Asia secondaries: Waiting for the flood

Secondary investors expect deal flow to rebound strongly once there is more certainty on valuations. In Asia, the opportunity will be larger and more nuanced than the post-global financial crisis frenzy

NewQuest Capital Partners was the product of a secondary transaction spurred by the global financial crisis. Following its merger with Merrill Lynch, Bank of America scooped up all the Asia-based private assets sitting at different points on its balance sheet and tasked a team with devising exit strategies. There was never going to be more capital to deploy – the Volcker Rule had limited banks' exposure to alternatives – so the team secured its future by pursuing independence.

In 2011, four secondary investors backed a $400 million fund that acquired 21 investments from the bank. Fast forward nine years and NewQuest has raised nearly $2.5 billion across four funds for a strategy that involves acquiring single assets and portfolios from GPs that need liquidity. By the end of 2020, the firm expects to have 30 investment professionals working out of four offices in Asia.

At the time of the NewQuest spin-out, secondary activity in Asia was negligible. Last year, it reached $8.5 billion out of a global total of $83 billion, according to Lazard. There was a notable swing to traditional sales of LP interests from the GP-led transactions that dominated 2018, reflecting a lumpiness in the market. But with a threefold increase in deal value on 2016, the trend is clear. "NewQuest is a good barometer of the general growth in secondaries in Asia," says Jason Sambanju, a partner at Foundation Private Equity who helped initiate the spin-out while at Paul Capital.

Secondary investors have been literally and metaphorically grounded for most of the past four months: even if they were able to conduct first-hand due diligence on assets, uncertainty on valuations and pricing has made it very difficult to underwrite deals.

Most industry participants expect a swift revival in activity once the outlook becomes clearer – probably in the last few months of the year – as GPs look for new ways to generate liquidity and LPs reassess their relative exposure to private equity. Comparisons are naturally drawn with the flood of sales that followed the global financial crisis, but this period promises to be very different from the one that gave birth to NewQuest. There is more money at stake, more variety in transaction type, and a greater understanding and acceptance of secondaries. And Asia is no longer negligible.

"We were expecting 2020 to be an extremely busy year. Several large GP-led transactions started to come together in the second half of 2019 and were going to launch in 2020. They have been delayed, but they will come back to market," says Damian Jacobs, a Hong Kong-based partner at Kirkland & Ellis. "Dislocation caused by COVID-19 will drive transactions in the secondary market as things stabilize. There is already evidence of that. Over the last four to six weeks, people on the sell-side and the buy-side have started having more serious conversations about transacting."

Motivated sellers?

Greenhill has similar numbers to Lazard on global secondary market volumes. It captured a record $88 billion in transactions for 2019, including 23 deals of $1 billion or above that together accounted for 43% of the total. Most of these involved portfolios of fund interests. Among them was a $5 billion sale by Japan's Norinchukin Bank to Ardian, which is described as the largest-ever secondary transaction. Ardian did two more deals in Greater China of $1 billion and $700 million, respectively.

"Many Asian investors entered the alternatives space 10 years ago. Now they have portfolios and maybe their funds haven't returned enough cash, so they need liquidity. There are also changes in regulation, changes in strategy, and they are familiar with secondaries, so they know there is a solution," says Jason Yao, a Beijing-based managing director at Ardian.

The regulatory-driven transactions are by no means as profound as the post-global financial crisis sales by global banks. They tend to come when investors exceed the government-mandated cap on their private equity exposure or Chinese groups struggle with currency controls. Lucian Wu, a managing director at HQ Capital, notes he has done several deals which arose from the increasing difficulties Chinese investors face when converting renminbi to US dollars. Uncertain as to whether they could meet capital calls made by offshore funds, they chose to liquidate.

Additionally, these deals are seldom needle-movers. The subset of Asian institutions with portfolios large enough to deliver a secondary transaction of $500 million or more includes numerous sovereign and state-owned investors that are not necessarily under pressure to sell. Like many of their global peers, these groups have come to market in recent years for two reasons: strategic shifts and attractive pricing. Right now, they are being patient.

"Either the core business is under pressure or they see attractive near-term opportunities to deploy capital and take advantage of dislocation in the market," observes Lloyd Bradbury, a Hong Kong-based vice president at Greenhill. "We are also hearing of universities and hospitals that have been hit hard on the revenue side. They are under pressure to find some liquidity, and endowments and foundations are a logical place to get it."

When the large investors do come back there are likely to be two key motivating factors. First, for private equity globally, capital calls have outstripped distributions for the past three years. This trend is likely to continue in 2020 and 2021 – unless there is a sharp rebound in M&A – and it will impact LPs' cash flow modeling that supported a certain level of commitments. Investors may find they cannot wait out these problems; they will be forced into the secondary market to rebalance, rather than purely for strategic portfolio management.

Some industry participants also point to the denominator effect. It has been muted so far because public markets in general have rebounded over the past two months. However, any kind of reset prompted by difficulties in the real economy could leave LPs overexposed to private equity in relative terms and obligate them to sell off assets.

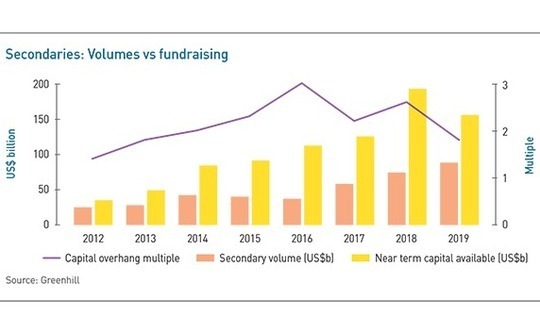

Second, there is ample demand from secondary buyers. According to Greenhill, there was $155 billion in near-term available capital at the end of 2019, down from $192 billion the previous year, but still nearly twice the 2014 total. In the past 12 months, Ardian, Lexington Partners and The Blackstone Group have closed funds of $19 billion, $14 billion, and $11 billion, respectively. Coller Capital and AlpInvest Partners are currently in the market, each seeking at least $8 billion.

While average secondary pricing for buyout funds fell to 93% of net asset value (NAV) in 2019 from 97% the previous year, portfolio valuations had been written up, so purchase prices in absolute dollar terms were stable. The combination of dry powder, the availability of leverage – assuming the financing environment remains favorable – and the presence of willing co-investors might ensure prices remain elevated in certain segments of the LP portfolio market even in the event of a glut of new supply. Fear of missing out is another factor.

"A lot of us felt we were too slow to jump back in after the global financial crisis. No one wants to be first to the party, but you want to be second or third. You don't want to be turning up at the end of the event," says Tim Flower, a managing director at HarbourVest Partners.

This sentiment is echoed by Kirkland's Jacobs, who makes the direct connection to pricing. "If they take that learning into account this time around, we can expect the market to pick up quicker," he says. "Given the amount of dry powder and the pressure on sponsors to deploy, you would expect that to impact pricing. And if pricing does recover, that will encourage more people on the sell-side to trade. It becomes a self-fulfilling prophecy."

Opposing poles

There remains a tendency among industry participants to push themselves towards opposing poles to avoid mainstream competition and premium pricing. Ardian focuses on large portfolios of LP positions, where it claims few others have the capacity to operate. Yao describes the preferred situation as one in which the seller wants to work with a single buyer on a range of solutions. While Greenhill started seeing more mosaic deals last year – portfolios are split into several tranches, each going to a different investor – complexity, timing, and certainty might encourage a leaner approach.

In contrast, middle-market specialists, which include Asia's local buy-side community, pursue smaller opportunities that emphasize on-the-ground capabilities. These investors exist on a diet of single LP positions sourced through their own networks and an array of GP-led transactions. In the latter space, tail-end fund restructurings where existing investors can choose to roll over or cash out have been joined in recent years by various new structures. Adoption is expected to accelerate in response to COVID-19 pushing out exit horizons.

Much like the traditional fund positions segment, there is a spectrum of need. Some GPs require emergency liquidity at the fund level to support portfolio companies with depressed revenue lines. NAV-based loans – where debt is secured against the asset value of the fund – are one option. Alternatively, they might try and reopen funds and take in new commitments or set up annex vehicles that sit alongside main funds. Existing LPs are typically approached first, with a secondary investor underwriting follow-on funding if there is capacity to be filled.

Preferred equity – where investors receive the lion's share of all distributions from future exits until they have recouped their principal plus an agreed return and often enjoy a smaller portion of the equity returns thereafter – can play a similar role. While the strategy has gained traction in the US and Europe, few transactions have been completed in Asia. Advisors say that sponsors in the region struggle with the relatively high pricing and are more likely to turn to existing LPs for support.

However, interest in preferred equity is rising, and it may eventually take hold. "Remember it's still early days in Asia, the market is only 10 years old," says Paul Robine, founder and CEO of TR Capital. "Basic LP interests have become a mature product and now secondary direct and restructuring are developing. The third wave will be credit solutions that have a very strong secondary bias."

TR Capital, which focuses direct secondaries and fund restructurings, has seen an influx of inquiries from Chinese GPs in recent months about carving out assets from renminbi-denominated funds into US dollar portfolios. This is not necessarily driven by distress arising from COVID-19, rather the pandemic has accelerated an inevitable phenomenon. Robine estimates that private equity firms in Asia ex-Japan are holding $250 billion in unrealized assets from funds formed 6-10 years ago.

The timelines for exits that were scheduled for different points over the next three years are now being pushed out. Yet many of these managers are increasingly impatient LPs. For example, an investor might have positions in three existing venture capital funds, each with a lifespan of 15 years and no preferred return for the GP. Liquidity events have not been forthcoming and the investor's overall allocation for that manager has tapped out. As as result, they refuse to come into the next fund unless there are some distributions in the near term.

"Our market is largely driven by GP motivation," says Darren Massara, a managing partner at NewQuest. "Maybe they want to generate distributions so they can raise a new fund, or rationalize a large portfolio, or effect a change in strategy. While they initially thought such liquidity would come through a trade sale or IPO, now that may be put off for a few years. Market volatility of the kind we are seeing typically recalibrates decision making. They can choose to exit at today's fair market value or hold for another three years to achieve an IPO. But eventually they will need liquidity."

Innovation game

Various structures can be employed to help them achieve this goal, with single-asset lift-outs, continuation funds, and strip sales among the most frequently highlighted. What's notable is not just the availability of these products – in a market that saw little beyond standard restructurings as recently as four years ago – but also the level of customization.

Strip sales are a case in point. A handful of deals have been completed in Asia, following two typical models: secondary investors take a pro rata strip comprising a minority piece of each portfolio company that is spun out into a new entity backed by secondary investors (Warburg Pincus in 2017, Blackbird Ventures in 2019); or investors buy a selection of positions in their entirety (Sequoia Capital India in 2016, Norwest Venture Partners in 2019). Now, though, hybrids are emerging.

"Typically, these deals are not intermediated and there is a lot of going back and forth between different options, seeing where there would be interest," says Foundation's Sambanju. "However, I've started to see situations where the intermediary comes out with a portfolio and in the second stage of the process you can design it the way you want it to be designed. There are more deals where it is pick-and-choose, rather than here is the strip, this is the price, take it or leave it."

The $100 million renminbi-to-US dollar fund restructuring of a portfolio managed by Kinzon Capital – which saw TR Capital take interests in seven companies – earlier this year is said to fit this profile. At least one other deal is currently in the market where the GP is seeking liquidity across an entire fund portfolio and negotiating a bespoke solution that will see a secondary investor take stakes of varying sizes in a still-to-be-decided subset of underlying positions.

"When you get to those structures, you can play around with waterfalls across the whole portfolio or you can do it on certain assets within a portfolio. It's almost like earn-outs across deals," adds HarbourVest's Flower. "This might be one of the ways of bridging the optics of what otherwise, on a straight cash basis, could be unacceptable pricing."

The extent to which investors are able to pull levers around price, timing and waterfalls to create solutions that meet the needs of incoming and exiting investors – while preserving alignment of interest with the GP – points to the increasing acceptance of secondaries in Asia. Massara of NewQuest contends that the market might be less mature than the US and Europe in terms of transaction volume, but it is now on par in terms of innovation. In his view, cookie-cutter GP-led secondaries will likely become ever scarcer.

And this, arguably, is the most profound contrast with the post-global financial crisis period. Asia has evolved from a market where GP-led deals were oddities driven by banks being forced to exit the alternatives space to one in which a private equity firm's objectives can be listed on a whiteboard and differing paths to liquidity are mapped out.

"When I started in 2008, hardly anyone had heard of secondaries. A big part of the post-global financial crisis effort was educating GPs and LPs on how secondary buyers could provide solutions," says HQ Capital's Wu. "A decade on, there is a much better appreciation of secondaries as a tool for rebalancing and more experience in accessing the market. It wasn't long ago that if you talked to GPs about anybody selling fund interests, they would feel offended. That stigma is no longer around."

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.