Official Record

Deal focus: GPs go big on China biosynthesis

Advances in synthetic biology and China’s carbon-neutral ambitions have prompted investors to re-examine bio-manufacturing plays. Mojia Biotech is among the beneficiaries

Fund focus: Qiming picks its moment

China’s Qiming Venture Partners more than doubled its fund size from the previous vintage, having launched the vehicle prior to the recent chaos and leveraged LP demand for the familiar

Deal focus: Carlyle targets consumerism in ceramics

The Carlyle Group, like many investors, sees premiumisation as a natural outcome of the expansion of India’s middle class. It could be the first to test this thesis in the local building materials industry

Deal focus: India's Shubham sees opening to accelerate

Shubham believes its long-curated datasets and institutional memory differentiate it from a growing pack of low-income housing lenders. Global impact investors appear convinced

Deal focus: CDH plays Asia wellness card

CDH Investments turned The Better Health Company from a New Zealand-only player into a brand with regional recognition. COVID-19 proved a minor obstacle to an ultimately successful trade sale

Deal focus: Novel angle on mobile adoption gains traction

Cashify is leveraging and propelling India’s mobile penetration narrative at the most fundamental level. Adding tech to the secondhand smart phone space has allowed it to create a first-of-its-kind brand

Fund focus: LGT eyes a buying opportunity

As LGT Capital Partners starts deploying its USD 1.65bn Asia fund-of-funds, it hopes that rationalising valuations and some consolidation of GP relationships will contribute to a strong vintage

Deal focus: Confidence unwavering in SE Asia e-commerce

Singapore online shopping platform ShopBack hopes to extend a fledgling theme of Southeast Asian IPOs in the US amid threats to discretionary spending in its core markets

Fund focus: Re-ups underpin FountainVest's Fund IV close

Despite headwinds that have afflicted all China-focused managers, FountainVest Partners closed its fourth fund just above target on USD 2.9bn. One-third of the corpus has already been deployed

Deal focus: Software Combined sees sense in aggregation

Backed by majority owner Navis Capital Partners, Australia-based Software Combined wants to reach up to USD 35m of EBITDA within three years through acquisitions of smaller B2B players

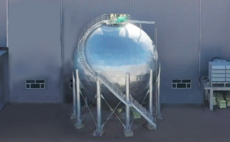

Deal focus: TH Capital identifies key niche in energy storage

Zhongchu Guoneng Technology is leading China’s push into compressed air energy storage as a means of harnessing fast-rising yet unstable wind and solar capacity. Tsinghua Holdings Capital is among the backers

Deal focus: Pakistan's Dastgyr aspires to emulate Alibaba

SOSV sees parallels between the e-commerce awakenings in Pakistan and China, though 20 years apart. Dastgyr has positioned itself at the fore, but it wants to be asset-light rather than asset-heavy

Fund focus: LPs endorse Potentia's software thesis

Potentia Capital took just four months to close its second fund on USD 438m, emphasizing the growing appeal of B2B technology opportunities in Australia and New Zealand

Deal focus: Hahn finds rich pickings in SK Group

Hahn & Company’s USD 1.3bn acquisition of an industrial materials unit from SKC is its fifth deal involving SK Group in four years. Being a good custodian is regarded as key to securing repeat business

Deal focus: Singapore biotech start-up generates US buzz

Singapore’s Tessa Therapeutics has developed a cancer drug that appears to be twice as effective as other treatments in its class. It has raised USD 126m with eyes on a near-term US IPO

Deal focus: VCs back steppingstones to immortality

Japan’s Alt is quicky commercialising a suite of learning voice recognition products as part of a plan to capture individuals’ personalities and values in a process it calls digital cloning

Deal focus: Hike supports Song Yao's second act

Orienspace, a Chinese rocket developer founded by the entrepreneur behind DeePhi Technology, has secured USD 60m in funding from Hike Capital and others to accelerate its launch schedule

Deal focus: Bud puts content creators first

GGV Capital first backed Bud before the founders had a market-ready product. Now the company has closed a Series B round and is looking to take its user-generated content tools into more markets

Fund focus: Eurazeo has SE Asia insurance tech covered

France-based Eurazeo has set up a USD 200m Southeast Asia VC fund dedicated to insurance technology with an unnamed global insurance company as the lone LP

Deal focus: WeRide confirms its ascendency

Chinese autonomous driving pioneer WeRide has climbed from near bankruptcy to a USD 4.4bn valuation within three years. A collaboration with Bosch could form a blueprint for other alliances

Deal focus: Venturi brings families into D2C

Consumer-focused private equity firm Venturi Partners drew on significant family office co-investment to co-lead a USD 108m Series D for India direct-to-consumer food specialist Country Delight

Fund focus: XVC stresses its idiosyncrasies

The China VC firm cuts against the grain, eschewing investment committee meetings and embracing consumer deals while others shun them. It works from a fundraising perspective

Fund focus: BlueRun defies China fundraising woes

Having secured USD 819m, across US dollar and renminbi vehicles, the early-stage investor wants to prove that China can deliver globally competitive technology

Deal focus: India's Fashinza in vogue with VC

The appeal of the boutique brand ensures that fashion will always be a fragmented space. As e-commerce splinters the industry even further, India’s Fashinza aims to tie it all together