SoftBank Ventures Asia

India's True Balance gets $28m Series D

Indian financial technology provider True Balance has raised a $28 million Series D round from a group including SoftBank Ventures Asia.

Profile: Jihoon Rim

Jihoon Rim has been a venture capitalist, CEO of one of Korea’s largest technology companies, and a US business school professor – in the space of a decade. He explains the appeal of new challenges

EV Growth, Jungle lead round for Indonesia's Waresix

Indonesian logistics technology provider Waresix has secured about $75 million in Series B funding led by existing backers EV Growth and Jungle Ventures.

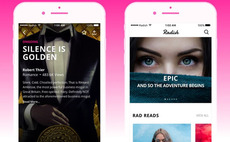

Korea, US-based serialized fiction app gets $63m

SoftBank Ventures Asia and Kakao have led a $63.2 million Series A round for Radish, a Korea and US-based producer and broadcaster of serialized fiction for mobile devices.

Vietnam's Propzy raises $25m Series A round

Gaw Capital and Softbank Ventures Asia have led a $25 million Series A funding round for Vietnamese real estate platform Propzy.

Vietnam's Sendo raises $61m Series C

Vietnamese e-commerce company Sendo has received $61 million in Series C funding from a group of investors including SBI Group and SoftBank Ventures Asia.

Chinese GPs back $120m Series B for OPay

A group of Chinese investors including Gaorong Capital and Sequoia Capital China have joined a $120 million Series B round for Nigerian logistics and payments technology company Opay.

Indonesia's Alodokter gets $33m Series C

Indonesian insurer Sequis Life has led a $33 million Series C round of funding for Alodokter, a local super app operator that connects patients with doctors and healthcare information.

Singapore's Carro raises $30m for extended Series B

Singaporean auto marketplace operator Carro has raised $30 million from investors including SoftBank Ventures Asia as part of an extended Series B round.

SoftBank Ventures Asia hits $269m first close on global fund

SoftBank Ventures Asia – previously known as SoftBank Ventures Korea – has reached a first close of KRW317.4 billion ($269 million) on a fund that will make early-stage investments globally with a focus on Asia.