China-Indonesia VC: Biding their time

Investments by China's tech giants becoming more prominent in Indonesia's tech space, but Chinese VC investors continue to tread cautiously in the country for the most part

Indonesian ride-hailing and delivery platform Go-Jek's recent $1.5 billion Series E round was notable for the level of Chinese participation, with Tencent Holdings, Meituan-Dianping, JD.com and Shunwei Capital all appearing on the investor roster. While this does signify growing interest in the country from China, it is important to appreciate the context.

First, looking at Chinese private equity participation in Indonesia-focused deals is a largely fruitless endeavor. Before Go-Jek, there was nothing significant, according to AVCJ Research. Even on the M&A front, there have only been 18 investments since 2010. This compares to more than 130 transactions in Southeast Asia as a whole, of which 12 topped $1 billion in value.

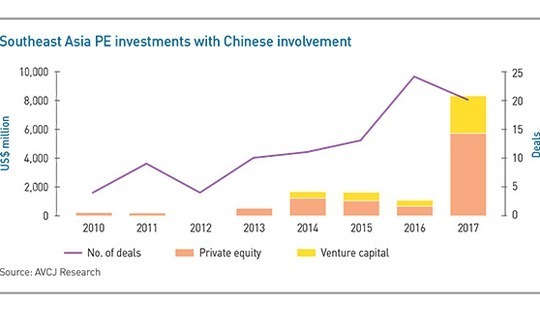

Similarly, there have been nearly 90 deals in the region that featured Chinese PE investors. It is worth noting that the 2017 total of $8.27 billion is inflated by the privatization of Singapore-listed Global Logistic Properties, a Singapore-listed company with substantial interests in China.

The relative dearth of Indonesia-based activity compared to the wider region could be a function of the difficulties deal-sourcing in the country or the importance that Chinese investors attach to scale. This is particularly true of tech transactions, which have grown in significance in recent years. A total of 17 VC deals featured Chinese capital in 2017, with $2.59 billion deployed. Around $414 million was committed across 20 deals the previous year. This on its own is more than the combined totals for 2010-2013.

The key driver is Alibaba Group and Tencent taking their domestic competition overseas. Four of the 12 M&A deals of $1 billion or more featured Alibaba as it bought Lazada and backed Indonesian e-commerce player Tokopedia. Ride-hailing app operator Didi Chuxing invested in its Southeast Asian peer Grab. Didi is said to be aligned with Alibaba in the Tencent battle, and Alibaba is reportedly set to back Grab as well. Tencent, which already has gaming, payments and e-commerce platform Sea, brought two of its frequent collaborators – JD.com and Meituan-Dianping – into the Go-Jek round.

All of these are relatively large companies that have established market-leading positions, so Alibaba and Tencent are playing safe and investing in line with their core operations. Some transactions appear in the private equity column as well because financial investors are also playing it safe by aligning themselves with domestic internet giants.

There are some exceptions. Gobi Partners started out as a China manager but has since raised Southeast Asia funds, while the likes of 01VC and ATM Capital have positioned themselves as covering two geographies and completed investments in Southeast Asia.

However, most Chinese VC firms – not to mention almost every technology corporate – do not have a base in the region and so lack the local knowledge and deal-sourcing capabilities. The market dynamics may well change in time, but Chinese VC capital players are most conspicuous in Indonesia when they make tours of the country. While they meet their local peers and the major companies, this has yet to translate into meaningful investment activity.

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.