Money troubles: PE compensation

A lack of transparency over compensation - or just a lack of compensation - is partly responsible for the still relatively high turnover in Asian private equity

"You could count on your fingers how many people know how the waterfall works, the LPs understand it better," one GP observed to AVCJ, when asked how well mid-level staff understood their compensation structure. "A waterfall is a description communicated between the fund and the LPs. There could be a completely different mechanism in terms of how members of the GP get their carry."

Most GPs avoid documenting these details. "If you document then you can't always deliver in a tax-efficient manner," the GP added.

These comments were made last year during an interview for a story on how LPs conduct due diligence on GPs. Compensation is obviously an area of focus. Most LPs want a European-style waterfall, with carried interest only accrued once all drawn down capital has been returned to LPs and an IRR hurdle has been met. At the same time, a fund manager might worry about retaining junior staff if carried interest payments are pushed several years down the line.

But the more pressing question for LPs, and one they might hope to answer during due diligence, is whether those junior and mid-level members of staff believe they are paid fairly. The GP's point was that cross-examining a partner on compensation is fine, but doing the same with a junior staffer is not. A confused answer might leave the LP to conclude "team unhappy, may move," when that is not necessarily an accurate reflection of the workplace environment.

Nevertheless, this lack of transparency regarding compensation is a problem for the industry. Roy Kuan, managing partner at CVC Capital Partners, told the AVCJ Forum last week that it was the number one reason for people looking for new employment, based on job interviews conducted by his firm. He also noted that "it is so easy to change the carry rules or the share ownership rules or the bonus rules."

Pool-based carried interest systems where people are paid according to their job title as opposed to the work they put into successful deals can lead to certain team members feeling underappreciated. However, just as damaging is when the bulk of the fund economics go to one or two founders rather than being shared out more equally.

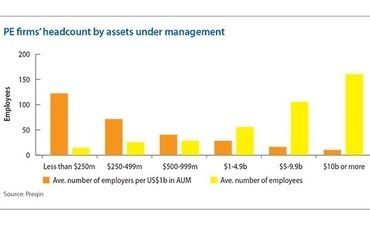

A Preqin study on private equity compensation and employment - based on responses from 200 PE firms globally - shows a gradual increase in headcount among GPs operating in the sub-$1 billion in assets under management space (the average number of employees for managers below $250 million is 14, rising to 25 for $250-499 million and 28 for $500-999 million). This reflects the relative leanness of firms in their early stages, but it should not be accompanied by meanness on compensation.

Founders that want to build a sustainable franchise and scale up without losing the talented people who can make that additional capital count would do well to invest in the future and share the wealth.

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.