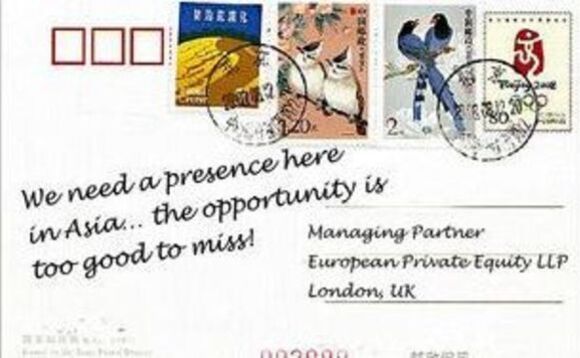

Wish you were here…

European nations may have deep historical ties with the Asia Pacific region, dating as far back as Marco Polo and Vasco da Gama, but European GPs have largely been late entrants to the region. European LPs, especially those with development capital mandates, in some cases preceded them, but by and large the groundswell of Western private equity investment into the region in the first decade of this century was fueled by the greenback, not the euro. With the entry of some major European buyout players like Permira, this may be changing, just as regulatory moves in the European Union cast fresh doubts over the prospects for the asset class at home.

What Asia has to offer

European private equity investors are generally under-allocated to Asia Pacific. According to AVCJ Research figures, European GPs have invested $64.22 bil...

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.