North Asia

Regional update: A time to invest?

Is now the time to invest in Asia? This is a question that keeps popping up in my conversations with limited partners. Obviously, the simple answer can always be “yes.” That is if these LPs are able to locate and gain access to the fund managers that...

Sun Capital exits US-based ASB to Japan's Lixil

Sun Capital Partners has exited its stake in American Standard Brands (ASB), a US maker of bathroom and kitchen fixtures, to Japanese toilet manufacturer Lixil Corp. for $542 million. The deal values the 138 year-old firm at around $342 million and includes...

Untapped Japan VC market targets mobile space - AVCJ Japan

Japanese venture capital is still being overlooked by LPs despite the untapped potential of Asia's fastest growing mobile internet space, industry participants told the AVCJ Japan Forum.

Vogo-backed Tongyang Life chosen as preferred bidder ING Korea unit – report

A consortium led by Tongyang Life Insurance, which is majority-owned by Vogo Investment, has reportedly been chosen as the preferred bidder for ING Groep’s South Korean life insurance unit. The consortium is said to have offered around KRW2 trillion ($1.7...

Korean government tries again to offload Woori stake

The South Korean government will once again try to offload its majority stake in Woori Finance Holdings, this time breaking up the asset into three pieces to be auctioned separately. The plan is to sell two regional banks and a brokerage and related units...

Governance issues could undermine Japan's economic reforms - AVCJ Forum

Prime Minister Shinzo Abe’s economic reforms have provided a boost for Japanese private equity but issues surrounding corporate governance continue to be a barrier to opportunities, industry participants told the AVCJ Japan Forum.

Success of Abenomics hinges on deregulation – Orix

The success of economic reforms introduced by Japanese Prime Minister Shinzo Abe ultimately depend on his ability to deliver on structural reform, the third of his “three arrows” policy, according to Yoshihiko Miyauchi, CEO of Orix Corp. This observation...

Cerberus fails in challenge to Seibu board

Cerberus Capital Management failed to its attempt to assert more control over the management of railway and property group Seibu Holdings, as shareholders voted down the PE firm's plan to secure more board seats.

Japan's INCJ in cooperative talks with private equity

The government-backed Innovation Network Corporation of Japan (INCJ) has been in discussions with domestic and foreign private equity firms over joint investment strategies.

J-Star promotes Satoru Arakawa to partner

Japanese mid-cap buyout firm J-Star has promoted Satoru Arakawa to the position of partner.

Korea's Castling gets first LP commitment, targets fund-of-funds

Castling Investment Group, a start-up alternatives investment advisory firm based in South Korea, has received its first external LP commitment – totaling $80 million – from a local museum foundation. The capital will be placed into a separate account...

Japanese, Chinese VCs provide $4.4m round for social site Muzy

The Silicon Valley-based venture capital arm of Japanese telecoms giant NTT Docomo, Docomo Capital, and Recruit Strategic Partners - the corporate VC arm of Japanese internet company Recruit Holdings - have teamed up with Chinese entrepreneurs to invest...

Japan divestments still strong despite 'double-edged sword' of Abenomics

Corporate divestments continue to be a strong source of buyout deal flow in Japan, regardless of the impact of recently introduced economic reforms, according to Richard Folsom, co-founder and CEO of domestic GP Advantage Partners.

Shogun diplomacy: Corporate management in Japan

History shows that Japan's corporate elites rarely take kindly to private equity knocking down their door. How can the outside investor best woo potential partners?

All smiles in Tokyo?

The timing of last year's AVCJ Japan Forum was perhaps fortuitous - a matter of days before the event Unison Capital announced that it agreed to sell sushi chain Akindo Sushiro to Permira for $1 billion.

Giant maintenance: PE and corporate Japan

Restructuring is a compelling story in Japanese private equity, but deal access is constrained by perception issues and government-linked competition. Will the there be anything left for foreign players?

Japan fundraising: Sink or swim?

Investor sentiment is gradually turning on Japan. The big buyout funds must convince LPs there is sufficient deal flow in their portion of the market; the smaller players must figure out how to talk to foreign LPs

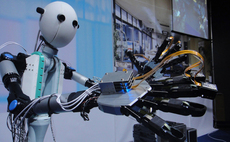

Willing to travel: Japanese tech firms look overseas

Japanese technology companies are going overseas, through corporate venture capital investments, joint ventures or commitments to third-party managers, in search of new markets and innovations

Cerberus challenges Seibu management ahead of annual meeting

Cerberus Capital Management has publicly questioned the management of railway and property group Seibu Holdings in a bid to gain support for its shake up of the company's board at a shareholders meeting later this month.

Korea's NPS to boost alternatives exposure

South Korea’s National Pension Service (NPS) will increase its allocation to alternative investments to 11.3% from 8.4% as part of an aggressive plan that will see a substantial drop in the pension fund’s fixed income exposure.

Oregon Investment Council backs Morgan Stanley, RRJ funds

Oregon Investment Council (OIC) has committed $75 million to Morgan Stanley Private Equity Asia’s (MSPEA) fourth pan-regional fund. The vehicle, which reached a first close of $750 million towards the end of last year after less than six months in the...

J-Star to close Fund II at $200m by end-June

Japanese mid-market GP J-Star will reach a final close on its JPY20 billion ($210 million) second fund by the end of this month, sources familiar with the matter told AVCJ.

Gree Ventures, MIC back $6m round for Japanese software firm

Gree Ventures and Mobile Internet Capital (MIC) have taken part in a JPY625 million ($6 million) investment round for Accounting SaaS Japan (A-SaaS), a developer of cloud-based accounting software.

Morgan Stanley-backed Hyundai Rotem gets green light for IPO

Hyundai Rotem, a South Korean railway vehicle manufacturer backed by Morgan Stanley Private Equity Asia (MSPEA), has received approval to list on the Korea Stock Exchange. It will likely be the country’s largest share offering so far this year and the...