish on the segment, having increased headcount from 10 to nearly 40 over the past 18 months. Co-CEO Scott Nuttall told analysts that it could triple again in the near term. HNWIs account for 10-20% of capital raised in recent years and there is a belief that it could reach 30-50% in the next several years.

Product-led evolution

The firm's US strategy has been relatively focused, prioritizing major wirehouses, wealth managers, and RIAs. A larger team – including buildouts in Asia and Europe – doesn't mean a change in approach. "I will focus on the largest players in Asia, in terms of where the money sits," Egloff says.

Rather, from a KKR perspective, democratizing access to alternatives is a function of product more than distribution channel. Open-ended products aimed at HNWIs across private equity, credit, and real estate are already an established part of the offering. The most recent addition is a fund – structured as closely as possible to a mutual fund – that can be sold directly into the US retail market.

The product is one of various '40 Act funds, so named because they are registered under the 1940 Investment Company Act. Accessible daily with quarterly redemptions, most strategies are available to all investor types, not limited to accredited investors. In the US, RIAs can simply click and buy, without the need to complete long subscription documents.

Several global GPs are already active in the space, using the '40 Act structure for interval funds, business development companies (BDCs), and real estate investment trusts (REITs). Blackstone's BREIT and BCRED – part of a shift to perpetual capital – are among the best known. Assets stood at $66.3 billion and $17.7 billion, respectively, as of September.

KKR has launched '40 Act funds across real estate, credit, and private equity. There is an emphasis on transparency and accessibility. For example, the KREST REIT offers daily reporting of net asset value, daily subscriptions via a ticker, anticipated quarterly tenders, and monthly distributions.

"These products can get fund managers that bit closer to the investment advisors and 401Ks, and for the international market, there are tax exemption frameworks that are appealing. I think this is a huge step forward for the industry," says Egloff.

The potential drawbacks of any semi-liquid product include liquidity mismatches and a drag on returns created by the need to hold assets in liquid form to satisfy redemptions.

Partners Group addresses this through integrated deal management. Investments are allocated across different funds, with a team of dedicated portfolio managers sitting above, calculating unfunded commitments, distributions, and ongoing liquidity on top of investment allocation. The goal is to protect existing investors and meet liquidity needs while not holding too much cash, even if that means restricting inflows via queues.

"They try to forecast cash flows from underlying assets across a range of scenarios, while working with us on the client side, asking how much is coming in this month, next month," says Jung.

"New entrants into the private markets space often do simple back-test calculations to show stellar returns on a 10-year basis, but liquidity management – or possible redemptions in the event of a financial crisis – are not considered. Liquidity management could have a significant impact on the overall return, yet it is often overlooked."

Blockchain bonanza?

Global Value SICAV Fund is offered to private banking clients of Credit Suisse and UBS and through three major wirehouses in the US. Distributors receive a portion of Partners Group's fee plus whatever they charge to clients, typically up to 3% of the commitment. Investors putting in upwards of $2 million can enter directly.

In September, a significant move was made in September towards eliminating even these barriers when the fund was tokenized by Singapore-based digital securities exchange ADDX, a first for a large global private markets firm. The product is limited to accredited investors, but the structure is designed to accommodate retail participants in the future.

Tokenization could transform the distribution, presenting a solution that is not only a fraction of the cost of a feeder fund, but also transacts faster, transfers more easily, and offers greater transparency.

"Many clients don't want to review a 160-page subscription document, but they are versant with their digital accounts. Maybe that digital account becomes a token or a unitization of a private equity fund, and a private bank serves as custodian," says Egloff of KKR. "The technology is available, and it's fairly simple. But it will take a few years to go mainstream and to gain investors' trust."

Potential speed of rollout is one of three issues raised by industry participants when presented with this version of the future. It is followed by likely breadth of adoption, given many GPs are still firmly wedded to pen and paper, and – more fundamentally – whether making private equity more attractive to HNWIs necessarily makes HNWIs more attractive to private equity.

"What do I need to do to manage that capital? And how sticky is it in a downturn? Those are the two critical questions that market leaders must answer in the next 10 years," says Juan Delgado Moreira, vice chairman at Hamilton Lane. "We haven't gone through a downturn since the HNWI boom, and so many of these structures haven't really been tested."

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.