Blockchain: Going mainstream

The most disruptive technology in financial services is also the most esoteric and misunderstood. As a long, speculative uptake phase unfolds, investors are coming to terms with the future

In many instances, it makes more sense to run financial services on a blockchain than on the internet because blockchain allows for the exchange of value, not merely data.

What the internet does for information through email and websites, blockchain does for assets through cryptocurrencies and non-fungible tokens (NFTs). Unlike email and websites, when a transmission is made using these kinds of applications, the sender no longer retains a copy. The asset – and its value – changes hands.

Blockchain validates value transfers by authenticating a chain of timestamped units of data that increases in complexity with each transaction. This process not only unambiguously defines the asset being transferred, it establishes ownership and stipulates the transaction rules. No entity can control or manipulate the network, which is disintermediated and decentralized.

In financial services, this brings significant efficiencies. When a lender puts money on a blockchain, the borrower gets the funds and liquidity almost immediately, along with clear yet highly customizable interest rate terms. In some use-cases such as remittances, speed is expected to be the game-changer. In others such as insurance, it will be the reduced cost of trust; the code is incorruptible, and no middlemen are required.

"If you use the banking or financial systems on blockchain, you will be awed by the experience and all the benefits. It's like the first time you use email," says Deng Chao, a managing director of the venture capital unit at Hong Kong-based financial technology provider HashKey.

"I highly recommend primary market investors such as private equity and venture capital take a closer look and invest in the space as early as possible. We need professionals who have strong experience in traditional finance to take the blockchain space to the next level as the industry goes more mainstream and more institutional."

Early experiences

HashKey, the digital assets arm of Chinese automotive parts supplier Wanxiang, is arguably the most experienced and active blockchain investor in Asia. Business lines include custody and brokerage services for digital assets, mostly serving family offices and high net worth individuals (HNWIs). There are also plans to launch Hong Kong's second licensed crypto exchange, following BC Technology's OSL platform.

HashKey claimed to set up Asia's first blockchain VC fund in 2015 and has backed more than 100 projects across two vehicles to date, including about 30 companies in financial services. The investment thesis is based on two core beliefs. First, blockchain will become key component of infrastructure for the next generation of business, like the internet today. Second, crypto will become a mainstream asset class for institutional investors on par with stocks, bonds, and gold.

There is much to be gleaned about the mainstreaming of blockchain investment in this story. Not least is the fact that 90% of HashKey's VC team comes from traditional finance, rather than technology. Chao estimates that a generalist investor with an open mind requires about six months to get up to speed on blockchain, after which he or she introduces valuable best-practice skills that many specialists in the sector lack.

Meanwhile, investment has followed an evolutionary path of increasingly sophisticated applications and accompanying hype cycles. As with the rise of the internet, the establishment of blockchain is set to be a multi-decade process. This started with the bitcoin boom in 2013 and progressed to the ICO craze of 2017 and the "defi summer" of 2020. These spurts were inevitably followed by some backlash, although similar to the internet's false starts, user adoption has continued to climb.

The ICO, or initial coin offering, briefly outpaced traditional VC seed funding until the capital raising scheme was largely deemed a public securities sale and subject to the same regulatory restrictions. The nomenclature quickly became tainted but similar sales are still being made with modified company exposure rights called governance tokens.

Likewise, momentum for defi, or decentralized finance, has experienced hiccups in sentiment as blockchain's much-ballyhooed resistance to hacking has begun to show cracks. The largest breach yet was experienced earlier this month when Poly Network, a Chinese defi platform operator, confirmed the heist of some $600 million in cryptocurrencies from its system. However, defi as a construct proved so transparent that the money was too hard to launder and quickly returned.

The latest boom appears to be playing out in NFTs, which promise to expand the concept of digital asset ownership from uniform units of value to individually distinct and copyrightable items. The consensus among analysts contacted by AVCJ is that although this area is poorly understood and inherently risky, it is neither a fad nor a bubble.

"It can be expected that some of the NFTs on the market now will be have little value in a few years' time. However, some will be worth a fortune. It's a similar phenomenon to websites in the early days of the internet," observes Nigel Green, CEO and founder of deVere Group.

Referring to the broader industry, Apoorva Bajaj, practice head for financial markets at GlobalData, describes blockchain as being amid an acceleration phase that will last at least three years. He expects VC investment to keep rising for another 5-7 years as the patents plateau, much like other technologies. "From 2025-26 to 2030 onwards, it will get into a stabilization phase, and we'll see more IPOs and M&A happening," Bajaj adds.

Follow the money

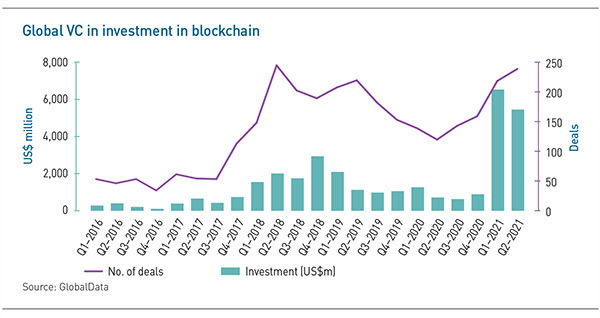

Global VC investment in blockchain companies averaged $1.1 billion per quarter throughout 2019 and 2020 before spiking to $6.5 billion and $5.4 billion in the first and second quarters of 2021, according to GlobalData. There was an average of 164 deals per quarter during 2019 and 2020, compared to 227 per quarter in the first half of 2021.

This research has produced a shortlist of 25 blockchain start-ups expected to become unicorns in the near term, at least 16 of which are directly involved in financial services. Bajaj identifies insurance claim processing, real-time remittance and P2P transactions, transparent auditing, streamlined know-your-customer processes, and supply chain and trade finance documentation as likely hotspots.

Although generalist funds, especially early-stage players, are expanding a toehold in this space, the bulk of investment has come from specialized fintech and blockchain investors. In Asia, leading lights include HashKey and Fenbushi Capital, which has made 60 investments to date and styles itself as the first blockchain VC firm in the region.

Approaching funds of this kind is an evolving science for institutional investors, especially since investments have tended to involve a mix of crypto and traditional currency allocations. At the portfolio level, the choice between crypto and dollars will depend on the target company structure and local regulations. At the LP level, comfort with crypto commitments generally diminishes with institutionalization, although this may change as the practice of benchmarking in crypto normalizes.

Singapore-based fintech fund administrator Ascent Fund Services notes that new investors in crypto funds must ask three key governance questions. Has the fund engaged a third-party custodian or it is safeguarding digital assets itself? Does the fund structure feature a system of checks and balances involving independent directors? Has the net value of the fund been independently calculated?

"If an LP investment is coming from a fiat source, then they will have the same kind of due diligence procedures as a non-crypto fund investment, but if the money is coming from crypto, there are certain extra processes that need to be in place to ensure that the commitment is from a regulated environment," says Calvin Tan, director of operations at Ascent. "Investors do need to declare the source of crypto commitments."

The ultimate driver for making these commitments work is the traction being seen in retail adoption. The current global population of blockchain-based wallet users – 80% of which are considered retail – is about 50 million, up from 10 million only two years ago. By comparison, there were about 360 million internet users in 2000.

This figure could escalate quickly. Facebook's Libra project, for example, is expected to start making cryptocurrency a routine part of life for its audience of 2.8 billion within the year. Launch was initially delayed by regulatory concerns, so the project is said to have restructured around the US dollar-denominated stablecoin USD Coin. In general, the emergence of stablecoins, which are pegged to fiat money, is expected to be instrumental in the popularization of blockchain.

Willing adopters?

Company creation will inevitably follow this wave, but it remains to be seen how quickly their offerings can be mobilized by incumbent banks and financial institutions. Kenrick Drijkoningen, co-founder of Singapore-based blockchain specialist LuneX Ventures is skeptical. He believes that crypto industry leaders the likes of Coinbase, Gemini, and Kraken will be the largest financial companies in the world in the next 10-20 years, leaving little room for traditional operators to play catch-up.

"All these fintech companies bidding for digital banking licenses in Singapore doesn't make any sense to me because none of them are going to make it. The only companies that succeed will be crypto-native and built on top of open public blockchains," says Drijkoningen.

LuneX spun out from Golden Gate Ventures in 2018, having raised $10 million for a debut fund that it claims had delivered distributions to paid-in of 2.5x to LPs as of March 2021. Fund II is on track for a first close of around $35 million next month with a more institutional LP base including US endowments. This vehicle, which has overall target of $50 million, will be co-managed with Singaporean gaming specialist Play Ventures as part of an ongoing integration of the two VC firms.

"This hasn't hit the mainstream finance industry yet. It was the same with the internet in the 1990s. People were still asking how they could integrate it into newspapers and video rental businesses," Drijkoningen. "Now, they're still asking the wrong questions, like ‘How am I going to integrate blockchain and crypto into my product?' No – your product must fundamentally change to survive in this world."

The saving grace here is that although traditional banks will need to overhaul their operations to remain relevant in the age of blockchain-based finance, swift and radical change is not the only way forward.

Even the most progressive financial institutions are still in the experimentation stages with blockchain, among them Fidelity, J.P. Morgan, Goldman Sachs, Standard Chartered, and in Asia, DBS Bank, which is offering a crypto custody service for HNWIs. Like Facebook, these organizations introduce significant retail access into the equation but with greater advantages in reputation. And their tentative tokenization is proving a robust area of investment.

Recent action in this vein includes a $310 million Series D round for US and Singapore-based Fireblocks that brought together Sequoia Capital, a mix of blockchain-focused funds, and SCB10X, the VC arm of Thailand's Siam Commercial Bank (SCB). The deal valued Fireblocks – a provider of underlying technology that helps companies build in-house crypto custody and transaction capacities – at $2 billion.

Since setting up SCB10X in February, the diversified fintech program has gradually sharpened its focus on digital asset transaction and defi service abilities, with other key investments including US-based players Ripple, a payments network, and BlockFi, a lending platform. Mukaya Panich, chief venture and investment officer at SCB10X, describes these as core banking functions and something SCB needs to master in a crypto context.

"We really like infrastructure because we believe that when you invest in an innovative area that has just started out, investing in picks and shovels never hurts. For blockchain, a lot of infrastructure must be built," says Panich. "More institutional clients will come in, and for them to come in, you need infrastructure that can support large volumes of digital assets. They want the ability to make sure the infrastructure is regulated and can deal with high volumes and frequency."

Services based on hybrid crypto-fiat accounts that connect with traditional banks are expected to be among the most attractive investment areas near-term. Further down the track, there is potential for this theme to evolve into programmable money, a concept increasingly associated with the use of blockchain in central bank-circulated notes, government stimulus packages, and other public-sector issuances. The idea is to spot systemic hazards before they fester into recession-sized crises.

The exchange angle

One of the best-funded categories currently is exchanges. In the past two months alone, Singapore's Rice Exchange received VC funding to bring blockchain to agricultural trading platforms, CoinDCX – an exchange focused on novice investors – became India's first crypto unicorn, and Hong Kong's FTX raised $900 million at a $18 billion valuation, up from a $1.2 billion valuation last year. Several investors tell AVCJ they are wary of overcrowding in this space and expect consolidation.

Given the still-malleable nature of blockchain usage in financial services, diversified and flexible models have surfaced as some of the most successful. Korea's Terra, which has transitioned from payments to a combination of savings, defi, investing, and ecosystem services, offers a unique case in point.

The company was launched in 2018 by Daniel Shin, founder of local e-commerce giant Tmon with a blockchain-enabled payments strategy that looped in online retailers such as Woowa Brother, Carousell, and Pomelo. Four of the six largest cryptocurrency exchanges globally signed on as lead investors in a $32 million seed round that year in support of the start-up's Chai app, which processes payments through a stablecoin pegged to the Korean won and reduces merchant fees from 3% to 1%.

Chai was spun off as an independent in 2020 and has already received two investments this year: a $25 million commitment from crypto specialists Galaxy Digital, Coinbase Ventures, and Pantera Capital; and a $60 million Series B led by SoftBank Ventures Asia.

Already used by 5% of Koreans, the company is building out a suite of stablecoins, among them TerraUSD, the fifth largest globally. New products include Anchor, essentially an opensource digital assets bank, and Mirror, which is touted as a decentralized Robinhood targeting developing markets.

The overall business is now effectively a sandbox for some 80 partners building financial projects from money market protocols and perpetual swaps platforms to NFTs. These are not clients per se, although the system does generate revenue through various transaction taxes. The idea is to build a network hinged on Terra's governance token, Luna, thus increasing its value. To this end, a $150 million ecosystem fund was raised last month with support from Lightspeed Ventures.

"Our overarching vision is to look outward and make onboarding mainstream people to crypto much easier than it historically has been," says Brian Curran, head of communications at Terra. "We like to look at the user, see what the issue is, what's preventing them from getting into crypto, and then help them enter the system either by offering them things like savings rates that are easily accessible or access to assets that they currently don' t have access to."

Luna has increased in value 2,000% since the start of the year, theoretically giving Terra market capitalization of around $6 billion. But questions remain about how regulators will respond to the stablecoin phenomenon as its advocates snowball in size and begin to function like unregulated banks.

Under scrutiny

Regulation has been a delicate factor in the blockchain story from the outset, perhaps not least because the technology is so arcane, lawmakers simply don't understand how it works. This was highlighted most recently in a sticky infrastructure bill debate in the US, where congressional proposals for defi brokers to file tax returns left crypto industry players grasping to explain why that's not physically possible.

In Asia, China has emerged as one of the strictest regulatory environments with blanket bans on crypto exchanges and financial institutions providing crypto transaction services. Still, the country is seen as an encouraging market for pure blockchain technology investment.

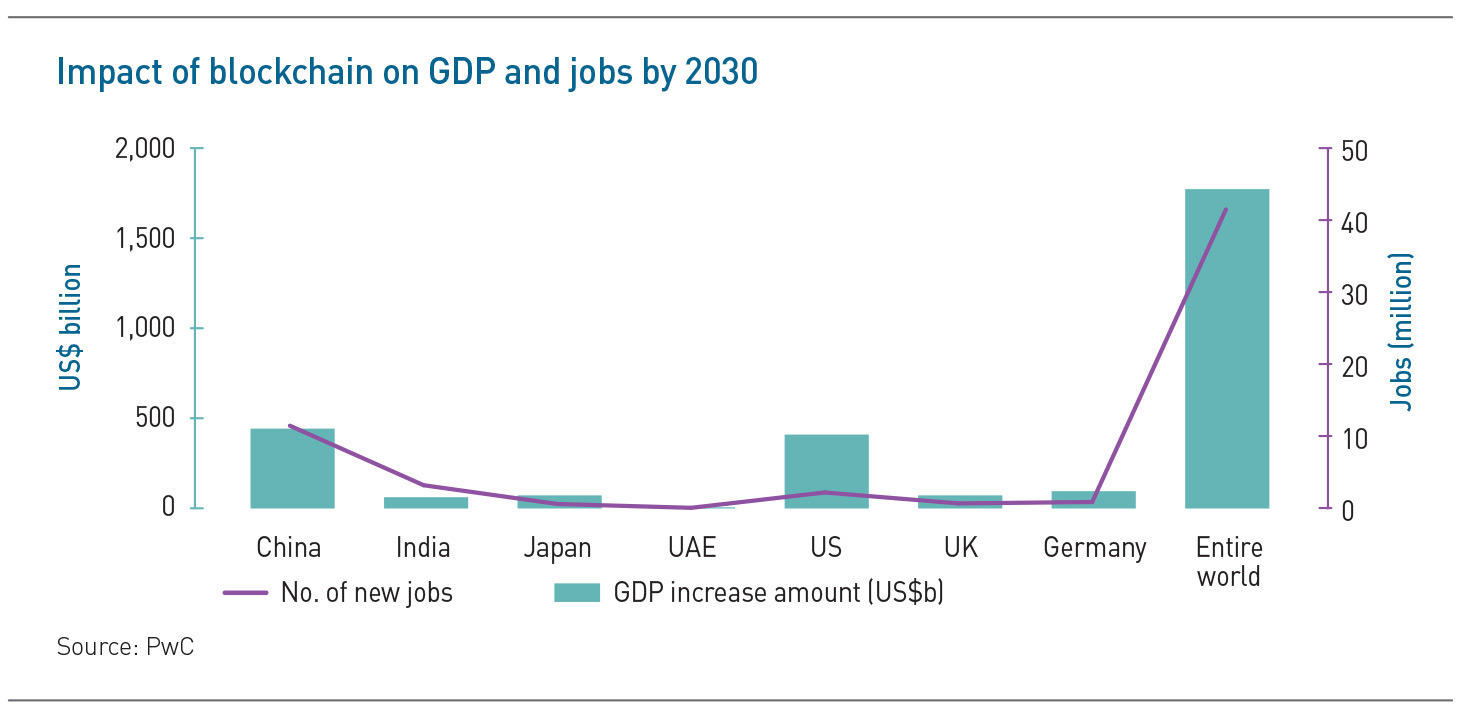

Indeed, PwC expects blockchain to lift China's GDP by $440 billion as of 2030, creating 11.4 million jobs. This compares to a $407 billion increase in GDP and 2.2 million additional jobs in the US over the same period. Financial services-focused plays illustrating this momentum include US and China-based blockchain security company Certik, which has received $61 million in funding in the past two months.

Most players in this space have a borderless mindset, however, and when the issue of regulation does come up, it's less about the strictness of the rules in any one place than their consistency. Operations will be geographically flexible. Teams will be as decentralized as the technology they manage. And the surge in global crypto adoption supporting new blockchain businesses will prove uncontainable, even within a venture fund timeframe.

"At the end of the day, crypto is going to change regulations; regulations are not going to change crypto. Regulators are fragmented across the globe. Crypto is a global movement being built natively online," says LuneX's Drijkoningen. "It's great for a jurisdiction to provide clarity, so companies can come and build their businesses in those jurisdictions with certainty around the rules. That's where a lot of the talent will go. But the movement itself will not be stopped by regulations in one jurisdiction or another."

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.