Exit options: China trade sales

Acquisitive mainland-listed Chinese companies have become the primary movers in the country's private equity trade sale market

Within the past fortnight, the total value of private equity exits via trade sales in 2015 has nearly doubled thanks to two announced transactions: Jin Jiang International's acquisition of budget hotel operator 7 Days Inn and Shenzhen Energy's purchase of China Hydroelectric.

Jin Jiang is paying RMB8.3 billion ($1.3 billion) for 7 Days Inn, with The Carlyle Group, Actis Capital, Sequoia Capital and GIC Private due more than two thirds of the proceeds. The $542.6 million China Hydroelectric deal represents a full exit for NewQuest Capital Partners and Tsing Capital.

Both companies were US-listed and taken private by their private equity owners in the last two years. The assumed objective in these cases is usually an IPO or reverse merger in the mainland or an IPO in Hong Kong, hopefully at a higher valuation than the companies were trading at on US bourses. Control, however, meant these investors could also consider a trade sale - a good position to be in, given IPOs are currently barred in the mainland and challenging in Hong Kong.

Just as significant is the identity of the buyers: Jin Jiang is listed in Hong Kong and its parent trades in Shanghai, while Shenzhen Energy is listed in Shenzhen. It points to a growing trend by which A-share and H-share companies are picking up private equity-backed assets.

The historical nature of PE investment in China - predominantly minority investments in entrepreneur-controlled companies - has made IPOs the exit option that retains an alignment of interest: the PE firm gets out, with a multiple of its money; the entrepreneur gets rich and retains control of the business.

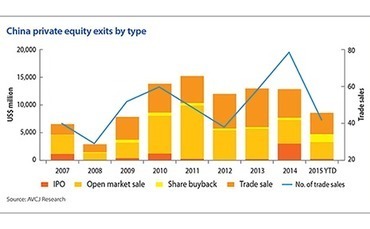

However, trade sales still account for a significant portion of the exit market. Between 2006 and 2014, annual trade sale value exceeded the combined IPO and open market sale value on five occasions. Trade sales have come out on top only twice by number of exits, which underlines the ability of one or two sizeable deals to move the needle.

AVCJ Research has records of 79 trade sales in 2014 - an all-time high - with total proceeds coming to $5.2 billion. So far this year, 42 trade sales have generated $3.9 billion, beating the IPO and open market sale numbers on both counts.

The impact of acquisitive listed Chinese companies on the M&A environment has been phenomenal. So far this year, 21 trade sale buyers have been mainland-listed companies, or 50% of the total. A further six deals have involved H-share firms. Last year, the mainland share was 59%, with a scattering of Hong Kong and US-listed Chinese companies making up the numbers.

This represents a significant turnaround from the three years before that: in 2011, 2012 and 2013, mainland-listed companies were responsible for 16%, 15.8% and 18.9% of all China private equity trade sale exits, respectively. This was roughly the same as the combined H-share and US-listed share.

The desire to acquire on the part of domestically-listed Chinese companies is in part strategic. Jin Jiang and China Hydroelectric deals are both examples of companies pursing targets relevant to their own operations. However, in other cases M&A is a springboard to reinvention intended to reinvigorate ailing stock market performance. Why else would apparel manufacturer Kaiser buy games developer Youkia?

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.