Fund-of-funds

Siebert goes native with Macquarie

Mike Siebert, hitherto an associate at Partners Group, has been recruited as a portfolio manager for the private equity arm of Macquarie Funds Group, to build the group's European capabilities.

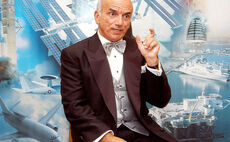

Wilshire woes

Dennis Tito, founder of Wilshire Associates, reportedly paid at least $12 million and possibly up to $20 million for an eight-day stay in orbit at the International Space Station and in transit, courtesy of MirCorp.

Fleming, Iglesias leave Wilshire in Tokyo, Canberra

Grant Fleming, the long-serving Managing Director of Wilshire Private Markets in Tokyo, and Ovidio Iglesias, Senior MD with Wilshire in Australia, have left the $6 billion fund-of-funds, the latest in a series of senior departures from Wilshire including...

Wilshire fundraising hit as Ennis resigns

Fund-of-funds Wilshire Private Markets has reportedly delayed its latest fundraising following the resignation of Jeffrey Ennis, its CIO and the latest senior executive to quit the firm within a year.

Private equity mood upbeat at ANZ Forum

The mood and sentiment among private equity GPs, LPs and advisors at the AVCJ Private Equity & Venture Forum \ ANZ 2010 in Sydney appears distinctly upbeat, showcasing the strength of Australia's macroeconomic fundamentals.

Religare-backed Northgate said readying fifth fund

US private equity fund-of-funds firm Northgate Capital, recently invested by Indian financial services group Religare Enterprises, is reportedly readying its fifth investment vehicle, Northgate Capital V LP.

Pantheon cites 'ownership culture' in sale to AMG

Pantheon Ventures, the London-headquartered international fund of funds manager, and longstanding pioneer of investment in Asian GPs, gave AVCJ some further insights into its recently-announced $775 million cash sale by Russell Investments to NYSE-listed...

Religare buys into Northgate

Religare Enterprises, the Indian financial services group, has announced an investment in US private equity fund-of-funds firm Northgate Capital, for a reported 60% controlling stake in the firm's management company.

Pantheon sold to AMG for $775 million

Pantheon Ventures, the UK-originated global fund-of-funds manager, has been sold for some $775 million in cash by Russell Investments, its owner since 2004, to Affiliated Managers Group (AMG), a US asset management firm coordinating a network of affiliates...

Thai Government Pension Fund will boost PE, realty

Thailand’s Government Pension Fund (GPF) will boost its overseas investments, including private equity fund investments and direct investments in real estate and infrastructure, Sopawadee Lertmanaschai, secretary-general of GPF announced earlier in Bangkok....

CIC enters Apax's "closed" Europe VII fund

China Investment Corporation (CIC), China's $300 billion sovereign wealth fund, has reportedly invested €685 million ($952 million) in Apax Partners' Apax Europe VII, a €11.2 billion ($15.5 billion) buyout fund that was ostensibly no longer open to investors....

Axiom closes Fund II ahead on $950 million

Singapore-headquartered independent fund of funds Axiom Asia Private Capital has delivered major corroboration for those who hoped that 2010 would see a rebound in private equity fundraising.

Philip Bilden of HarbourVest Partners

Philip Bilden, Managing Director for Asia Pacific at influential fund of funds HarbourVest Partners, talks about the firm's investment strategy and the relative attractions of different regional markets.

Rebecca Xu of Asia Alternatives on China

Rebecca Xu, one of the three co-founding MDs of independent fund of funds Asia Alternatives Management, describes her firm's edge in the PRC market and her assessment of the opportunities and developments there.

HarbourVest makes promotions as Delbridge steps back

HarbourVest Partners has given several Asia-based executives wider roles, as one of its pioneering investors in the region moves to a less active position.

China giants put their best fund forward

Amid unparalleled interest in the evolution of China’s domestic private equity environment, two major PRC financial institutions have announced progress in forming their own private equity funds.

Australian Catholic Super invests Partners Group, Lexington

The Australian Catholic Superannuation and Retirement Fund (ACSRF) – which recently changed its name from the Catholic Superannuation and Retirement Fund – has reportedly made two new private equity commitments of A$50 million ($46.3 million).