Buyout funds: Growth paradigm

Most traditional large-cap buyout funds have become hybrids in Asia, taking minority stakes in businesses to generate deal flow in certain markets and to harness regional growth trends

Getting traction in certain Asian markets necessitates compromising on control. Much is made of nascent buyout themes in China, India, and Southeast Asia, but they remain nascent. Putting meaningful amounts of capital to work means taking the odd minority stake.

Of the major global and pan-regional players, The Blackstone Group might be the only refusenik, having previously struggled with Asia growth deals in its global funds.

So, when is a buyout fund not really a buyout fund? Bain & Company's latest global private equity report asks whether buyout vehicles have run their course. They remain the industry's single largest category with 41% of global assets under management (AUM), but that is down from 61% in 2010. Capital has gravitated to growth, venture, and distress strategies. Even within buyouts, generalists are giving way to sector, impact, long-hold vehicles.

Bain links this shift towards specialization to rising AUM, fierce competition for assets, and sky-high price multiples, which have forced managers to reevaluate how they can differentiate their value creation capabilities. In the race to stay relevant, it advocates making bold moves based on core competencies, which may involve adopting new products and adjacencies and going deep into sub-sectors.

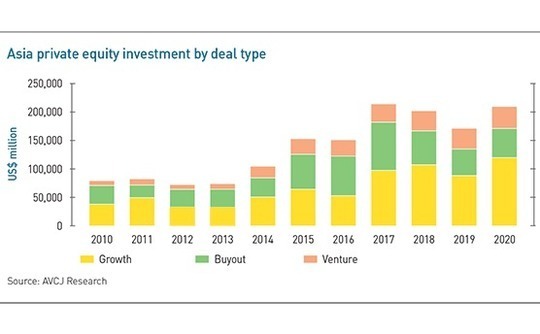

In Asia, buyout funds do not appear to be in danger. They raised $30.1 billion last year, with a record $24.6 billion going to pan-regional players – 23% of the overall total, up from 4% in 2019. That massive jump underlines the significance of which firms are in the market during any given year. KKR gobbled up $13.1 billion on its own.

KKR's Asia portfolio includes a liberal helping of minority deals, from ByteDance in China to Jio Platforms in India to Gojek in Southeast Asia. There are investments outside of technology as well, but that misses the point about how large-cap buyout funds are evolving in Asia. It is not about being specialist, though most have advanced their sector capabilities; it's about not missing out on businesses behind the Asia growth story.

Growth capital investment in technology start-ups came to $30.6 billion last year, less than half the record high of $63.6 billion in 2018. But as recently as 2014 it was only $3.5 billion. Investors might be less comfortable backing pre-profit, high cash-burn companies than they were before, but perceived market leaders still command a following. One-third of the 2020 total went into nine deals of $500 million-plus.

Baring Private Equity Asia built its reputation on growth capital, but the firm has since evolved into a buyout player. Late-stage rounds for tech start-ups haven't really featured in recent years.

However, one of the best-performing investments in its most recent fund – on paper – is probably Chinese online-to-offline healthcare platform JD Health, which listed in Hong Kong last year and has a market capitalization of $58 billion. Baring bought in a few months earlier at a valuation of $7 billion.

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.