Wilshire woes

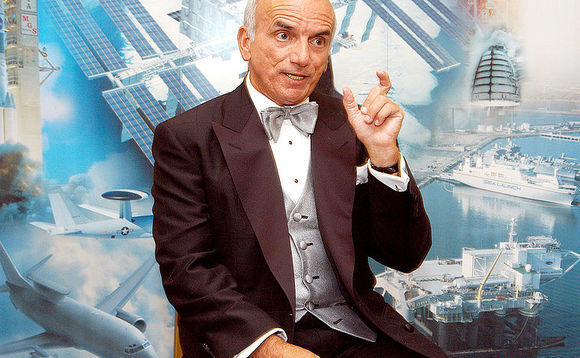

Dennis Tito, founder of Wilshire Associates, reportedly paid at least $12 million and possibly up to $20 million for an eight-day stay in orbit at the International Space Station and in transit, courtesy of MirCorp.

However, news of the impending collapse of the $6.5 billion Wilshire Private Markets fund-of-funds group – in part allegedly due to his own intervention – may be bringing him back down to earth.

Breakdown of a leading team

The latest development unfolded as the Australian and Asian senior leads at Wilshire Private Markets apparently stepped down, with Ovidio Iglesias, senior managing director based in Australia, and Dr. Grant Fleming, managing director of Wilshire Private Markets in Tokyo, following the exit of CIO Jeffrey Ennis. Wilshire Australia's other senior investment professionals have also apparently left. Wilshire Private Markets was noted for its early and strong presence in Asia Pacific.

Industry talk points to the departure of Wilshire Private Markets senior MD Thomas Lynch in 2007 as the catalyst for the subsequent meltdown. Lynch, now an MD with Los Angeles and New York-based investment consultant Cliffwater, apparently left over differences about the distribution of proceeds from his highly successful division. According to some sources, Lynch's group contributed up to 45% of the group's revenues. In the wake of his exit, Wilshire seemingly took the view that the Private Markets division was given too much autonomy, and sought to implement a plan which, as indicated by a widely-distributed email from Tito, sought to bring the group closer to the rest of the business: a one-firm model. Ennis and senior MDs Dan Allen and Iglesias formed a triumvirate to run the group, with Iglesias in particular bringing deep client relationships to the table.

Last summer Kevin Nee was hired as the new president of Wilshire Private Markets, apparently in contravention of the original post-Lynch plan. Allen left the next month for a new career with Los Angeles Capital Management, soon after Laurie Coggan , the group's former CFO. Ennis stayed on at Wilshire until this month, with Iglesias and Fleming resigning immediately after his departure. The group is understood to have delayed its next round of fundraising, and parent Wilshire Associates has relinquished its 30% share of proceeds to try to retain talent employed by the firm.

At the time of writing, the Wilshire Private Markets website still listed Iglesias and Fleming in their former roles. However, it is understood that both are now much-sought-after by other firms, including Lynch's new platform.

The existing Wilshire fund-of-funds business will now require extensive rebuilding, at the very least. Reports indicate that LPs in Australia, a key market for the firm courtesy of Iglesias, are reviewing their commitments to Wilshire Private Markets. Ostensibly LPs from other markets are doing the same.

Causes and consequences

The catalyst for this domino effect collapse of the team at Wilshire Private Markets is as yet a very grey area, but sources speculate that the parent firm's senior leadership, under Dodd, overplayed their hand when the Ennis/Allen/Iglesias triumvirate raised objections to Nee's new role. With their complaints dismissed the trio and other key team members were left to make their own decisions about their careers and their future.

To isolate a top fund-of-funds team requires serious pressure or equally aggressive stonewalling, as individual integrity – in terms of keeping promises to LPs to stay with a particular firm and investment strategy – is much-prized within the industry. Sources say that Iglesias, Ennis, Fleming et al. may have to devote some time to rebuilding relationships and reputations, though these individuals are also tipped to succeed on the basis that they were placed in an untenable situation. Such are the trusted nature of the commitments involved.

One potential outcome for the group is a new independent fund-of-funds firm. Although all the investment principals who defected from Wilshire are high-value professionals individually, some in the industry believe their value as a team is greater than the sum of their parts.

As for Wilshire Associates, sources concur that the ordeal is especially badly timed, with an increased emphasis on LP rights and enhanced investor communication. Wilshire Private Markets' fiduciary obligations to LPs appear to have been casualties of an internal power struggle, and the individuals themselves.

None of the principals contacted for this article were prepared to comment to AVCJ.

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.