Europe

Blackstone-backed China National BlueStar intends to buy Norwegian solar cell maker

China National BlueStar, the Chinese specialty chemicals company partly owned by US buyout firm the Blackstone Group, is reportedly in talks to acquire some or all of Norwegian solar cell maker Elkem AS, owned by a Norwegian conglomerate Orkla ASA.

Vikram Lall appointed non-executive director at Elephant Capital

Vikram Lall, Brewin Dolphin Holdings’ former corporate finance director, has joined Elephant Capital as a non-executive director on the India-focused PE fund’s board.

MVision recruits Macquarie's Michaela Sved as infrastructure Director

Placement agent MVision Private Equity Advisers has recruited Michaela Sved, formerly Head of Investor Relations for Macquarie Infrastructure Partners, as a Director.

RBA may pick up Candover investee Securency in fire sale amid bribe investigation

The Reserve Bank of Australia (RBA) is likely to take full ownership of banknote manufacturing company Securency International Ltd, as a bribe investigation continues at RBA's JV partner in the company, invested by Candover Partners.

London's MaxCap appoints Syed for family office APAC exposure

London-headquartered multi-family office and investment management group MaxCap Partners has announced the engagement of Mohammad Kamal Syed as its CEO, emphasizing his experience in Asia Pacific markets, while founding CEO Michael George steps down to...

Industry Q&A: Bruno Raschle

Bruno E. Raschle, Executive Chairman at Zurich-based fund of funds Adveq Management, talks about Asia-focused trends among GPs, LPs and regulators, and what this implies for the future of the asset class in the region.

Khazanah forms clean energy investment JV with Camco

Khazanah Nasional, Malaysian's SWF, has announced a JV agreement with emission reductions and clean energy developer Camco International Ltd. (Camco), to invest into the clean energy and emissions sector in Southeast Asia.

Samsung and Prodos Capital in US may take Gianfranco Ferré

South Korean conglomerate Samsung Group and American private equity firm Prodos Capital Management emerged as the final bidders for Italian fashion house Gianfranco Ferré, which has filed for bankruptcy protection, in a deal offering to buy out the firm...

3i picks up Mizuho Investment for Europe debt

3i Group has acquired a unit of Japan's Mizuho Corporate Bank, Mizuho Investment Management (UK), which specializes in European debt, for some GBP18.3 million ($28.68 million).

3i plans RMB fund under Queen's blueprint

UK private equity major 3i Group is planning to launch a renminbi-denominated fund as part of an overall two-year plan, announced 3i CEO Michael Queen, coming alongside the second Indian infrastructure fund expected since March this year.

Navis completes exit from Linatex

Navis Capital Partners has completed its exit from investee Linatex to the UK's Weir Group, for $200 million, following a regulatory approval from South Africa's Competition Commission.

CDC under scrutiny for Asia, other expenses

The UK's development policy investor Commonwealth Development Corporation (CDC), which participates in many Asia-focused funds, is under review by the UK International Development Secretary Andrew Mitchell, following press enquiries about its staff's...

Oz Future Fund, two others invest $576 million in new UK capital lender

Australian sovereign wealth fund the Future Fund, as well as Lord Rothschild and UK buyout leader Apax Partner’s founder Sir Ronald Cohen have together invested EUR450 million ($576 million) in Haymarket Financial, known as HayFin, a new start-up specialist...

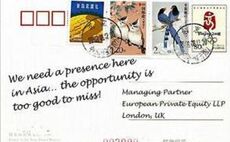

Wish you were here…

European nations may have deep historical ties with the Asia Pacific region, dating as far back as Marco Polo and Vasco da Gama, but European GPs have largely been late entrants to the region. European LPs, especially those with development capital mandates,...

Adveq's Wong leaves in Beijing

Darren Wong, MD of the Beijing office of leading Swiss-headquartered fund-of-funds Adveq Management, has left the firm, with Nils Rode, MD and Co-Head of Adveq's overall investment management practice, assuming management of Adveq's Asian funds business....

Korea's National Pension Fund buys Parisian shopping center

The National Pension Service of Korea (NPS) has acquired 51% stake in the O'Parinor, a shopping center in the Parisian suburb of Île-de-France, from London Stock Exchange Listed realtor Hammerson LLC.

New regulations in Europe: the perils of painting with a broad brush

While new alternative asset regulation in the US is more or less a done deal, the European attempt to accomplish the same remains stalled.

Partners Group gets $100 million KIC real estate mandate

Korea Investment Corporation, the SWF that manages some $27 billion of assets for the Korean government and the Bank of Korea, has mandated around $100 million to Swiss-based private equity firm Partners Group to seek investment opportunities in the private...

Hands hands on for China

Guy Hands, high-profile chairman of UK buyout leader Terra Firma Capital Partners, has publicly said that his firm is looking for partners to enter the China market.

Temasek hires former UK business minister as consultant

Former British Minister for Economic Competitiveness, Small Business and Enterprise Baroness Shriti Vadera has been hired by Singaporean SWF Temasek Holdings as a consultant.

Ex-Unilever Banga joins CDR for operations

Manvinder (Vindi) Singh Banga, formerly Chairman and MD of Unilever in India and later Singapore-based President of its Foods, Home and Personal Care division, is set to join the London office of global buyout major Clayton, Dubilier & Rice (CDR), as...

Fosun, A Capital co-invest Club Med

A Capital Asia, the Hong Kong-based private equity and financial advisory firm, has announced a PIPE co-investment with Fosun, China's largest privately-held conglomerate, in Euronext-listed Club Méditerranée (Club Med), with Fosun picking up a 7.1% stake...

Agnellis' Exor plans Asia private equity JV with Jardine, Rothschild

Exor SpA, the Italian industrial holding company controlled by the Agnelli family behind Fiat and other leading businesses, is planning a private equity joint venture with Jardine Matheson Holdings and private bank NM Rothschild & Sons, focusing primarily...

CLSA invests Norway with desalination company Aqualyng

CLSA Capital Partners has invested $8 million for a minority stake in Norwegian desalination company Aqualyng Holding, as part of the latter's efforts to raise $24 million of capital.