Vietnam: Growth agenda

Comparisons with the dynamics in China a decade ago are often used to illustrate Vietnam's potential. The country may replicate some of its larger neighbor's success, but patience and reform remain paramount

Chinese private equity firm CDH Investments entered Vietnam five years ago in search of companies that could replicate the developmental path forged by businesses in its domestic market. The GP saw parallels in terms of consumer behavior, entrepreneurial mindset, and political systems, and in Mobile World it found a company with the right management team and business model to achieve scale.

Mobile World went public in 2014 and continued to deliver on its expansion thesis. CDH profited from its investment but it has yet to deploy more capital in Vietnam. The private equity firm's cross-border coverage now focuses on deals where there is an opportunity for expansion into China, not mimicking the China model on a smaller scale.

Being compared to China sometimes seems as much a burden for Vietnam as an indicator of its unrealized potential. Every time a global private equity firm makes a sizeable commitment in the country there is a blaze of publicity about how this is a bet on one Asia's most promising consumer markets. Often with reference to successful China investments these GPs have made in the same sector.

The optimism is not misplaced, and the growth trajectories are not inaccurate. The problem is that in those moments hype tends to take over from reality. Industrialization and urbanization are driving Vietnam's economy onward, as has been the case in China. Mass-market consumption has taken hold, while at its tip the nascent middle-class clamors for premium products and services, much like China.

At the same time, Vietnam has ASEAN's third-largest population, but it ranks sixth in terms of GDP and GDP per capita. The country is still grappling with state-owned enterprise (SOE) reform, investment in energy and infrastructure is required to sustain expansion, and a long-term blueprint is needed for an economy that relies more on domestic demand and less on foreign direct investment. China successfully addressed these issues and there is no reason Vietnam cannot, but it is a protracted process.

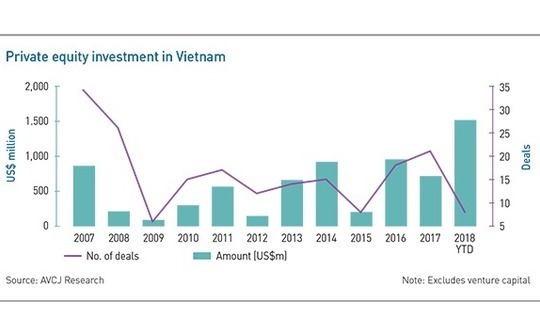

In this context, it is not surprising that the private equity market remains shallow. The $1.5 billion deployed so far in 2018 looks impressive, but almost all of it went into three deals: an $850 million pre-IPO investment by GIC Private in Vinhomes, a $370 million pre-IPO investment by Warburg Pincus in Techcombank, and a $200 million commitment from Warburg Pincus to seed a warehousing platform.

Investment activity has tracked economic cycles in the past – resulting in some sharp peaks and troughs – and Vietnam now appears to be enjoying an upswing. Sustaining it rests on a multitude of factors, but one stands out: continued SOE reforms that consolidate the private sector's position at the heart of the economy. This will help deliver the truly scalable independent businesses that PE investors, whether they are local sellers or pan-regional buyers, really want to see.

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.