Venture

Indonesia VC: Corporate kingpins

The corporates and family groups that dominate Indonesia’s economy are becoming increasingly active in the VC space. To independent GPs, they are more friend than foe, but agendas and approaches vary

VC-backed real estate start-up gets $11.7m from Mitsui

Mitsui & Co has agreed to invest JPY1.3 billion ($11.7 million) in Renoveru, a VC-backed start-up focused on online services in Japan’s home renovations market.

Volkswagen China invests $180m in VC-backed Mobvoi

Volkswagen's China unit has agreed to invest $180 million in Beijing-based Mobvoi, a venture capital-backed start-up that is developing artificial intelligence (AI) technology for the automotive sector.

China auto trading platform Souche gets $180m Series D

Warburg Pincus has led a $180 million Series D round of funding for Chinese online second-hand car trading platform Souche, less than five months after the company’s previous round worth $100 million.

Banyan raises $725m across US dollar, renminbi funds

Banyan Capital has raised more than RMB5 billion ($725) million across two China-focused venture capital funds – one US dollar-denominated and the other in renminbi.

Mahindra leads $21m round for India's Medwell

Mahindra Partners has led a $21 million Series B round for Indian home healthcare start-up Medwell Ventures, operator of Nightingales Home Health Services.

China credit assessment platform Wecash gets $80m

Wecash, a Chinese financial technology company that provides credit evaluations online, has completed an $80 million Series C round jointly led by China Merchants Venture Capital, Forebright Capital and SIG Asia.

Deal focus: Freightos looks to take shipping digital

GE Ventures leads a $25 million round for Freightos, giving the Hong Kong-based logistics software specialist dry powder to build out its price information marketplace for freight forwarders

Sequoia India leads Series C for Australia's HealthEngine

Sequoia Capital India has made its debut investment in an Australia-based start-up, leading a A$26.7 million ($20.2 million) Series C round of funding for HealthEngine, an online healthcare marketplace.

VCs back China female-focused consumer finance start-up

Shanghai Mime Financial, a consumer finance platform targeting the young females in China, has raised a Series C round led by domestic investors Haier Capital, Xiyu Capital and Panda Capital.

Grab buys VC-backed Indonesian e-commerce player Kudo

Southeast Asian ride-hailing app operator Grab has agreed to acquire Kudo, an Indonesian online-to-offline (O2O) e-commerce start-up backed by a number of venture capital firms.

Redpoint, Sinovation lead round for China online TCM player

Redpoint Ventures and Sinovation Ventures have led a Series B round worth RMB100 million ($14 million) for Xiaolu Clinic, a traditional Chinese medicine (TCM) online services provider.

GE Ventures backs Hong Kong digital logistics business

GE Ventures, the VC arm of General Electric, has led a $25 million extended Series B round of funding for Freightos, a Hong Kong-based logistics technology company. It brings total funding for the business to $50 million.

Morningside closes debut renminbi VC fund at $143m

Morningside Venture Capital, a China-focused early-stage VC firm that used to manage only US dollar-denominated funds, has closed its first renminbi vehicle at RMB1 billion ($143 million).

China personal lending platform Yongqianbao raises $68m

Yongqianbao, a Chinese mobile app that provides personal loan services, has raised a RMB466 million ($68 million) Series C round co-led by Golden Brick Capital and CICC Alpha.

B Capital leads $25m Series C for India's Icertis

B Capital Group - a VC firm launched by Facebook co-founder Eduardo Saverin - has led a $25 million Series C round for Icertis, an India and US-based company that provides cloud-based contract management software.

Deal focus: BlackBuck climbs the logistics ladder

BlackBuck receives $70 million in Series C funding as it continues its mission to cure the dysfunction in India's fragmented long-distance trucking industry

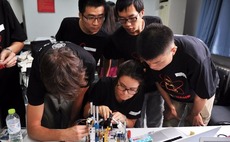

China edtech: Tangible teachings

Educational hardware remains an emerging investment segment globally. In China, cultural shifts are piquing expectations for a local boom, but success will depend on various cross-market diversifications

Korea to invest $102m in life science start-ups

The South Korean government has pledged to establish a KRW113.5 billion ($102 million) fund to support life science start-ups through related ecosystem and infrastructure investments.

China Growth Capital leads $14m round for Tiger Brokers

China Growth Capital has led an extended Series B round worth RMB100 million ($14 million) for Tiger Brokers, a Beijing-based online brokerage start-up, with participation from existing investor ZhenFund.

VCs invest $33m in Japan's Dely

Jafco, YJ Capital, and Gumi Ventures have taken part in a JPY3.7 billion ($33 million) funding round for Japanese online food media start-up Dely.

Tencent leads $350m round for VC-backed Kuaishou

Kuaishou, a Chinese live-streaming video app backed by VC investors and search engine Baidu, has raised $350 million in a new round of funding led by Tencent Holdings.

China video communication player Xiaoyu Link gets $18m

Xiaoyu Link, a Chinese video communication services provider, has raised a RMB125 million ($18 million) Series B round of funding jointly led by ZhenFund and Zhen Cheng Fund.

Sequoia, Fosun Kinzon invest $15m in India travel site Ixigo

Sequoia Capital has led a $15 million Series B round for Indian online travel marketplace Ixigo, with participation by Fosun Kinzon Capital, the investment arm of Chinese conglomerate Fosun International.