Official Record

Fund focus: Tower goes large with debut fund

Tower Capital Asia is repositioning itself as a large, globally connected PE firm as it transitions from deal-by-deal investing to a fund structure. Deep roots in Singapore remain the nucleus of the strategy

Deal focus: AI integration pays off for Evomotion

With investors going cold on China artificial intelligence, Evomotion has remained popular and profitable by delivering hardware and software to corners of the market that are either overlooked or hard to access

Deal focus: Morse Micro takes Wi-Fi to the next level

Australia’s Main Sequence Ventures plans to make Morse Micro one of the few Wi-Fi chipmakers in an easy-to-imagine future where more reliable, long-range device connectivity surges in demand

Fund focus: Glenwood gains traction with carve-out thesis

Korea-focused Glenwood Private Equity has closed its second fund on KRW 900m (USD 648m) from local LPs, having established itself as a mid-market corporate divestment specialist

Fund focus: Baring restocks its dry powder

Baring Private Equity Asia claims a pipeline full of USD 1bn-plus investment opportunities to meet the needs of an USD 11bn-plus fund – but for now it is being cautious about pursuing them

Deal focus: L'Oréal shows staying power

Europe-based personal care giant L’Oréal looked past short-term impediments like lockdowns and asset price corrections to join Cathay Capital in supporting Chinese perfume brand Documents

Deal focus: Anchorage exits rail player, launches Fund IV

Australia-based Anchorage Capital Partners has extended a string of exits with the sale of a local rail industry player, while going to market seeking AUD 500m (USD 339m) for its fourth fund

Deal focus: Remote working delivers for Glints

An outsourced talent management service that enables companies to recruit in far-flung markets has become the bulwark of Glints’ business on the back of COVID-19, underpinning a USD 50m Series D

Deal focus: PAG goes back to the theme park

PAG returns to a historically fruitful niche with the acquisition of Japanese theme park operator Huis Ten Bosch. COVID-19 made the deal possible but remains a wildcard

Deal focus: Jai Kisan taps India rural resurgence

The founders of technology-enabled credit platform Jai Kisan went against the grain by forgoing urban customers and targeting India’s rural poor. A USD 50m Series B is an indicator of its progress

Deal focus: Turning data into operational efficiencies

Chinese data mining start-up Prothentic has managed to turn first-time business into repeat subscription business, which led to valuation increase between funding rounds even as the wider market stagnates

Fund focus: Fundamentum finds its niche

As one of few Series B and C specialists operating in India, The Fundamentum Partnership expects to have plenty to choose from over the next two years as the glut of early-stage start-ups thins out

Fund focus: Cherubic continues to scale

Early-stage investor Cherubic Ventures initially struggled to get traction with its idiosyncratic Greater China-US strategy, but the firm sees its USD 110m haul for Fund V as validation of the thesis

Fund focus: Insignia takes two months to scale up

Insignia Venture Partners received subscriptions to its third fund amounting to twice the size of the final corpus, underlining the appeal of Southeast Asia. The GP is keen to leverage China’s talent exodus

Deal focus: Allegro pumps up in New Zealand

Australia’s Allegro Funds has made its first investment from its largest fund to date, flexing new capacity to invest at scale with petrol station chain Gull New Zealand

Deal focus: Creador goes early in digital banking

Only six digital banks are licensed to operate in the Philippines. Enthused by the prospect of helping build one of these select few from the ground up, Creador moved fast to back UnoAsia

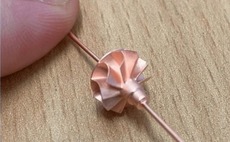

Deal focus: China start-up mines 3D printing's micro potential

Supported by a string of Chinese investors, Boston Micro Fabrication has carved a niche serving global manufacturers that want 3D printing solutions for very small components

Deal focus: Navis penetrates Thai hospital segment

Navis Capital Partners’ acquisition of NP Medical extends its coverage of the Southeast Asia hospital space to a third geography while tapping into a general trend towards specialty providers

Deal focus: Prosus looks to aggregate India's fruit farmers

B2B marketplaces are the prevalent theme in Prosus Ventures’ agricultural technology investments in Asia. However, as fruit specialist Vegrow demonstrates, supply chain dynamics are not uniform

Deal focus: Hahn & Co takes GP-led secondaries to new high

Hahn & Company has closed a USD 1.5bn single-asset continuation fund for Korea's Ssangyong C&E, giving it more time to complete the company's transition from cement maker to broader environmental services player

Fund focus: Lightspeed ramps up in India, Southeast Asia

Lightspeed Venture Partners is leaning hard into developing Asia with long-range vision, added operational resources, and a new USD 500m war chest

Deal focus: Seeing light at the end of the COVID-19 tunnel

Taiwan travel start-up KKday continues to raise capital seemingly on its own terms despite flights remaining largely grounded. It expects a boom toward year-end and near-normalcy in 2023

Deal focus: SJL fills Korea's cross-regional gap

Steve Lim launched SJL Partners to help Korean corporates pursue M&A in the US and Europe, having seen global GPs pass on such opportunities. Meridian Bioscience is the latest addition to the portfolio

Deal focus: Dayone champions lithium-ion alternative

In throwing its support behind Enpower Greentech, Dayone Capital hopes the Chinese company can turn solid-state batteries into a commercially viable reality for electric vehicles