Six years ago, Indonesia was Asian private equity's next big thing. Expectations of deal flow emanating from the region's third most populous economy – happily characterized as young, keen to consume, and with income levels rising rapidly from a low base – were the pretext for all kinds of expansion plans. Global and regional GPs hired more people on the ground and boosted their presence in Singapore, the logical hub for Southeast Asia activities.

Indonesia's fundamentals remain intact, even though its economy has taken a beating in the interim. Meanwhile, expectations of similar consumer growth are now also attached to the Philippines, while even the likes of Vietnam and Myanmar are cited as feasible long-term and longer-term targets. But for those seeking large-cap deal flow, Southeast Asia has yet to deliver.

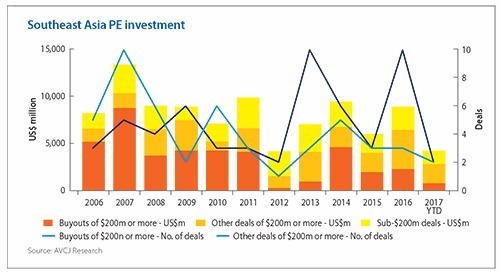

Private equity investment in the region came to $8.9 billion in 2016, according to AVCJ Research. It doesn't represent a huge increase on the average of $7.3 billion for the five years preceding that, and is well short of the pre-global financial crisis peak of $13.4 billion reached in 2007.

As for deals of $200 million or more, there were 12 last year worth a combined $6.4 billion. That is the most seen in a single year since 2007, and it follows 12 apiece in 2013 and 2014, with the six announced in 2015 appearing to be the aberration. Break these totals down by deal type, however, and a slightly different picture emerges. There have been no more than six buyouts of $200 million-plus in any of the last six years, and the average is three.

Among the growth deals in this size category, there is the usual scattering of established companies where private equity investors have come into support expansion or to take out positions held by other financial sponsors. But the big trend is technology start-ups. Ride-hailing app Grab has raised four sizeable rounds since October 2014, the most recent of which closed earlier this year. Go-Jek and Sea (formerly known as Garena) are two other Southeast Asian unicorns that appear in the list.

Technology has been the biggest change agent for investors in the region in recent years, and private equity firms are increasingly getting involved in large, late-stage rounds for start-ups. If they want buyouts, Singapore unsurprisingly remains the choice location, accounting for eight of the 15 largest since 2011. And CVC Capital Partners continues to be the principal actor in other Southeast Asian markets, for example leveraging its ties to the Riady family to get several deals in Indonesia.

Family ties are where it begins and ends for big buyouts in Southeast Asia. Private equity firms have yet to convince these groups to sell in meaningful numbers, and in the absence of widespread corporate distress – where financial realities cannot be ignored as a result of poor enforcement regimes – it is difficult to say when this might change.