ESG: Digging deeper

Comprehensive adoption of responsible investment protocols in private equity is being driven by a handful of players within the global LP community. They must continue to establish industry best practice

Come 2036, all companies in the California Public Employees' Retirement System (CalPERS) investment portfolio will be expected to comply with globally-adopted corporate reporting standards and demonstrate a measure of diversity - by gender, ethnicity, skill sets, and so on - in their boardrooms. For private equity managers specifically, allocations from America's largest public pension plan will be conditional on compliance with Institutional Limited Partners Association's (ILPA) reporting framework.

These are three of 23 strategic goals that appear in the 30-year timeline that accompanies CalPERS' environmental, social and governance (ESG) five-year strategic plan, which was formally endorsed in August. It is the product of a 12-month process intended to establish how the pension plan's underlying investment beliefs could be applied in a governance context.

The timeline seeks to map out progress across a broad range of areas from reporting standards, to diversity and inclusion, to sustainable investment research, to private equity fee transparency. But in terms of reporting alone, the implications for private equity managers are clear: CalPERS wants voluntary reporting, including enhanced disclosure of ESG considerations, to become regular mandatory reporting on ESG, enabling proper benchmarking of performance.

"One of the most significant strategic priorities is advocating for better data and standards across the industry," Priya Mathur, a CalPERS board member, told the AVCJ ESG Forum in September. "In order for us to compare managers and investment opportunities we need to understand how they stack up. If data disclosure and standards are not consistent it is very challenging to make these comparisons. That being said, in our due diligence and monitoring efforts, right now we are really looking at what are your [the managers'] policies, and how you are integrating it into your investment practices."

CalPERS started focusing on governance issues more than 30 years ago and over time factored environmental and social considerations into its risk-return assessments as well. As a drafting signatory of the UN-endorsed Principles for Responsible Investment (PRI), it can claim to be an early mover on ESG. However, the pension plan's current position of seeking to understand how a manager approaches these issues rather than imposing standardization is emblematic of a global LP base still developing an approach - in terms of internal structures for ESG coverage as well as what is asked of external GPs.

Diligence debate

The PRI drew up guidelines for private equity in 2008-2009 and launched a model ESG due diligence questionnaire for LPs towards the end of last year. Yet the organization's most recent progress report on the asset class noted "a gap between responsible investment due diligence and the systematic translation of these findings into fund documentation and manager evaluation practices."

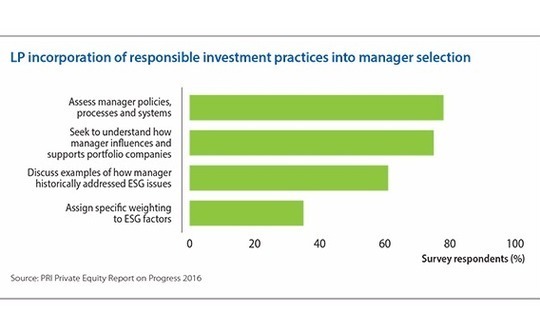

Of the 126 LP respondents to PRI's survey, almost all include in their selection practices a review of a GP's responsible investment policy, discussion of governance and management of responsible investment, and questions as to whether the GP is a signatory to the PRI or other relevant organizations. Fewer investors systematically look at how to assess and weight the information received from managers during the selection process.

However, this is just the beginning of the LP's assessment. A follow-on conference call or meeting with the GP is the next step, which allows USS to discuss the answers to the questionnaire in more detail. The LP will also dig back into the manager's track record to find out to what extent ESG considerations have factored into past investments.

"We look at portfolio companies from previous funds, identify ESG risks, and ask the managers how they addressed those risks. If it's a new fund we look back at where the individual managers were before and ask questions about what they did in previous funds, just to get an understanding of how they are addressing ESG risks in their management," said David Russell, co-head of responsible investment at USS Investment Management. "We provide that information - our assessment of how we believe the manager will address ESG risks - through our investment committee process."

For other sophisticated practitioners, questionnaires fashioned on the PRI approach are also just one facet of the process. Netherlands-based PGGM, for example, developed a risk-scoring system built on the answers to its questionnaire and uses that as the starting point in further discussions with GPs. If a GP is found wanting in certain areas, the pension fund will work with it on developing an action plan intended to deliver change.

Australian superannuation fund HESTA, meanwhile, has dispensed with the physical questionnaire entirely, preferring initial exchanges to take place over the phone. The same questions inform the structure of the discussion but HESTA finds that asking them directly - with the flexibility to go off-script where necessary - makes for better assessments. Case studies of ESG policies in action feature prominently, whether in initial due diligence or ongoing oversight.

"The questions we ask help us structure how we assess managers compared to one another, or how an individual manager might respond to the same question over the life of the investment as we go through that monitoring process," said Joanne Saleeba, investment manager for ESG at HESTA. "It is important we tailor questions to what we think is important, based on our investment beliefs and approach. That is going to be different from what other funds think is important."

No box-checking

This emphasis on the bespoke as opposed to the generic extends into how these LPs want managers to report back to them on ESG. Annual reporting is not discouraged, but at the same time it is not seen as essential by some investors. Once again, there is preference for direct interaction, although there is general consensus that this should happen more often and be more structured.

The challenge is taking all these different discussions and submissions and distilling them into criteria through which GPs' approaches to ESG can be fairly compared. "I don't want generic reports but I want reporting back to the LP and I would like that to be standardized, at least so I can compare GPs. You take differences into account, but if you have a standardized way of doing it you can better assess it," said Marcel Jeucken, managing director for responsible investment at PGGM.

Groups such as PGGM have held workshops for GPs on answering questionnaires to ensure a more structured and common line across its portfolio managers. Attempts have also been made at industry-wide standardization. However, it is difficult to achieve uniformity while making sure ESG compliance doesn't descend into box-checking and group-think.

One of the problems is diversity within the LP community. Asked why some investors lean towards binary questions in their questionnaires, Russell of USS said it was a matter of money. "We are able to analyze the responses coming back from GPs but many smaller funds lack the resources we have and therefore go with a quantitative approach, where they can get a mark and it's easier for them to analyze," he explained.

Russell heads a team of six people who cover responsible investment at USS, which is the UK's largest pension fund with GBP55 billion ($68 billion) in assets. PGGM has EUR200 billion ($222 billion) under management and 12 professionals dedicated to ESG across the portfolio.

At $295 billion behemoth CalPERS, the global governance division has an investment director, a financial markets investment manager with four subordinate investment officers, and a further four investment officers covering knowledge management, sustainable investing, corporate engagement, and principles and proxy voting, respectively. The annual budget is $1.96 million. The strategy review involving the ESG five-year plan also called for an additional $1.86 million to cover new hires who would bulk up the sustainable investment and proxy voting and corporate engagement resources reporting to the CIO.

Doubling the budget may be untenable for some smaller LPs. Others are simply unwilling to make such an accommodation because they do not buy into the ESG concept. Veronica John, a senior managing director with placement agent Diamond Dragon and before that an investment officer with the Asian Development Bank, observed that integrating ESG into a fundraising pitch is a balancing act.

"Working with GPs to get them ready for an institutional fundraise, we walk a very fine line in terms of talking about ESG and its incorporation into the manager's investment strategy and due diligence processes. A lot of LPs don't really want to talk about that," she said, adding that the investors attending an ESG-dedicated event - who by and large are already advocates of ESG - cannot be seen as representative of the LP universe. "They think it could negatively impact returns, whereas most of us in this room know it actually enhances returns. It's a challenge."

US investors are generally regarded as laggards on ESG, although this does not necessarily mean they wholly reject it. Christopher Ailman, CIO of California State Teachers' Retirement System (CalSTRS), previously compared acceptance of ESG in North America to "an upside down U. California focuses more on ESG, and then Oregon and Washington a little bit; the Canadians get it but aren't fully introducing it; and you've got some of the northeast states and New York. But then it stops - the whole middle of the country is missing." However, he added that interest has grown over the last four years.

To Mathur of CalPERS, the major impediment to wider incorporation of ESG principles is an "old-fashioned way of looking at investment," with five years seen as a long-term view. Once mindsets switch to longer horizons, priorities change. Private equity managers, for example, might find that LPs pay more attention to the composition of a portfolio company's board ahead of an IPO. This reflects an appreciation on the part of the LP that the company will remain in its portfolio for years after listing and board diversity is widely seen to deliver higher-quality corporate governance.

Two-speed world

The PRI progress report discovered faster proportional growth of GPs incorporating responsible investment into their processes than LPs (six percentage points year-on-year versus 0.9 percentage points). It has also seen rapid growth in its GP signatory base since 2009, while LP uptake has been modest. The report concludes that a core group of institutional investors is driving responsible investment within private equity and this is pushing more GPs to strengthen their capabilities in this area, particularly during fundraising cycles.

This bifurcated universe is perhaps a logical state of affairs given ESG is a relatively recent introduction to private equity in most markets. It is therefore incumbent on this core group of LPs to establish industry best practice, trusting that protocols will percolate through the industry. Greater standardization, driven by GPs if not the wider institutional investor community, will come once these approaches achieve critical mass.

While the leading LPs are actively engaging with managers on ESG - for example, establishing whether a middle-market GP is in fact fully aware of governance liabilities, risk management and labor relations but does not communicate this in ESG language - they also have increasingly clear-cut expectations.

A number of these reflect structural changes the LPs themselves are making to better incorporate responsible investment into their processes. Nearly every institutional investor that spoke at the AVCJ ESG Forum advocated integration and detailed their progress towards achieving it: establishing cross-asset sustainability teams within investment offices that share intelligence; embedding ESG specialists in the investment process from sourcing to exit; and making ESG considerations the responsibility of investment professionals.

Much rests on the alignment of interest between GP and LP, how this influences a private equity firm's long-term vision for its franchise, and the role that ESG can play in building a legacy that benefits both sides. "What I think is most important, more important than any ESG policy, is trying to find out if ESG is in their investment beliefs," said Anders Strömblad, head of alternative investments at the Second Swedish National Pension Fund. "Despite the progress, there is a lot of lip service still out there."

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.