Asia secondaries: Continuation conundrum

The rapid ascent of single-asset continuation vehicles in the US and Europe might be emulated in Asia, but investors are approaching the market with measured optimism

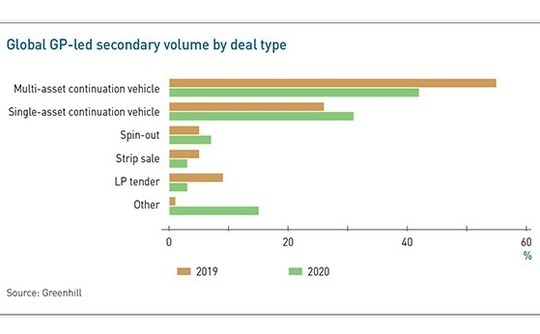

As recently as four years ago, sales of LP fund positions dominated secondary activity, with GP-led transactions accounting for less than one-quarter of global volume. In 2020, the GP-led share hit 44%, as the market rebounded aggressively from a COVID-19 induced lull with a slew of continuation funds, spinouts, strip sales, and LP tender offers in the second half of the year, according to Greenhill.

Digging into the GP-led segment, the advisor uncovered a notable trend. While motivating factors were unchanged – managers seeking to generate distributions ahead of a fundraise or secure more time and money to extract value from companies in a fund nearing the end of its life – the mode of access had shifted. Multi-asset continuation vehicles were losing momentum, slipping below 50%. Single-asset continuation vehicles, meanwhile, were in the ascendency, rising from 26% to 31%.

The uptick has been linked to a preference for pandemic-proof deals in more resilient sectors. But it also reflects an ongoing phenomenon whereby private equity firms are being more creative in their use of secondaries to achieve strategic objectives rather than generate liquidity for zombie assets. Moreover, these deals are – gradually – taking hold in Asia.

"As a trend, single asset continuation funds as a percentage of secondaries is currently on a one-way, upward growth trajectory," says Stuart Wrigley, a managing director in the alternative capital markets and strategy group at Goldman Sachs. "From an innovation perspective, Asia is consistent with the US and Europe, but it lags in terms of volume. Given the Asia buyout space lends itself more to growth sectors and companies, there will be more of a focus on that."

A handful of transactions of $500 million-plus are in the market, at varying stages of advancement, according to several sources. Among them are Hopu Investment's position in the China business of warehousing giant GLP and two assets in Korea, Hahn & Company-owned Ssangyong Cement, and a position held by MBK Partners' credit fund in fried chicken restaurant franchisor BHC Group.

Given it is estimated that fewer than 10 single-asset continuation deals – featuring incoming secondary investors, rather than GPs transferring assets between funds – have closed in Asia to date, and only a couple were of meaningful size, this represents a significant step up. So significant, in fact, that some industry participants suggest it may take considerable time and effort to find investors willing and able to participate.

"With single-asset deals, the bar is set higher because of the risk profile. In the US and Europe, a large opportunity might be oversubscribed out of the gate because it meets the bar," says Martin Yung, a principal at HarbourVest Partners. "In Asia, the bifurcation in terms of asset quality and GP quality is generally broader than in developed markets which, combined with a relatively smaller buyer universe, means the execution risk is higher and it may take longer to build a syndicate."

A marmite strategy?

Convincing secondary investors that have traditionally found comfort in diversified portfolios acquired at discounts to net asset value (NAV) to take the concentration risk on a single asset, typically at a premium to NAV, is tough. While it is argued that single-asset continuation vehicles have become too big a part of the market to ignore – and an investor could do enough of them to create what is effectively a diversified portfolio – there are still plenty of skeptics.

Jason Sambanju, a partner at Foundation Private Equity, believes that single-asset risk is enough of a concern to make such deals inappropriate for a fund focused on LP secondaries. In addition, he is uncomfortable with the characteristics of some deals coming to market, specifically that they are happening too early in the fund life.

"Why would you do a mid-lifecycle continuation deal? It doesn't fit the classic profile of what makes a continuation fund interesting: re-setting the cost base, giving the GP a new chance to make carry, giving existing LPs exit options," Sambanju says. "Some deals are more like late-stage co-investments for LPs. They won't get a great return, but the asset is de-risked because other investors are involved. It doesn't appear to be the secondaries approach of aligning yourself to make optimal returns."

On one hand, it might be acknowledged well in advance that the asset requires additional time, perhaps because of a shift in the underlying business model or as a result of a bolt-on acquisition that will not deliver synergies immediately. Similarly, turnover at the GP level might mean the interests of those charged with managing the asset are not fully aligned with those of the fund, so restructuring is required to put in place appropriate incentives.

On the other, a private equity firm could pursue a continuation vehicle because other exit paths have failed to materialize – which means the secondary investor might be paying over the odds for exposure to a problem asset and give the manager a return they can't get anywhere else – or to generate liquidity from a prize asset ahead of a fundraise. In the absence of full transparency, the prospective incoming investor may never know the real reason for the transaction.

"We've seen situations in which the manager was trying to raise a new fund and said they thought it might be best to carve out an asset and sit on it for another four or five years. You must question the motivations," says Martin Liew, head of private equity integrated investments in Asia at Partners Group. "It is not unusual for GPs to try selling minority interests in strong assets to boost distributions just before fundraising. We've also had discussions with GPs regarding mediocre assets. The risk is you catching a falling knife with an asset that has failed to scale."

Issues of trust

Much rests on how much trust the secondary investor is willing to place in the manager. This explains why Axiom Asia prefers to work with GPs it has backed through its primary fund-of-funds business and why Goldman Sachs often works with the same GP on multiple transactions. "There is one manager in the US with whom we have done four single-asset continuation funds," Wrigley notes. "Why? Because we have a strong conviction in them as a sponsor."

The Ssangyong Cement transaction is interesting in this context because it essentially represents the continuation of an investment that began in 2012 and the product of an industry consolidation thesis. The private equity firm bought Daehan Cement out of bankruptcy and subsequently added on Gwangyang Cement. It also made a separate minority investment in Ssangyong. All three deals came from Hahn & Co's debut fund.

In 2016, the GP assumed majority control of Ssangyong, committing capital from Fund II. The existing cement assets were folded into Ssangyong, which meant Fund II facilitated an exit for Fund I. Now, LPs in Fund II have the option to roll over their interests into a continuation vehicle for Ssangyong. Secondary investors are being lined up to participate, while Hahn & Co will roll over carried interest the deal generates for Fund II and make a new investment in Ssangyong from its third fund.

"There is an opportunity to reposition the business as an environmental services play, but it will take more time. That is the rationale for the single-asset fund," says a source close to the deal. "Fund II is of the 2015 vintage, so there is no pressure to do the continuation immediately. However, there is a multi-year plan for the business and no desire to wait until the latter stages of the fund."

The goal is to complete the process by year-end. It is thought the deal could amount to $1.5 billion, including the LP rollover, commitments from secondary investors, and the GP's contribution.

The largest single-asset continuation transaction supported by secondary investors came in 2018 and involved a minority position held by Capital Today China Group in Yifeng Pharmacy. HarbourVest took the lead, contributing $100 million out of $250 million in new equity, according to filings. LP rollover accounted for a further $173 million, while Capital Today and its team members contributed $92 million in cash and carried interest arising from the transaction.

Asked to map out the investor base for a hypothetical $800 million to $1 billion deal, allowing for a degree of uncertainty in LP rollover, industry advisors suggest that two lead investors would be required, each writing a check of $150-200 million. Once those are in place, a syndicate would be formed comprising a string of individual commitments in the $30-50 million range.

The arrival of opportunities of this size in Asia does facilitate participation by investors who want to do more here but are generally unwilling to write anything smaller than a multiple-hundred-million-dollar check. "We are seeing deal sizes increasing and more buyers coming into the Asian market," says Damian Jacob, a partner at Kirkland & Ellis.

Yet it complicates rather than solves the advisor's dilemma: Is the asset so small that no one wants to look at it or so large that no one can absorb it? Industry participants note that placement agents are becoming highly selective, dismissing smaller propositions that don't meet minimum requirements in terms of size, asset quality, and manager reputation, while wanting visibility on who the anchor investors might be before taking on a larger mandate.

Obstacle course

There are numerous reasons why secondary investors might be reluctant to commit substantial sums to single-asset continuation deals.

First, they might be constrained by single-asset concentration limits, although this appears to be a diminishing concern. Juan Delgado-Moreira, vice chairman at Hamilton Lane, points to the influence of credit facilities and larger fund sizes. He also identifies a more immediate COVID-19 effect, whereby investors have become comfortable with concentration if it offers exposure to quality assets and management teams in stable sectors.

To a certain extent, Hamilton Lane embraces concentration in its secondary funds, and others appear to be doing the same in different ways. Several investors talk about portfolio construction at the program level as well as at the deal level, the implication being that they can accommodate concentration where there is a suitable level of conviction regarding the asset and the manager.

Second, secondary players need resources on the ground to conduct due diligence – as a direct investor rather than as a portfolio investor.

"It is different from pricing a fund using a DCF [discounted cash flow] model, where there are many high-level assumptions about how the fund might perform. You must understand what the company does, the competitive dynamics," says Alex Lee, a managing partner at Axiom. This is another reason why Axiom prefers to work on single-asset continuations with portfolio managers where it is confident a satisfactory level of due diligence has been performed.

Secondaries investors that are set up to acquire positions directly from GPs and manage them internally are reluctant to participate in these deals at all. TR Capital is one of them, but the environment is shifting before its eyes. CEO Paul Robine notes there have been situations recently in which GPs have halted negotiations with his firm over a direct sale in favor of pursuing a single-asset continuation vehicle.

Third, there is less scope for downside protection, which is arguably a far more pertinent concern in Asia than anywhere else given the proliferation of minority growth investments. While there might be a level of creativity in the governance and exit rights of a single-asset deal that doesn't feature in a portfolio transaction, there is less scope to tweak carried interest streams to give the buyer downside assurance and let the seller participate in any upside if the portfolio outperforms.

"When you have a portfolio of assets it creates an opportunity to put in a structure. We have seen in instances where a multi-asset continuation fund includes more exotic structures to provide some downside protection for the buyer and/or upside sharing with the selling entity. This is often not available in a single asset deal, so you have fewer levers to play with," says HarbourVest's Yung.

Regardless of geography, economics can be a sticking point, with buyers wary of backing a stranded asset and sellers seeking reassurance that they aren't leaving value on the table.

Most buyers insist the manager rolls over carried interest into the continuation vehicle, with some compromise if a portion of the proceeds is going to departed team members who are no longer involved in the management of the asset. An additional commitment in the form of cash from the GP or investment from a later fund – on the same terms as incoming investors – is also often requested.

For the selling LP, a partial crystallization of carry by the manager is preferable because it acts as an indirect validation of the selling price. This has become a point of contention, especially where members of the LP advisory committee for the exiting fund, which must sign off on any deal, are also participating in the secondary transaction, several industry participants observe.

There is also sometimes debate over fees charged to LPs that roll over into the continuation vehicle. The Institutional Limited Partners Association (ILPA) guidelines state that these should be the same as for the exiting fund, but this is not always the case.

"If it's an old fund that has already performed, the GP might argue that it has delivered what was promised to its investors. It's a new start and economics, including management fees and carry will be appropriate for the continuation fund," says Aiva Sperberga, a principal at Campbell Lutyens. "On the other hand, if the GP hasn't yet delivered value, some of the existing investors might seek to roll to capture the future upside and it is then more important to offer a true status quo."

Competing priorities

Every transaction comprises assorted moving parts that could come loose and stymie progress. The broader question is how quickly single-asset continuation vehicles are likely to catch on in Asia and whether there is sufficient capacity and risk appetite among investors to keep up with supply.

On the GP side, Zhan Yang, a principal at Coller Capital, observes that these structures have proved their viability as a comparable exit route to an IPO or trade sale. Managers increasingly prefer to retain an asset and create more value than incur the opportunity cost of looking for new ones, and now they have more tools at their disposal. Axiom's Lee is more circumspect, highlighting the time that must be spent on a continuation vehicle and the risk that a deal doesn't close.

"Many of our GPs prefer to liquidate the portfolio in the traditional way," he says. "By the time they might consider restructuring at the tail-end of a fund, they might have raised two or three subsequent funds, so there are other things to do."

The LP perspective is also nuanced. Few industry participants doubt the ability of large investors to mobilize capital in Asia should they so desire, bringing big-ticket co-investors into deals where additional equity is required. It remains to be seen how the region stacks up against other opportunities globally. Does the potential upside of high-growth Asia outweigh the greater certainty of developed markets where managers are more proven and control deals are more commonplace?

For many secondary investors, which deploy from global capital pools, this might amount to a binary question. Asia is not their core strategy, so when opportunities are presented at the investment committee level, they are examined in the context of what could be done in the US, Europe, and Latin America.

"We have heard investors say, ‘This is interesting, but there are more interesting opportunities in the US,'" adds Sperberga of Campbell Lutyens. "Good preparation and investor targeting is therefore very important in ensuring a successful transaction."

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.