Vietnam: Improving sentiment

With regional and global GPs showing greater interest in Vietnam, local managers have an additional exit option - and an opportunity to show that country funds can perform across multiple cycles

Most private equity firms have a tale to tell of trials and tribulations in Vietnam. For Navis Capital Partners, it came in 2009 when furniture manufacturer Theodore Alexander reached its low point. The business was acquired in May 2008, largely as a labor arbitrage play: it produced furniture at relatively low cost in Vietnam and sold it to foreign customers. But within six months real estate markets globally were reeling and Theodore Alexander took a hit.

Navis reengineered the business and eventually sold it last year to a Chinese home furnishings importer. The GP made back its money, but the deal was not an outperformer. Fortunately, it was one part of a regional portfolio, and so Navis could find higher returns elsewhere.

Local GPs, on the other hand, have at times suffered for their lack of geographic diversification. Vietnam has seen two dramatic peaks, in 1997 and 2007, followed by equally dramatic troughs. The typical experience in 2007 was as follows: with price-to-earnings (P/E) ratios on the domestic stock exchange hitting 35, a fund manager backs a private company at an entry valuation of 18; then the public market crashes, P/E ratios plummet, and the lucrative IPO exit the GP was hoping for is no longer viable.

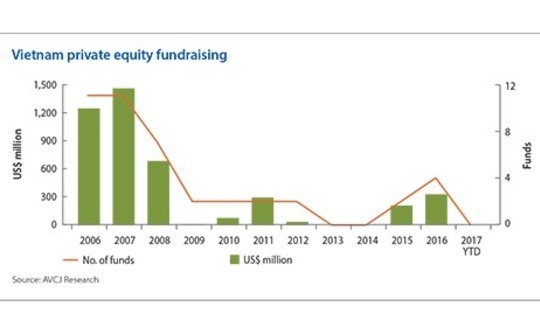

Private equity fundraising activity in Vietnam should be considered against this backdrop. AVCJ Research has records of fewer than 40 partial or final closes by country-focused vehicles since 2006. Over half of the capital raised during this period came in 2006 and 2007. Last year, fundraising reached $326 million, the most since 2008, because three of the four GPs active in the PE space – Mekong Capital, PENM Partners and VI Group – achieved final closes. The fourth, VinaCapital, operates a listed closed-end fund.

Four local managers might be the right number for Vietnam at its current stage of development; it is about the same as Indonesia. But what the incumbents need to prove beyond doubt is that a Vietnam fund can support a sustainable strategy across multiple cycles.

They are now well positioned to do just that. Global and regional private equity firms are showing greater interest in Vietnam, and there's reason to believe that their previously intermittent forays into the country could become more consistent. They want companies that are properly governed and managed, and primed to operate at scale, and local GPs have the networks and skills to meet this demand.

Track records are better than 5-10 years ago – with fewer blow-ups and a number of home runs – and it is hoped that more competition for trade sales plus deeper capital markets can generate the returns that prospective LPs want to see.

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.