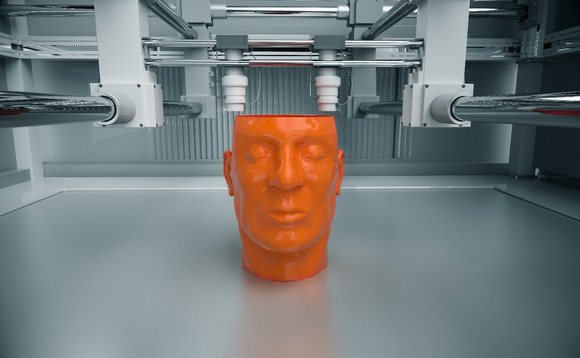

3D printing: Dimension jump

3D printing technology is expected to grow at an accelerated rate now that its practical applications have come into focus. As a global manufacturing leader, Asia could be at the center of the boom

When China Everbright and Israel-based Catalyst Private Equity teamed up earlier this year to lead a $25 million investment in 3D printing company XJet, it marked an inflection point for Asian confidence in the technology. "After the initial hype about 3D printing, there was a decline, and now we are again experiencing and seeing a significant boost in interest in the industry from both financial investors and strategic players," says Yair Shamir, Catalyst's founding and managing partner.

The commitment came within days of the International Data Corporation (IDC) projecting that annual 3D printing investment would climb 187% over the next three years in Asia ex-Japan to reach $4.3 billion. Like the XJet deal - which is focused on the decidedly industrial work of perfecting a liquid metal ink jetting system - this forecast is rooted in a future for 3D printing removed from the disillusionment of a fizzling consumer market.

The evolution from novelty shop to factory floor appeals to investors who look for practicality in innovation. In the context of Asia's globally dominant manufacturing sector, however, the maturation of 3D printing as an industry could also herald a shift in leadership from West to East.

"Today, few 3D printers sit on actual manufacturing lines due to speed constraints and limited efforts from existing machine manufacturers to enable factory integration," says Tyler Benster, general partner at Asimov Ventures, a US-based firm with a strong focus on 3D printing. "That said, the potential of this integration is enormous and no region is better positioned than Asia to spearhead this advancement. Asia is in a unique position to drive adoption of 3D printing for the production of finished goods, especially as components of goods that are already being produced in Asia."

Back to reality

According to research group Wohlers Associates, North America and Europe control at least two-thirds of the global 3D printing space, leaving Asia Pacific with only 27%. This market has grown by at least 30% each year from 2012 to 2014.

The overheating process was largely driven not only by unrealistic outlooks for the consumer market, but also by concrete success stories such as the rise of 3D printing to account for 23% of the $12 billion prototyping industry and 98% of global production of hearing aids. This combination of quickly cooling consumer market expectations and consistent progress carving out large portions of lower-profile segments has primed GPs' hopes for a rapid rise in investment activity.

"It became clear that the industry's expectations were way ahead of the short-term reality and that the consumer space was not where this was going to happen," says Catherine Wood, founder and CEO of Ark Investment Management, an investment firm which recently launched a vehicle exclusively focused on 3D printing companies. "We needed that shake-out to take place, and now we're on the other side of it."

Projections for the expansion of 3D printing on the back of this rebound in sentiment vary widely across a range of high-growth scenarios. Ark expects the industry to grow from about $5.2 billion in 2015 to $40 billion in 2020. Credit Suisse and Wohlers factor among the more conservative researchers, with targets of $12 billion and $20 billion by 2020, respectively. McKinsey & Company, meanwhile, sees the market reaching a valuation of $180-490 billion by 2025 as more manufacturers take the technology beyond prototyping into the more efficient creation of end-use products.

In Asia, opportunities in this transition will be tied to the phenomenon of capital replacing labor as the key input for manufacturing. As such, high-tech jurisdictions will be at an advantage as they close a longstanding operational cost gap with developing economies that continue to rely on cheap labor. Markets that operate more freely are expected to see start-ups displace established manufacturers in verticals such as consumer goods, medical devices and industrial components. "The big advantage in the Asian Pacific market is in its potential for short-run productions," Catalyst's Shamir says.

The majority of 3D printing industry development activity in Asia Pacific is currently taking place in the form of education, from specialized in-school labs for Chinese children to enterprise-level training organizations in more mature markets such as Australia and Korea. Commercial adoption of the technology from this interest base will depend on the support of both private investment and government initiatives that specifically prioritize 3D printing like the "Made in China 2025" plan.

"The transition for Asian manufacturers could be longer compared to North America and Europe in light of the low labor cost and less technology-savvy Asian manufacturers," says Maggie Tan, associate vice president for IDC Asia Pacific. "In addition, manufacturers may be more resistant to change considering that they have made significant investments in traditional machinery or workflow that ‘works just fine' for them now."

Some of the best opportunities for value accrual have been identified in high-end technological manufacturing segments that demand exacting engineering standards, including the robotics, aerospace and automobile industries. These industries combine an early interest in integrating 3D printing technologies with an impetus to cut operational costs due to macro factors including the slowdown of Chinese growth and a steady appreciation of the US dollar.

Increasing industrial interest in this context is expected to drive business models across the 3D printing sub-segments of machines, materials, software and services, although there will be challenges for young companies. As adoption of 3D printing grows, demand for software that integrates the technology into existing company digitization strategies is expected to follow, but the current dominance of software heavyweights such as Autodesk could make this a difficult area for start-ups to penetrate. The services segment, likewise, offers low barriers to entry but little potential for differentiation.

"I see machines as the most likely to generate venture-sized returns. Although materials are a high-margin item in the industry right now, these profits are generally locked to the machine manufacturer," Asimov's Benster adds. "Start-ups will also find it difficult to compete with the massive economies of scale of the major material suppliers as volumes grow. The challenge with services is that 3D printing fundamentally commodifies the manufacturing process into a box that can be purchased."

Exceptions to this view so far have included Japan's Kabuku, a services start-up that operates a website selling customized products such as smart phone covers in materials such as plastic, ceramic, metal and rubber. The company raised JPY750 million ($7.4 million) last year from Global Brain, Dentsu Digital Holdings and Mitsui Sumitomo Insurance Venture Capital.

However, even consumer-minded start-ups in less technical industries have cited machines and materials - rather than services - as the most likely growth areas for 3D printing investment. Daniel Christian Tang, a Canadian custom jewelry printer currently planning an Asian expansion, sees this trend unfolding with the greatest disruption and innovation taking place in niches that have the most laborious production processes.

"3D printing machines will continue to improve in resolution until they reach a threshold for minute detail, with print speed becoming the driving factor for development," says Luca Daniel, co-founder of Daniel Christian Tang. "Engineering newer and better materials to print will also help expand the use and applicability of 3D printed pieces to other industries that require specific materials, like the luxury jewelry industry printing in precious metals, or the biomedical field printing at a cellular level. An optimal entry point would be to invest in companies that are trying to use current 3D printers to print new materials, or developing means to print materials not yet engineered for 3D printing techniques."

Material growth

IDC's Tan expects that as awareness and operational knowhow improves, near-term investment will focus heavily on a need to expand material availability at the professional range of printers. "Venture investors in this area should look at vendors and companies with the capabilities to expand material usage while understanding how traditional manufacturing works in order to help users in integrating the new technology to their existing and future workflow," she says.

Early-stage investors are therefore advised to target verticals that can exploit an expanding range of materials using off-the-shelf printers. Companies in these areas are considered easier to get started, more scalable and able to accumulate most of their value in intellectual property, branding and sales channels. Printer technology developers may be slower to get into profitability but they will also represent a growth area as rising competition in manufacturing drives higher performance standards.

The most fundamental strategy in 3D printing investment, however, may be a matter of understanding the need for carefully negotiated collaborations that bridge the gap between technology and manufacturing. This is because the tendency among manufacturing businesses to be more conservative with system rollouts than technology players could represent a potential drag on the development and competitiveness of the 3D printing industry, especially in emerging Asian economies.

"These two industries work at different cadences, so there will have to be some partnerships where technology and industrial companies bring those cultures together," says Ark's Wood. "The winners are going to be those who embrace the technology, are evolving quickly and understand how to go to market in the industrial world."

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.