A public affair: India IPOs

Private equity-backed IPOs are undergoing a revival in India, but innate volatility means they are just one of multiple exit options that GPs should consider

Of the 14 private equity-backed IPOs on Indian bourses since the start of the year, New Silk Route Advisors (NSR) had a hand in three: Ortel Communications, VRL Logistics, and Coffee Day Enterprises, the latter alongside several other investors.

Parag Saxena, CEO at NSR, puts this down to preparation. The firm's work began in early 2014 with a study indicating that the New Democratic Alliance, led by Narendra Modi, would win the general election and take a pro-business stance. Planning for the IPOs - ensuring the portfolio companies could respond with the nimbleness required by the public markets - started not long after that.

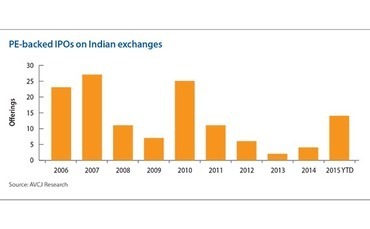

Approximately 20 more PE-backed companies have submitted draft offer documents over the course of 2015, adding to the backlog from the previous year. Given the time it takes to get through the approvals process, many of these candidates will have to wait until 2016, but the number of IPOs in 2015 is already the highest in five years. Between 2012 and 2014 there were only 12 in total.

The broader private equity exit picture is also encouraging: investors have generated proceeds of $8.1 billion, a record high. The number of liquidity events is tracking last year's total but strong trade sale activity is pushing up the total in US dollar terms.

In fairness, that trade sales have generated more than three times the full-year figure for 2014 is due to a small number of large transactions. Led by the $1.17 billion acquisition of a 51% stake in Viom Networks by American Tower Corporation (partial exits for IDFC Alternatives and Macquarie SBI Infrastructure Management), the 10 largest deals account for 80% of the $6.2 billion trade sale total.

The IPO revival points to an increase in open market sales down the line, but few industry participants have confidence in a sustained flow of public market exits. As Brahmal Vasudevan, CEO of Creador, put it to AVCJ recently: "The windows are quite narrow. What usually happens is people get carried away when markets are doing well and they try to hold things longer to get a better return."

There are various measures that could make IPOs and open market sales easier, not least reducing the amount of time it takes to get approval for listings and follow-on offerings, changes to post-issue lock-up procedures, and perhaps even a separate platform for start-ups where compliance requirements are less stringent. More institutional and retail investors need to get involved as well.

A more overriding need, expressed by NSR's Saxena among others, is that Indian companies need help in building scale. It is apparent in certain areas - Viom, a telecom tower business, is a particularly strong example from the infrastructure space, while Coffee Day has achieved scale in the consumer sector - but not all. Public market investors find it easier to get behind a business that boasts stability and meaningful size.

In the meantime, the best preparation for an IPO might be to ensure that a public market listing is not the only option.

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.