Indonesia: All about the tech

The center of gravity within Indonesia's private markets appears to have shifted from PE to VC. Is it a structural or a cyclical phenomenon?

Five years ago, the founder of an Indonesian internet start-up was on the road pitching investors for an early-stage funding round. The company is now a unicorn and one of the private equity executives who passed on the deals works for it in a business development role. It is among the more striking of multiple stories that capture the gravitational shift from PE to VC in Indonesia's private markets.

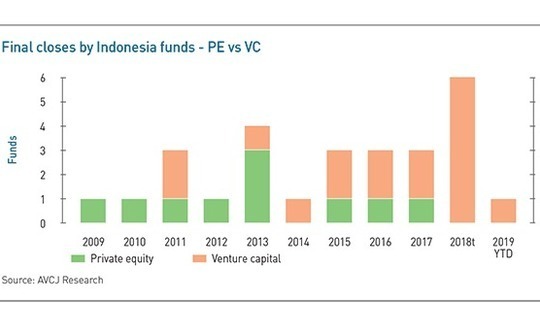

Between 2009 and 2013, there were seven final closes on Indonesia-focused private equity funds compared to three for venture capital, according to AVCJ Research. In the five years since then, VC managers have raised 13 funds while their PE counterparts trail on three.

In terms of investment, annual commitments to tech start-ups over the past decade have grown from negligible to more than 70. And for the first time, in 2018 the aggregate US dollar amount deployed in venture capital deals exceeded private equity. One transaction – Go-Jek's $1.5 billion Series E – accounted for over 80% of the VC total and participants included a string of global GPs and strategic players. Expect more of the same in 2019.

Several investment professionals that started out in private equity have been drawn to technology, either working for VC firms or for start-ups directly. There is also growing interest in the space among Indonesia's domestic conglomerates, with captive VC units, balance sheets, and family offices being mobilized to seek exposure to internet upstarts.

AVCJ isn't immune from the VC effect either. In our first Indonesia Forum in 2012, there were no sessions dedicated to technology. This rose to one session in each of the next two years followed by a breakthrough in 2015: venture capital shared top billing with private equity in the opening panel and there was a later session on e-commerce. Technology has been a fixture ever since then, increasingly impinging into discussions on separate topics much as it disrupts traditional industries.

So what happens next? The Indonesian government wants to have five unicorns by the end of 2019 and 20 by 2025. By then, it is not unreasonable to suggest that each of the current crop of four should have listed, bringing the exits that early-stage investors can point to as validation of their theses. In the meantime, other start-ups will get traction and more capital will be drawn to domestic VC firms, which are currently relatively few in number and not finished deploying their second funds.

It is unlikely to play out that seamlessly in reality. Valuations in Indonesia have not reached China levels, but on its current trajectory, the bullish sentiment that seeps through the market could reach a tipping point well before the deadline for the 20th unicorn is reached. Naming precise dates is a dangerous game, but ultimately Indonesia cannot be immune to the cycles that every other VC market in the world goes through. There will be some pain in this process, but also some long-term benefits.

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.