Taiwan PE: Exit issues

For private equity investors in Taiwan, getting money out can be just as much of a concern as getting it in

Three times in the past five years, the sale of Taiwan-based cable television provider China Network Systems (CNS) has been announced. On two of those occasions it failed to go through - first the regulator nixed an acquisition by Want Want China Holdings, then Ting Hsin International Group's bid was derailed by a tainted cooking oil scandal that has set back its entire business.

Assuming it will be third time lucky and Morgan Stanley Private Equity Asia and Far EasTone Telecommunications' $2.3 billion purchase of CNS goes through, it will be a profitable and much-desired exit for MBK Partners. It will be good for the private equity industry too.

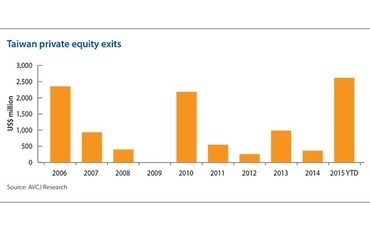

AVCJ Research catalogues investments and exits based on date of announcement. Furthermore, a number of Taiwan deals inevitably slip through the categorization cracks, falling into the China or Hong Kong buckets because that is where a Taiwan-owned operating business is located. And Taiwan is a shallow market in which a handful of very large transactions really move the needle.

Therefore, the 2015 exits figure should be viewed with caution - it reads $2.6 billion, but still the biggest annual total on record. In addition to CNS, which accounts for the bulk of the total, The Carlyle Group agreed to sell Ta Chong Bank to Yuanta Financial Holdings for around $300 million.

Carlyle also exited Natural Beauty Bio-Technology, a Hong Kong-listed business of Taiwan origin, through a management buyback (relations with the Taiwanese founder are said to have been strained). This doesn't appear in the Taiwan data, but should the PE firm sell Eastern Broadcasting - an asset it bought in 2006 - before the end of 2015, that would significantly boost the annual total.

The activity is significant because, for some, getting money out of Taiwan has been just as hard as getting money in. Carlyle is already responsible for the second-largest exit on the Taiwan all-time list, after the CNS deal, but it was a hard-won victory. The PE firm eventually sold Kbro, another cable TV company, to Dafu Media in 2010, having seen a previous exit attempt blocked by the regulators.

Ownership of media and financial services assets - another historical problem area for private equity exits - is a sensitive issue in most jurisdictions, and perhaps more so in Taiwan. To a certain extent, the onus is on PE investors to think out their exit options and consider where they may run into obstacles.

At the same time, given the soul-searching taking place in certain sectors over long-term development strategies, and the role that China and PE investors may play in these, uncertainty doesn't help. When private equity firms look at opportunities in Taiwan, the question is often, "I like this asset but how much time am I going to waste over it?" This may well apply equally to entry and exit.

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.