Fund focus: See Fund backs university talent

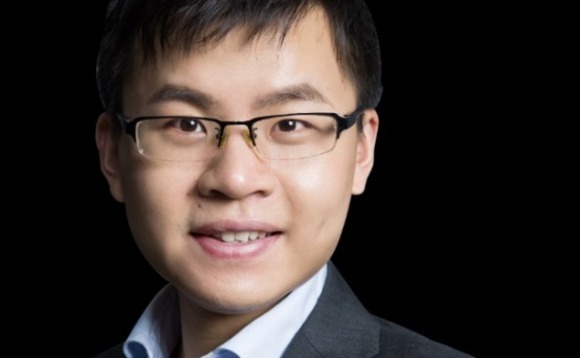

Having launched his own start-up on campus, Song Yao of See Fund is returning to China’s academic institutions to look for the next generation of hard technology unicorns

There was a sense of inevitability to Song Yao's emergence as a venture capital fund manager.

His story is an inspirational one. In 2015, as a fresh graduate in electrical engineering from Tsinghua University, Yao launched artificial intelligence (AI) chip developer DeePhi Technology on campus in conjunction with one of his professors. Three years later, the business was acquired by US-listed Xilinx at a valuation of $300 million.

Dozens of other students, looking to follow in his footsteps, subsequently reached out for advice on becoming entrepreneurs, raising capital, and understanding corporate structures. It amounts to a readymade early-stage deal pipeline. Yao credits Tsinghua – where DeePhi is used as a demo project in transforming research projects into commercial products – for cultivating technology talent.

"Tsinghua was the first university to issue a policy encouraging teachers to commercialize their research results in 2015 and our company was the first to demonstrate the success of this policy. The university was one of our stakeholders," he explains.

Tsinghua alumni have founded many tech start-ups, notably video-sharing and social networking platform Kuaishou, which recently listed in Hong Kong. The department of electrical engineering alone served as a breeding ground for nearly half of China's top semiconductor start-ups – from Will Semiconductor to Spreadtrum Communications to Galaxy Core – across chip design, manufacturing, and packaging and equipment.

"China is entering the era of hard technology development. When we use a network of Tsinghua alumni to connect people in the space, it is an efficient way to find the best projects," says Yao.

When DeePhi launched, few investors were interested in AI chips. However, Gaorong Capital and GSR Ventures provided initial funding – in part because Tsinghua alumni occupy senior executives roles at both venture capital firms.

Yao's new venture, See Fund, closed its debut vehicle at RMB200 million ($31 million) with a similar kind of LP following. Sequoia Capital China, Hillhouse Capital, Matrix Partners China, CPE, ZhenFund, FreesFund, Ant Group, Zhongguancun Science City Science & Technology Fund, ByteDance, and Tsinghua Holdings all made commitments.

See Fund will leverage Yao's networks to back cutting-edge technology companies founded by staff and alumni of Tsinghua and other top universities. The firm will donate 30% of its fund management fees to Tsinghua.

Yao needn't look far for his own sources of inspiration. Tsinghua alumnus Feng Deng co-founded firewall manufacturer NetScreen in 1997 and sold it to Juniper Networks seven years later at a valuation of $4.2 billion. Deng established Northern Light Venture Capital in 2005, building the firm's assets under management to RMB30 billion.

See Fund has three key focus areas: semiconductors, pan-electronic IT, and the industrial internet. It will support 10-15 start-ups, typically in the pre-Series A rounds. Check sizes will be in the RMB5-20 million range. The goal is to build an ecosystem of 100 companies within five years. Eight investments have already closed, most of them emanating from Tsinghua's department of electrical engineering.

Yao plans to launch the second fund in the second half of the year, with a target size of around RMB400-500 million.

GPU chips for general-purpose computing have emerged as the flavor of the month in China venture capital, with the likes of Moore Threads and Iluvatar CoreX completing sizeable rounds. The thesis is that these chips have the highest market ceiling, given the exponential growth of AI-related applications. Yao, however, is a champion of specialization.

"GPUs will continue to grow, no doubt, but they were originally used only for image rendering. Now, as general-purpose chips, they have insurmountable disadvantages," he explains. "Their power consumption is very high, so in scenarios with heat dissipation limitations or battery usage, there is no way you can use GPUs. Ideally, we will design dedicated chips for different scenarios."

To this end, he believes that the prevalence of Moore's Law – the ability to pack twice as many transistors on the same sliver of silicon every two years – is ending. Start-ups must sacrifice some versatility in order to thrive.

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.