GP-LP: Rules of engagement

Large LPs want to reduce the number of PE managers in their portfolios and generate more value from the outperformers that remain. The GP-LP relationship is becoming closer and more complicated

"When running concentrated portfolios, who you choose to have that relationship with becomes very important. The nature of that relationship becomes very important. Who else is around that table in terms of your peers and what their capabilities are versus yours becomes really important," Steve Byrom, head of head private equity at Australia's Future Fund, told the AVCJ Forum in November. "If you are going to have a concentrated set of GP relationships - maybe 15-30 in total - then the relationship with each GP is more important than it ever has been."

Of Future Fund's A$122.8 billion ($88.5 billion) in assets under management as of June 2016, A$12.8 billion was invested in private equity across 29 managers. Putting that much capital with so few managers was unheard of 10 years ago, but it is increasingly where LPs are headed.

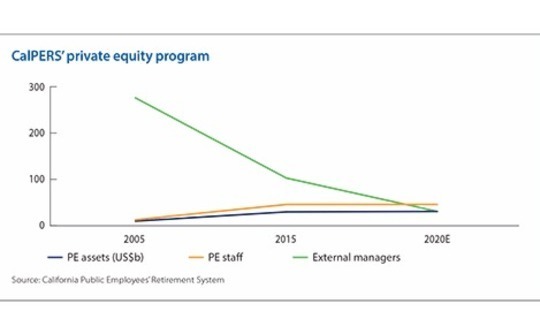

California Public Employees' Retirement System (CalPERS) sits at one end of the evolutionary spectrum: a longstanding investor in PE, by 2005 it had $9 billion with 275 managers. The pension fund expects exposure to the asset class to hit $30 billion in 2020, but it wants the GP relationships to number just 30, down from 102 in 2015. Alberta Teachers' Retirement Fund is at the other end of the spectrum, having established its program in 2009. The PE portfolio will double to C$2.5 billion ($1.9 billion) over the next eight years, but the target number of GP relationships is currently 15.

This dynamic is recalibrating the GP-LP relationship, placing much greater emphasis on effective communication. Large institutional investors want to draw more value from their private equity exposure, which means they will pay closer attention to cost efficiency and compliance on one side and potential for direct participation in deals alongside the fund on the other. For GPs, the fundraising landscape will become more polarized between those that are oversubscribed and those that struggle to get commitments, and increasingly complicated.

Speed counts

Co-investment is not the only consideration, but it is a priority for LPs pursuing concentrated portfolios - part of the larger allocation they make to each GP is earmarked for co-investment, typically on a zero fee basis in order to bring down costs. It also presents a series of structural challenges to private equity firms, as well as helping identify which LPs really belong in the top echelon and which do not.

Of the 128 LPs in BC Partners' ninth fund, which closed in early 2012 at EUR6.5 billion ($8.6 billion at the time), 105 wanted co-investment, Charlie Bott, the firm's managing partner and head of investor relations, told the Forum. BC delivered, with EUR0.50 in co-investment offered on top of every EUR1 in core equity deployed. However, not all LPs participate equally: only 6-7 serve as "co-sponsors," working alongside the GP on deals from day one; 8-10 are classified as co-underwriters that come in before closing; and the rest are limited to downstream syndication.

"All LPs handle co-investment their own way and it is an unknown for GPs because many of these LPs have come into the co-investment scene over the last few years and it takes time to build capabilities and processes," said Ivan Vercoutere, managing partner and CIO at LGT Capital Partners. "It is important is provide the initial feedback early, within a day or two. Too many times I hear GPs say they've approached a number of LPs who demanded co-investment but not heard back for two weeks."

The ability to respond quickly to co-investment opportunities is seen by some LPs as just as much of a differentiating factor as any particular sector insight they might offer. Future Fund's Byrom recalls a GP asking for references of previous co-investments because it previously lost out on a deal after a handful of LPs that had expressed a strong interest in going direct were unable to respond in four weeks. "The key criteria today seems to be reliability," he noted.

To this end, the likes of Ontario Teachers' Pension Plan (OTPP) hold weekly or monthly dialogues with GPs about what is in the deal pipeline. This enables the LP, which insists on participating in co-investments as a co-underwriter or co-sponsor involved from the outset, to engage in some initial internal discussions on the company and industry, as well as the potential pricing and structure, so if it wants to move on an opportunity it has a running start.

By creating more touch points with their managers, LPs increase the human resources burden on the managers as well. One of the purposes of a concentrated portfolio is it allows more time for building relationships that extend into the ranks of the deal leaders who are the main contacts for co-underwritten transactions. However, it remains incumbent on the investor relations professionals to manage LP involvement in co-investment.

"We spend a ton of time at BC, among the IR professionals, trying to work out what co-investment strategy best suits each deal and talking to the deal teams about it," said Bott, noting that there is more art than science to these processes. "Right now in house we have two co-investments in process and two more in the pipeline, it's a huge part of what we do."

For global buyout firms that have multiple strategies and look to meet the needs of these large institutional investors across their product portfolios, co-investment is one bucket to be filled. It doesn't have to be tied to a specific fund. Rather, an LP might commit $1 billion for The Carlyle Group to deploy in several vehicles, with the understanding that there will be a certain amount of co-investment. This gives the GP a degree of flexibility - helpful when the deals most likely to generate co-investment are lumpy and relatively unpredictable mega transactions.

"In the US, for example, our current fund is $13 billion and we wouldn't put more than 7-8% of that into any one deal. If we are bidding on an equity check of $2-3 billion we are going to need co-investment," said Jonathan Colby, a managing director with Carlyle. "We are pretty sure over the course of a five-year period there will be a deal at least in excess of $1 billion of equity. We don't know when it's going to happen, what sector it will be in, and whether it will appeal to the GP, but our burden is to offer it to them in the range that is appropriate to each of the LPs."

Fair treatment

What private equity firms try to resist is awarding co-investment rights or guarantees of a certain amount of direct exposure from a particular fund. Both Carlyle and The Blackstone Group have in the past structured co-investment on a pro rata basis, with each LP awarded a portion of each opportunity based on their equity commitment to the fund. The approach was abandoned because it was unwieldy and didn't meet large LPs' demands to write bigger checks and come in as co-underwriters.

Pacific Equity Partners in Australia has gone through a similar transition. For Funds II to IV, the corpus was two thirds core equity and one third supplemental equity for deals above a certain size. The management fee was split 2% and 1% (although the supplemental fund only charged this on drawn capital), while both tranches charged 20% carried interest. In Fund V, a subset of prequalified LPs participate in co-investment on a discretionary basis with zero fees.

The onus is on picking the right LP for the right co-investment, a thought process that could also take into account whether an investor can offer value-add in a certain situation because they offer sector or geographical expertise. Again, flexibility comes into play when creating bespoke structures that exist alongside funds for LPs that have certain co-investment expectations and not necessarily co-underwriting.

"It's difficult for a manager like us to give guaranteed co-invest on a one-off basis. Imagine if you engage in a one-off negotiation with one large strategic LP, there are a number of other large strategic LPs [to deal with]," said Carol Kim, senior managing director in Blackstone's investor relations and business development group in Asia. "However, if you set up a dedicated co-invest vehicle that is adjacent to the fund and have investors that specifically sign up for that, it is fine for the GP to automatically allocate co-invest to that vehicle. That is a very different to a one-off allocation."

Whatever the solution, and even if it does not involve showing every potential co-investment to every investor, GPs must be seen to treat LPs fairly. Failure to do this will have consequences when the GP is next on the fundraising trail, and perhaps with the regulators as well. The likes of Carlyle are required by the Securities & Exchange Commission (SEC) to convene co-investment committee meetings that exclude the fund heads in order to ensure allocations are in line with fiduciary responsibilities.

As in other areas of private equity, the law is playing catch up with the industry as approaches to co-investment evolve. Indeed, Bott's fear is that regulation becomes too overbearing and the SEC ultimately rules that the current imperfect but serviceable allocation method should be remedied by making it correspond exactly to fund commitments - i.e. returning to the pro rata system that was dismissed for being impractical.

"Someone who commits $1 billion will say, ‘$1 billion out of a $13 billion fund will give me 6% of the co-investment, which means across a fund investment cycle I may get $30 million, no thank you very much,'" he explained. "You will end up with a logistical nightmare of inviting everybody in and then people weeding out. It is not a situation we want to go down."

While the regulators may not end up taking such a hard line, the complexities presented by co-investment won't go away simply because of the level of demand. There is no shortage of capital looking to enter private equity, co-investment is increasingly seen as part of the package, and some LPs are building out their teams accordingly. Pressure is also likely to be felt more keenly further down the food chain as mid-market managers are lobbied for co-investment, although perhaps not on a zero-fee basis.

Closer scrutiny

Co-investment might be the most visible expression of the changing GP-LP relationship - offering insights into the lengths GPs will go in terms of economics and creative structuring - but it is not the only one. And for some institutional investors, it is not an issue at all. However, when PE firms relate stories of deeper negotiation on fund terms and governance issues it is not only a function of increasing regulation but also a reflection of how LPs are seeking to draw more value from their GP relationships, and protect their downside.

In a November presentation by CalPERS - which was responding to criticism of the seemingly lax approach it took to tracking carried interest - the risks tied to PE were listed as follows: blind pools; wide dispersion in manager performance; infrequent valuation estimates; difficulties determining benchmarks; investment timing driven by fundraising cycles; complex, high and non-transparent fees; challenges predicting cash flows; idiosyncratic contracts; and the need for a broad set of skills to select managers, structure investments, and track performance.

Reducing the number of GP relationships is just one way to cut the complexity. CalPERS also plans to "focus on cost effective structures with better alignment" - which amounts to driving down fees, through steeper discounts based on the size of fund commitments as well as pursing zero fee co-investment - push for better transparency and disclosure, and improve monitoring and governance.

This makes for an instructive snapshot of the areas LPs the world over are likely to focus on, with priorities and remedies varying by group.

It is worth noting that if CalPERS achieves its 2020 target, the pension fund's in house private equity staff will exceed the number of GP relationships by 45 to 30, which means more man hours devoted to each one, whether the focus is governance or co-investment. It is a scenario few would have thought possible in 2005, when a team of 12 looked after a portfolio of 275 managers.

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.