Investments

Aramaco backs Singapore clean energy certificates player

Aramaco Ventures, a VC unit of Saudi oil giant Aramaco, has led a USD 10m Series A round for Singapore’s Redex, an early mover regionally in renewable energy certificates (RECs).

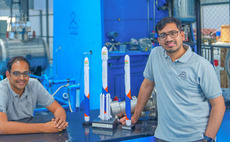

Temasek leads $27.5m round for India space tech player

Temasek Holdings has led a INR 2.25bn (USD 27.5m) pre-Series C round for Indian rocket developer and launch services start-up Skyroot Aerospace.

Indian contract manufacturer Aequs raises $54m

Indian contract manufacturer Aequs has raised INR 4.5bn (USD 54m) in equity funding led by Singapore-based Amansa Capital.

Diageo sells whisky brand to Korean turnaround investor

Global beverage giant Diageo has agreed to sell Windsor, Korea’s best-selling whisky brand, to Pine Tree Investment & Management following the collapse of a transaction involving other Korean private equity firms.

KKR commits $400m to Malaysia's OMS Group

KKR has agreed to invest USD 400m in Malaysian telecoms infrastructure and subsea cable services company OMS Group.

CVC buys majority stake in Philippines hospital business

CVC Capital Partners has acquired a 63.94% stake in Philippines-based hospital operator The Medical City (TMC) following the completion of a tender offer.

Lightspeed leads $50m round for Singapore's YouTrip

Lightspeed Venture Partners has led a USD 50m Series B investment in Singapore-based travel wallet and currency exchange app YouTrip.

Saudi fund invests $100m in China's Pony.ai

Saudi Arabia’s Neom Investment Fund, a strategic venture vehicle for the planned smart city of Neom, has made a USD 100m commitment to Chinese autonomous driving player Pony.ai.

Husk Power raises $43m for Asia, Africa mini-grid strategy

India, US, and Nigeria-based renewable energy developer Husk Power has raised USD 43m in Series D funding from global VC investors for a South Asia and sub-Saharan Africa mini-grid rollout.

Q&A: Pacific Equity Partners' Jake Haines

Australia-based Pacific Equity Partners quietly launched a credit strategy – PEP Capital Solutions – in 2021 and has since deployed AUD 700m (USD 445m). Jake Haines, a managing director at the firm, explains where it has gone

Asia distress: Landslides on hold?

Investors are witnessing an uptick in turnaround opportunities based on delayed pandemic effects and a poor macro outlook. The trend remains anecdotal, but some markets could see a surge

Deal focus: isBIM targets real estate's digitisation catch-up

A renewed focus on safety and sustainability has prompted property developers to consider technology-enabled fixes. IsBIM is riding the wave from Greater China through Asia and the Middle East

Deal focus: Bolt.Earth looks to close India's EV infrastructure gap

Bolt.Earth turned its electric vehicle operating system into the foundation stone for India’s largest charging network aimed at two- and three-wheelers overlooked by mainstream operators

Bain, DNE launch $250m China advanced manufacturing platform

Bain Capital and Chinese industrial infrastructure developer DNE Group have jointly launched a USD 250m advanced manufacturing investment platform.

General Atlantic backs India travel platform, Affirma exits

General Atlantic has acquired a minority stake in TBO.com, an India-based business-to-agent travel portal that serves a global customer base, for an undisclosed sum. The deal facilitates a partial exit for Affirma Capital.

Indonesia sustainable construction start-up raises $10m

Stilt Studios, a sustainable construction start-up founded by the former co-CEO of Lazada Indonesia, has secured USD 10m in Series A funding – comprising debt and equity tranches – which will be used to support expansion into Australia, Europe, and the...

Faering invests $30m in India's Vastu, Multiples exits

Faering Capital has invested USD 30m in India’s Vastu Housing Finance, facilitating an exit for Multiples Alternate Asset Management.

Australia's Employment Hero raises Series F at $1.3b valuation

Australian human resources start-up Employment Hero has achieved a valuation of approximately AUD 2bn (USD 1.3bn) on closing a AUD 263m Series F round led by US-based venture capital firm TCV.

Blackbird, Airtree back $18m round for Australia's Darwinium

Blackbird Ventures and Airtree Ventures have participated in a USD 18m Series A round for Darwinium, an Australian digital security start-up that moved its headquarters to the US in April.

PEP participates in $634m Australia land lease operator deal

Pacific Equity Partners (PEP) and property owner and manager Mirvac have agreed to acquire Serenitas, land lease operator Serenitas for an enterprise value of approximately AUD 1bn (USD 634m).

Q&A: BII's Holger Rothenbusch

Holger Rothenbusch, head of infrastructure and climate at British International Investment, unpacks the opportunities and challenges of a significant new credit programme for developing Asia

Anchorage targets Australia's Southern Cross Media

Anchorage Capital Partners has teamed up with ARN, which owns a range of broadcasting and outdoor advertising assets in Australia, to make a AUD 225.5m (USD 144m) bid for Southern Cross Media.

China's Baichuan AI raises $300m

China-based artificial intelligence (AI) start-up Baichuan AI has raised USD 300m in a first tranche of Series A funding from an investor group featuring Alibaba Group, Tencent Holdings, and Xiaomi.

Korea's STIC to exit biofuels player to PE-backed consortium

Korea’s STIC Investments has agreed to sell biofuels producer Daekyung Oil & Transportation to a consortium backed by SK Group, Korea Development Bank (KDB), and Eugene Private Equity.