Singapore VC: Filling the gap

Investors are pursuing a number of strategies for addressing Southeast Asia's late-stage VC funding shortfall

Singapore's efforts to foster a start-up ecosystem have been nothing if not methodical. Initial efforts focused on incubators, then added incentives and funding support for early-stage venture capital followed by Series A providers and corporate VC. International investors would come into Series B rounds if they had enough quality companies to work with.

This has played out as anticipated, at least to a certain extent. Investors from China, Japan, and India have begun to back Southeast Asian start-ups, many of which transfer their corporate headquarters to Singapore once they reach a certain size. Two Australian investors participated in a Series D round for restaurant booking platform Chope last October, while Japan's Rakuten Ventures co-led a Series C for flea market shopping app Carousell in May, having led the previous round on its own in 2016.

Nevertheless, attracting institutional capital is not easy. Arrif Ziaudeen, Chope's founder and CEO, previously told AVCJ that a company needs traction in two or three foreign countries, a convincing path to profitability, and decent exit prospects to generate interest among overseas investors. Even then, it is necessary to cast a wide net in terms of geographies.

With several Southeast Asia-based venture capital firms looking to raise later-stage funds, this process may become smoother. B Capital Group has already closed a $360 million vehicle that targets start-ups ready to scale globally, typically participating in Series B and C rounds. It operates in Southeast Asia, India, and the US.

Vertex Ventures raised $210 million for its latest Southeast Asia and India fund, which will concentrate on Series A and B investments. Openspace Ventures, East Ventures, and Monk's Hill Ventures are also targeting larger vehicles than before, with a similar remit to Vertex, while Vickers Venture Partners and Gobi Ventures are aiming to address Series B and C opportunities.

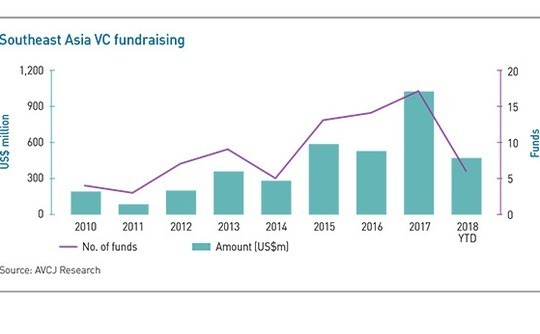

The gap they want to fill is clearly expressed in the data. Seed and Series A investments accounted for about 80% of overall Southeast Asia VC deal volume in 2012-2016, according to AVCJ Research. The Series B portion was just 10%. A study published by Temasek Holdings and Google identified 1,370 announced deals involving Southeast Asian internet companies from the start of 2016 to September 2017. Only 94 were Series B and C rounds, while eight were Series D or later.

But the strategy is not invulnerable. First, it remains to be seen if LPs are completely sold on the idea. This is said to be born of a reluctance to back larger funds until they have seen more of a track record from smaller vehicles. Second, there is a danger that the amount of capital chasing later-stage deals will exceed the opportunity as it stands. Anecdotal evidence suggests there is already more corporate money entering the space and it's unclear how many start-ups are ready for it.

Ziaudeen's criteria for attracting international investors are demanding, but they should be. Southeast Asia needs success stories, not companies that fail to deliver on business plans.

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.