PE and tech investment: Forward planning

The growing influence of technology across every industry is forcing PE firms to review approaches to investment. Ensuring the right people have the right information sits at the heart of these efforts

When Lunar Capital bought Nicholas & Bears last year, the Hong Kong-based babywear retailer was making virtually no online sales there. Six months into the PE firm's ownership, that metric is tracking up 100% year-on-year. It is a case of success driven by muscle memory.

Six years ago, Lunar acquired Yeehoo, another traditional retailer, and turned the business into the largest player in China's babywear space, online and offline. "The old management did not have much experience with e-commerce, so we put in a strategy to change that mindset and we appointed some management who were younger and had more creative ideas as to how the company could embrace technology," says Derek Sulger, a partner a Lunar.

The knowledge and expertise accumulated through this process has since been put to work in other parts of the consumer-focused buyout firm's portfolio. Lunar acquired five snack food businesses and built up an e-commerce team – some of whom transferred from babywear – that looks after online marketing and distribution for all five. Now the model is being replicated once again for an arts and culture education platform in Beijing as well as for Nicholas & Bears.

This is one of a range of strategies employed by private equity investors in Asia as they try to stay up to speed on technology. Approaches vary based on firm size, the structure and scope of internal resources, existing domain expertise, and investment mandate. But there is a common desire to understand the implications of different innovations and identify ways in which portfolio companies can minimize the threats or take advantage of the opportunities presented by disruption.

"Business objectives remain the same – growth and profitability – using conventional processes like cost take-out, growth strategies, new markets. But increasingly any element of any transformation for any organization involves an element of digital because it can be a force multiplier," says Kaushik Sriram, a principal at A.T. Kearney.

Staying informed

Broadly speaking, technology is embedded into a private equity firm's investment operation across three areas: deal sourcing, due diligence, and post-deal value-add. However, the more telling delineation is between understanding the implications of innovation for a business and then actually doing something about it.

"We will see disruption through our diligence and then it's about estimating the rate of change. That's where it becomes a very complicated game," says Patrick McCarter, co-head of the global tech, media and telecom (TMT) team at The Carlyle Group. "If you're on the side getting disrupted, how much revenue is at stake and what is going to happen to it? And if you are on the disrupting side, how fast can you penetrate some legacy provider and how are they going to react to that?"

Much of the evolution in the private equity firm's response has been in sharing expertise and information – an acknowledgment that technology impacts every part of its business and therefore the solutions to problems could come from unlikely corners.

Seasoned C-suite executives who offer advice on a part-time basis play an influential role in shaping in-house views on different industries and companies. For example, earlier this year Carlyle named the former CEO of Chinese software giant Kingsoft and head of R&D for Microsoft in China, as a senior advisor to its Asia private equity business. This is part of a concerted effort widen the firm's intelligence networks, which is mirrored to some degree by most global GPs.

The likes of Carlyle and The Blackstone Group differ from TPG Capital, KKR and Bain Capital in that they don't have dedicated venture or growth strategies. But offices have still opened in the San Francisco Bay area to stay close to where a lot of cutting-edge innovation is taking place. Outreach also includes inviting start-ups to address conferences for portfolio company CTOs and chief information officers as well as internal investment teams.

KKR has further institutionalized how it thinks about technology internally by creating a global innovation team. The team is tasked with considering how technology can be better used across investment analysis, operational work with portfolio companies, and the firm's own systems and processes. Members are drawn from different investment and operations units, and they work closely with a broader innovation council comprised of members from various parts of the firm.

"We are looking at areas like artificial intelligence (AI), machine learning, and robotics. Part of our focus is figuring out signal versus noise because, we know disruptive technologies are important, but it's sometimes challenging to determine what we should be paying attention to within that," says Terence Lee, a director at KKR and a member of the innovation team in Asia Pacific. "We form relationships with global experts and apply the best of what they know to our investment and value-creation process by making connections to portfolio companies and facilitating discussions."

He adds that plenty of investment opportunities are emerging around traditional companies that are in the process of being disrupted and need help. KKR's more informed approach to due diligence – of which the innovation team forms part – allows the firm to properly assess technology risk. In some cases, this has resulted in deals being discarded because the risk was too high.

Elements of this due diligence are still outsourced. Some private equity firms commission entire portfolio scans to get an idea of how every portfolio company is being impacted by different technological innovations, perhaps with a view to ranking them based on how effectively they are keeping pace with change. This in turn could form the basis of a system that enables a GP to track progress and identify common areas of weakness, establishing issues that should be prioritized.

However, most projects involve specific businesses: assessing a company's exposure to disruption by nimble competitors; identifying initiatives that could offset or take advantage of that disruption; and taking a view on whether change can be delivered fast enough to have a meaningful impact on financial performance during a five-year ownership period.

Ben Jelloun, a director in KPMG's global strategy group, is the process of answering these questions for a GP considering an investment in a business that relies heavily on customer engagement by phone. A substantial investment in automation and AI is required to maintain competitiveness and the seller wasn't prepared to do this due to uncertainty about how the industry will evolve.

"The private equity firm is doing a deep dive into what technology is out there, how it is being leveraged, and how it could change the landscape," Jelloun says. "Services are morphing into something people haven't seen before. If you are already burdened by legacy systems, how do you make the shift? Perhaps you'll end up investing in new technology for four years and then find you still haven't realized your investment thesis."

Implementation issues

Moving from analysis of technology risks and opportunities around a company to the implementation of initiatives that address them, there is still a reliance on third-party expertise. This is essentially a bandwidth issue: it is simply not practical for individuals to try and work across an entire portfolio. Even if the required domain knowledge is distilled into a few categories – advanced analytics, the internet-of-things (IoT), and e-commerce – companies will have very different needs.

While the sector teams within global firms will sometimes recruit people with specific skillsets that are relevant to a subset of businesses, Carlyle's McCarter observes that it is usually incumbent on executives in those teams to leverage their industry relationships and bring in talent on a case-by-case basis. The same applies, by necessity as well as desire, to less well-resourced middle-market private equity investors.

"At the GP level we must make sure all team members know what it takes to move the needle," says Lunar's Sulger. "You have offsites, you put them through case studies, you show how other companies have tackled that challenge. Once they are aware of the problem they implement a solution. Usually that involves hiring people and giving them clear mandates."

Indeed, headhunters have yet to see a raft of technology appointments by private equity firms in Asia. Michael Di Cicco, a partner at Heidrick & Struggles, notes that there is a lot of activity in corporate venture capital – which is how the corporate world tries to head off disruption by emerging technologies – but independent GPs are holding steady. Rather, there has been a spike at the portfolio company level as businesses bring in the likes of CTOs and chief digital officers.

These sentiments are echoed by Edward Barker, head of alternatives in Asia for Stanton House, who has also seen a change in the types of people sought for senior roles because of technology. "We hired a CEO for a China retail business and there was a preference for candidates in their mid-30s to mid-40s. A lot of that was due to digital awareness. The younger age groups are often savvier with this stuff than more seasoned executives," he explains.

Another explanation for the paucity of technology-oriented direct hires by private equity firms is that, in many cases, fund sizes are still small compared to other markets. There is a knock-on effect in terms of headcount. GPs will scale up more on the operations side, but only when their resources allow it.

This may or may not be connected to the view, expressed by several executives on the consulting side, that private equity firms in Asia suffer from a dearth of operational talent, with technology expertise a prime example. The traditional predominance of growth investing in markets like China is likely a contributing factor in that GPs didn't have to play an active role in managing portfolio companies. At the same time, parachuting in global talent doesn't necessarily work either because the dynamics of value creation – such as the importance placed on relationships – are different.

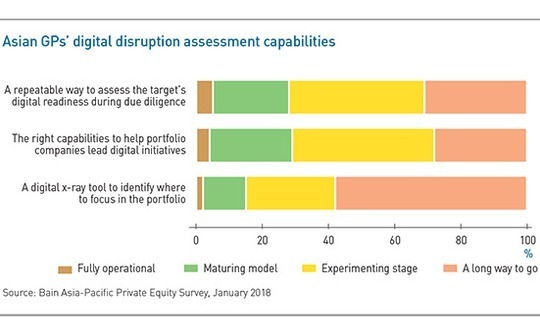

A Bain & Company survey published earlier this year found that Asian private equity investors themselves see approaches to disruption as a work in progress. Only 5% of respondents said they were fully equipped to assess digital readiness during due diligence, while just 4% believe they have the right capabilities to help portfolio companies lead digital initiatives. More than two-thirds said their firms were either at an experimental stage in these areas or "have a long way to go."

Behind the buzz

According to James Dubow, head of Asia at Alvarez & Marsal, the main area of weakness is where knowledge of a disruptive technology crystallizes into an action plan. "You need to have the internal DNA to think about these opportunities and how to respond to them," he says. "People get caught up in the buzzwords, but they don't always have a comprehensive grasp of what they mean in terms of a business."

Almost every brick-and-mortar retailer in Asia has developed an omni-channel proposition in response to the rise of e-commerce. Even among companies that were ahead of the curve in terms of making products available online, Dubow notes that plans were not always fully formed. Classic failings include neglecting the end-to-end sales, logistics and inventory management that underpins online-to-offline integration and allows retailers to respond quickly to changes in demand.

Advances in digital marketing have added to the complexity of these businesses. Establishing an online storefront within Alibaba's Tmall platform might still be the default option in terms of reaching Chinse consumers, but it isn't the only option. Social e-commerce is transforming how companies engage with potential customers, as evidenced by the "opinion leaders" who stream infomercials for Lunar's babywear business through apps that are linked to Alipay and WeChat Pay.

"Digitization cannot happen overnight, it requires a huge change management effort," adds KPMG's Jelloun. "We have been working with a food and beverage company on its China business for 18 months and the entire digitization program will take three years. The question is do private equity firms have the appetite to make that investment and commit for the duration."

In the instances where investors do have individuals at the GP level responsible for certain technology functions across the portfolio, it is usually because management teams lack the breadth to do it themselves. For example, Shaw Kwei & Partners hired a brand manager this year to coordinate marketing and communications across a portfolio of predominantly industrial businesses led by people who are authorities on lean manufacturing rather than WeChat.

Kyle Shaw, a managing director with the firm, adds real estate and enterprise resource planning (ERP) systems to the list of tasks best executed directly. "We can't expect the current staff to bring in a new ERP system and we don't want to hire a consultant to do it because that's sub-optimal. Someone at the GP needs to have ownership of the project," he says. "It's necessary for us to have that certain competencies in-house and standardize approaches across the portfolio."

This is largely consistent with an observation by Andrew Tymms, a partner at Bain & Company, that some private equity firms are focusing on select initiatives and makings sure they can drive them in a repeatable way rather than seeking to do everything and be a specialist in nothing. It also reflects two of the prevailing characteristics that define control-oriented middle-market managers in Asia.

First, they tend to work with small, less sophisticated companies where the technology improvement might be straightforward, but it needs to happen in the context of broader changes in systems and management. Second, portfolios can be relatively concentrated in terms of industry, which facilitates the development of domain expertise. Lunar's investment strategy is largely predicated on operating in and around a handful of consumer verticals because it has deeper insights into what moves the needle.

Larger firms differ in their perspective, but parts of the basic premise are similar: leveraging internal knowhow and external networks to harness technology and drive returns. The need to imbue digital thinking into all investment and operations professionals, regardless of sector or strategy, will have long-term implications for in-house resources. Specific approaches are likely to adapt in line with demand, but the one thing GPs cannot afford to do in the face of disruption is ignore it.

"Everyone is pursuing some sort of digitization strategy and these are stretching business models and bringing in new products and services. The actions of competitors, and even groups that traditionally haven't been in certain industries, are potential threats," says Michael McCool, a managing director at AlixPartners. "The next 18-30 months will see change at a pace we've never seen before. Will it calm down after that? It's hard to see, but we will become used to that pace of change and it will feel like it's calmed down."

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.