Southeast Asia VC: Knowledge transfers

When venture capital firms move into Southeast Asia, they often use existing operations in China or India as a launching pad. Different lessons can be learned from these two markets

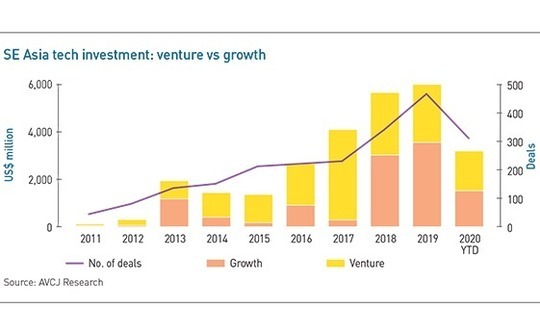

Southeast Asia is a natural VC expansion market. Ten years ago, early-stage technology investments amounted to less than $100 million with fewer than 50 deals announced, according to AVCJ Research. In 2019, nearly $6 billion was put to work across more than 450 transactions, with nearly 60% of the capital going into growth-stage deals. As recently as 2017, the growth stage share was less than $300 million.

Fund sizes have tracked this evolution, with the longest-standing local players now raising or deploying their third vehicles. Some have added growth funds to address the proliferation in later-stage opportunities, many emanating from their own portfolios.

With Google, Temasek Holdings and Bain & Company noting that Southeast Asia's internet economy surpassed $100 billion in 2019 and is likely to hit $300 billion by 2025, other investors want in. They include established players in China and India – some affiliates of global firms – that dip their toe in the region, like what they see, and decide to establish a permanent presence.

Lightspeed Venture Partners is the latest example, having announced plans to open a Singapore office earlier this week. While they will initially invest out of the firm's global funds, the operation is more an offshoot of Lightspeed's existing operation in India than in China. Akshay Bhushan, a partner in the India practice, will lead the new office and divide his time between the two. The two new hires are both from within the region.

These are interesting strategic decisions. When Sequoia Capital entered Southeast Asia, the firm's India team also picked up the mandate. Meanwhile, China-only players such as GGV Capital, Qiming Venture Partners and Shunwei Capital entered Southeast Asia first and then moved into India.

There is a natural affinity between Singapore and India, based on tax treatment, relevant service providers, and relative proximity. But the rationale for most expansion initiatives is the replication in these target markets of patterns investors have seen play out in their home markets. The selling points for a Chinese VC in Southeast Asia include first-hand experience of evolving consumer-facing business models and access to Chinese technology companies with relevant expertise.

Indian investors cannot match this, but perhaps they have the edge in other areas. Lightspeed has completed fewer than 10 deals in Southeast Asia, but at the end of last year, business services accounted for one-third of the India portfolio. Half those companies were focused on the US and the rest on Southeast Asia. Many Chinese VCs are still getting their heads around B2B and their immediate priority will be the domestic market.

Ultimately, lessons can be learned from both markets, but the trick is understanding how they can be applied in Southeast Asia. One investor, looking to develop a strategy for online education in Indonesia, studied relevant start-ups in China and India. In both countries, the industry has demonstrated great potential, though in very different ways. Put very generally, in India online education replaces traditional schooling for many students, whereas in China it supplements it.

Asked where Indonesia stood on this spectrum, the investor answered: "Somewhere in the middle."

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.