automobiles

India used car dealership raises $43m Series B

Spinny, an online platform for selling used cars, raised $43.7 million in a funding round led by The Fundamentum Partnership, an Indian growth capital VC firm.

Malaysia's Socar gets $18m from Korean investors

Korea’s Eugene Private Equity and KH Energy have provided $18 million in Series A funding to the Malaysian arm of local car sharing company Socar.

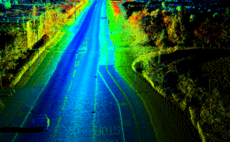

Deal focus: Lightspeed targets solid-state LiDAR

Having assessed some 40 autonomous driving companies globally, Lightspeed China Partners decided that Hesai - a business born in the US and raised in China - is best-placed to take the technology forwards

India EV: On a roll

India’s electric vehicle space is nascent but growing rapidly on the back of a concerted policy push. Investors see enormous potential, especially in the world’s largest two-wheeler segment

Lightspeed, Bosch lead $173m round for China's Hesai

Chinese smart sensor maker Hesai Technology has raised a $173 million Series C round led by Germany’s Bosch Group and existing investor Lightspeed China Partners.

Malaysia's Carsome raises $50m Series C

Japan’s Daiwa Securities and Mitsubishi UFJ Financial Group have joined a $50 million Series C round for Malaysian used car trading platform Carsome.

Ping An leads $70m Series D for India's CarDekho

China’s Ping An Insurance has led a $70 million Series D round for Indian online auto marketplace CarDekho. It is Ping An’s first venture investment in the country.

Korea VC backs SE Asia ride-hailing start-up MVL

Korean VC firm SV Investment has led a KRW5.6 billion ($5 million) round for MVL, which operates the Tada ride-hailing service in Southeast Asia.

China electric car maker Xpeng closes $400m Series C

Xpeng Motors, a Chinese electric vehicle manufacturer established by Xiaopeng He, previously founder of web browser UCWeb and a senior executive at Alibaba Group, has raised $400 million in Series C funding.

Chinese auto parts platform Casstime raises $80m

Sequoia Capital China and Source Code Capital have co-led a $80 million funding round – described as the first tranche of a Series C – for Chinese aftermarket car parts supplier Casstime.

Deal focus: Fast fashion strategy pays off for Worldtool

CLSA Capital Partners backed Japan's Worldtool having been won over by a Uniqlo-inspired business model. It turned into a domestic and overseas expansion story

CLSA exits Japanese automotive tools retailer

CLSA Capital Partners has exited Worldtool, a Japanese automotive tools retailer that primarily operates under the Astro Products brand, to domestic home improvement chain Royal Homecenter.

Japanese flying car developer receives $14m

Japanese flying car developer SkyDrive has raised a $14 million funding round from a group including Itochu Technology Ventures and Strive.

China autonomous driving start-up receives $50m pre-A

DeepRoute, a Shenzhen-based autonomous driving solutions provider, has received $50 million in a pre-A funding round led by Fosun RZ Capital.

Chinese auto parts supplier raises $28m in Series A extension

Mancando, an automotive parts supplier based in Guangdong province, has raised RMB200 million ($28 million) in an extended Series A round led by Legend Capital, with participation from Eastern Bell Venture Capital, Galaxy Capital, and Oriza FoF.

Mahindra & Mahindra to buy 55% of India's PE-backed Meru

Indian automotive conglomerate Mahindra & Mahindra has agreed to acquire an up to 55% stake in Meru Cab, a technology-enabled taxi company backed by True North.

Grab commits $500m to Vietnam tech ecosystem

Grab, a Southeast Asia-focused ride-hailing app operator backed by a number of PE and VC firms, has committed to invest $500 million in Vietnam’s technology ecosystem in the next five years.

J-Star exits Japanese auto industry supplier

J-Star has sold Tokai Trim, a Japanese manufacturer of seat covers for cars and motorcycles, to domestic hotel chain operator Rembrandt Holdings.

PEP to acquire APAC business of US-based Horizon

Australia’s Private Equity Partners (PEP) has agreed to pay A$340 million ($230 million) for the Asia Pacific division of US automotive industry equipment supplier Horizon Global.

China's CHJ Automotive gets $530m Series C

Chinese electric vehicle manufacturer CHJ Automotive has raised $530 million in Series C funding led by Xing Wang, founder of online-to-offline services platform Meituan Dianping.

Singapore's Carro raises $30m for extended Series B

Singaporean auto marketplace operator Carro has raised $30 million from investors including SoftBank Ventures Asia as part of an extended Series B round.

China's SAIC Capital closes $145m auto industry fund

SAIC Capital, an investment manager controlled by Chinese automaker SAIC Motor, has raised a RMB1 billion ($145 million) fund that will target deals throughout the automotive industry supply chain.

Toyota invests $600m in China's Didi

Japan’s Toyota Motor Corporation has agreed to invest $600 million in Chinese ride-hailing giant Didi Chuxing and to expand their joint venture focused on services for Didi’s drivers.

Quadrant set for debut deal from Australia growth fund

Australia’s Quadrant Private Equity has made the first investment from its new growth fund, with an agreement to acquire domestic auction sites Graysonline and AreYouSelling for A$60 million ($42 million).