Investments

China's WeRide raises $310m

Chinese autonomous driving start-up WeRide has raised $310 million in Series B funding across three tranches led by Chinese electric bus manufacturer Yutong Group.

Portfolio: MSPEA and Korres

Morgan Stanley Private Equity Asia helped ethical Greek cosmetics maker Korres beef up an underweight international presence with a plan that will see China become the main growth engine

Australia's VC-backed Xpansiv raises $40m pre-IPO round

Australia and US-based Xpansiv CBL, a VC-backed marketplace for clean commodities such as carbon offsets and renewable fuels, has raised $40 million with plans to list in Sydney this year.

Hanwha leads $300m Series A for Grab's financial unit

Korea’s Hanwha Asset Management has led a $300 million Series A round for the financial services unit of Singapore-based ride-hailing and services platform Grab.

Warburg Pincus, Goodwater lead Series D for Vietnam's MoMo

MoMo, a Vietnam-based mobile wallet provider, has closed a Series D round of more than $100 million led by Goodwater Capital and Warburg Pincus.

Indonesian stockbroker Ajaib raises $25m Series A

Horizons Ventures, which is controlled by Hong Kong billionaire Li Ka-shing, and Indonesia’s Alpha JWC Ventures have led a $25 million Series A round for Indonesian investment platform Ajaib.

Buyouts in 2021: Winners and losers

Asia could prove to be a deal-rich market in 2021, but buyout investors are still figuring out the long-term implications of COVID-19 for companies that cater to changing consumer demands

Korea media platform gets $12m Series C

Korea’s SV Investment has led a $12 million Series C round for local media and advertising platform Dable at a valuation of around $90 million.

Novo Tellus backs Singapore semiconductor industry supplier

Novo Tellus Capital Partners has invested S$23.6 million ($17.7 million) in Grand Venture Technology, a Singapore-listed provider of testing, assembly, and engineering services for semiconductor manufacturing.

Bow Wave joins $175m round for Philippines-based GCash

Bow Wave Capital Management, a US-based private equity investor in mobile payment ecosystems globally, has participated in a $175 million round for Philippines-based mobile wallet GCash.

China HR software start-up raises $190m

WorkTrans, a Chinese human resources services provider, has raised $190 million through two tranches, a Series C of $50 million and a Series D of $140 million.

Chinese fitness app Keep raises $360m

Keep, a Chinese mobile app that provides fitness training programs, has raised $360 million in Series F funding led by SoftBank Vision Fund.

Sequoia leads $150m Series B for China's Visen Pharma

China’s Visen Pharmaceuticals, a drug developer targeting glandular conditions such as dwarfism and growth deficiency has raised a $150 million Series B round led by Sequoia Capital China.

China smart storage player Hive Box raises $400m

Hive Box, a China-based self-service package drop-off and pick-up operator, has received $400 million in funding from Trustbridge Partners, Asia Forge, Sequoia Capital China, Redview Capital, and All-Stars Investment. The pre-money valuation is $3 billion....

Goldman leads $50m round for China's Perfect

Perfect Corp, a Chinese developer of online beauty apps, has raised a $50 million Series C round led by Goldman Sachs.

China's Horizon Robotics raises $400m

Horizon Robotics, a Chinese developer of microprocessors that support artificial intelligence (AI) technologies, has raised $400 million in the second tranche of a Series C round led by Baillie Gifford, Yunfeng Capital, CPE, and electric vehicle battery...

Carlyle leads $123m Series D for China's Abbisko

The Carlyle Group - investing through its Asia growth fund - has led a $123 million Series D round for Chinese cancer-focused biotech developer Abbisko Therapeutics.

Hillhouse leads $28m round for China's DataCloak

DataCloak, a Shenzhen-based start-up that helps companies install data security systems on devices used by employees, has raised a $28 million Series B round led by Hillhouse Capital.

Hidden Hill leads $110m round for China's Baibu

Chinese B2B fabrics trading platform Baibu has raised $110 million in an extended Series D round led by Hidden Hill Capital, the private equity platform of logistics giant GLP.

India B2B marketplace Udaan raises $280m

Udaan, an India-based B2B marketplace, has raised $280 million from an investor group that includes existing backers Lightspeed Venture Partners, Tencent Holdings, DST Global, GGV Capital, and Altimeter Capital.

Carlyle buys Japanese X-ray equipment maker

The Carlyle Group has acquired a majority stake in Rigaku Corporation, a Japanese manufacturer of X-ray equipment, for an enterprise valuation of approximately JPY100 billion ($970 million).

Goldman, Anchor commit $100m to China car park operator

Goldman Sachs and Anchor Equity Partners have led a $100 million Series B round for Sunsea Parking, a China-based car parking management company.

China AI chip player Enflame raises $279m Series C

Enflame Technology, a Chinese artificial intelligence (AI) chip designer, has raised a RMB1.8 billion ($279 million) Series C round led by CPE, China Capital Investment Group, and Primavera Capital.

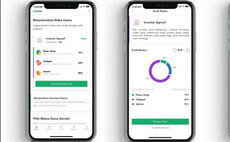

Sequoia India leads $30m round for Indonesia's Bibit

Sequoia Capital India has led a $30 million investment in Bibit, an Indonesian robo-advisory app for first-time investors.